Insurance Returns: Limitation of Nonlife NOL Against Life Subgroup Income

The limitation of Nonlife NOLs against life subgroup income is done automatically in the tax application. The 35 percent limitation is automatically calculated in the top consolidation of the tax return. The computation is the lesser of the available Nonlife consolidated NOL or the consolidated life subgroup taxable income after capital loss offset. This computation is done on the yellow workpaper screen shown below.

Steps required to view computation screens

- Navigate to Tax Forms > Federal > 1120 Life-Nonlife Consolidation > 1120 Corporate Tax Return.

- On the 1120, Page 1 tab, navigate to the Tax, Refundable Credits, and Payments section, and find line 30 - Taxable income. Select the link in the field to take you to the yellow workpaper.

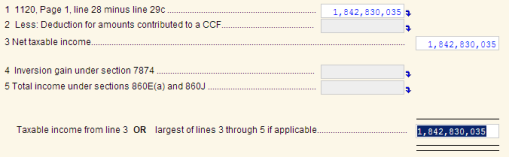

- Select in the field of item 1 labeled 1120, Page 1, line 28 minus line 29c.

- The Life-Nonlife Consolidated Taxable Income workpaper is displayed. Navigate to item 7 labeled Consol. OLD or NOL offset (*).

- Select the link in the field under the Nonlife subgroup column 2, labeled Nonlife against Life, to take you to the Consolidated subgroup OLD or NOL Utilized workpaper.

- Navigate to item 2 labeled Limitation on subgroup losses. Select in the field in the Nonlife subgroup column for the item labeled Nonlife against Life.

- The Limitation on Nonlife NOL Utilization per Reg. 1.1502-47(m)(4)(x) worksheet is displayed.

1120/oit_ins_nol_3.htm/TY2021

Last Modified: 03/20/2020

Last System Build: 01/31/2023

©2021-2022 Thomson Reuters/Tax & Accounting.