Insurance Returns: State Returns

Activating State Returns

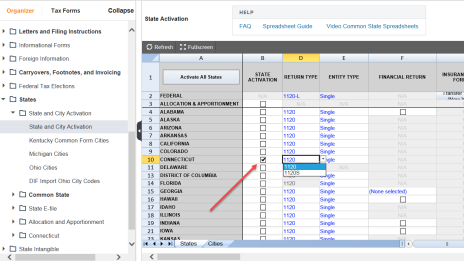

1120 state returns are activated on the state activation spreadsheet, found when you navigate in Organizer > States > State and City Activation > State and City Activation.

For each state, select the check box in column B - State Activation for a single company or consolidated return member company.

In addition, select the Return Type and Entity Type by selecting the down arrow beside each item to open a list of options.

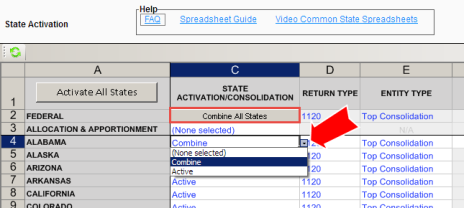

In a consolidated return, mark states to combine by selecting Combine in the drop-down list in column C.

Combine and Active are mutually exclusive options.

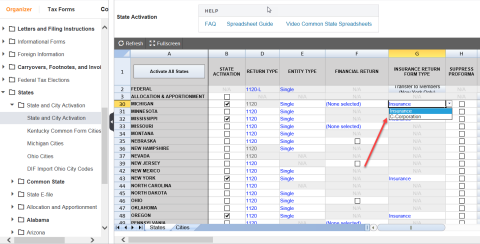

Additionally, four states have their own insurance returns: Michigan, Mississippi, New York, and Oregon. Individual state instructions indicate whether an insurance return only is required, or an 1120 state form can alternatively be used. The State Activation spreadsheet indicates these insurance states in column G - Insurance Return Form Type with an entry of Insurance displayed in the cells. Insurance is the default selection if the federal return is an 1120-PC or 1120L. The choice of Insurance or C Corporation return is made at the member company level (that is, at the parent and subsidiary company level), based on the desired state return form.

At any consolidated level, only for New York, the selection of Insurance or C Corporation can be transfered to the member companies by selecting the Transfer to Members (New York) button at the top of column G.

For a PC Basic account, only a federal single company return can be filed, which does not include consolidations or state return. In addition, the Electronic Organizer is the only data source available for PC Basic users.

Allocation and Apportionment

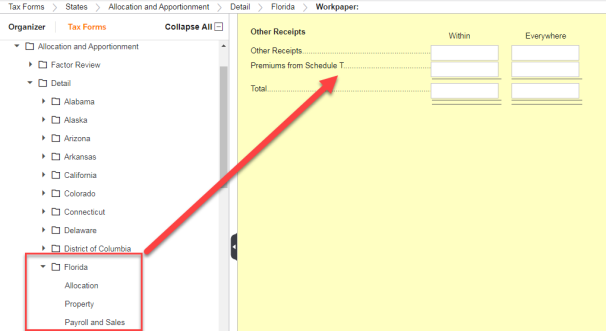

If Schedule T of the Annual Statement is used, amounts automatically flow from Schedule T to the Sales - Other Receipts workpaper. Amounts from Schedule T can be suppressed from flowing to the Allocation and Apportionment area.

Navigation: Tax Forms > States > Allocation and Apportionment > A&A Detail > [State] > Payroll and Sales > Other Receipts and Misc. Other

1120/oit_ins_state.htm/TY2021

Last Modified: 03/20/2020

Last System Build: 01/31/2023

©2021-2022 Thomson Reuters/Tax & Accounting.