Insurance Returns: Mixed Group State Consolidation

There are two different structures of setting up a mixed group state consolidation return:

- multitier structure

- single tier or flat consolidation structure

Multi-tier Mixed Group State Consolidation Structures

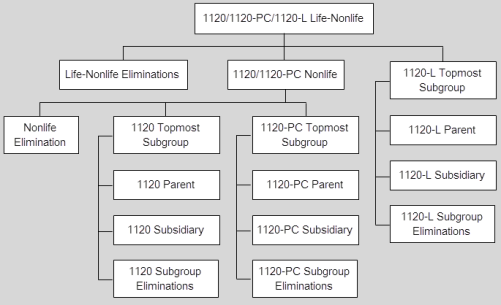

Similar to the federal mixed group consolidation, this structure includes a topmost 1120 subgroup, a topmost 1120-PC subgroup, and if applicable, a topmost 1120-L subgroup. The 1120 topmost subgroup is consolidated with the 1120-PC onto a nonlife topcon (or subcon if there is an 1120-L subgroup in the consolidation). Then, if applicable, the nonlife subgroup is consolidated with the topmost 1120-L subgroup into a life-nonlife consolidation.

Single-Tier or Flat Mixed Group State Consolidation Structure

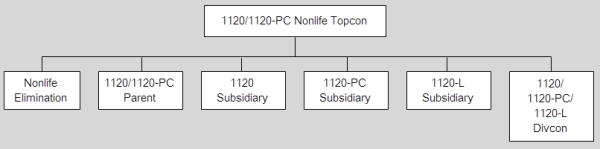

This structure should be used only for mixed group state consolidation returns. The state combined includes one nonlife top consolidation, one nonlife elimination, and all underlying 1120, 1120-PC, and 1120-L companies. There should be no mid-level subgroup subconsolidations with this structure. This state combined allows every underlying company to be shown on the top consolidation return. It is designed to be used for states, such as Illinois and California.

- Illinois requires every underlying company to be shown on its Schedule UB.

- The California form requires that both the income and deductions be shown for every underlying company.

This structure should also be used for those states that do not allow subgroup subconsolidations.

Nonlife Eliminations

For the 2012 tax year and after, a subgroup elimination return can be converted to a nonlife elimination return. This is beneficial to those who had eliminating entries entered on their subgroup eliminations for the federal return. However, for single-tier mixed group state consolidation, since there are no mid-level subgroup subconsolidations, the subgroup elimination returns cannot be used. Now, the subgroup elimination returns can be converted using this feature into the nonlife elimination return, and all existing subgroup eliminating entries are then transferred to nonlife elimination return.

Also, starting with 2012, both 1120 and 1120-PC subgroup elimination returns can be combined into one nonlife elimination return. This is beneficial to those who had eliminating entries on both 1120 and 1120-PC subgroup eliminations for the federal return. This feature combines all 1120 and 1120-PC eliminating entries into one set of entries on the non-life elimination return.

Best Practice for Conversions

Best practice for the conversion is to make a copy of the subgroup elimination return. If the parent is an 1120 company, then the 1120 subgroup elimination return should be copied. If the parent is an 1120-PC company, then the 1120-PC subgroup elimination return should be copied.

After copying, the return can be converted to a nonlife eliminations by selecting the appropriate button, 1120-Non-life Eliminations or 1120PC-Non-life Eliminations. These buttons are found on Organizer > General Information > Basic Return Information > Return/Entity Type Conversion tab.

E-filing

A PDF copy of the federal return can be obtained and attached to the mixed group state consolidation return. There are two copy options: one is to copy the federal return directly from the mixed group state consolidation itself. The other option is to copy the federal return from a different return. The latter option should be chosen for a mixed group state combined return that uses the single-tier structure, since it is not federally compliant.

1120/oit_ins_mixed.htm/TY2021

Last Modified: 03/20/2020

Last System Build: 01/31/2023

©2021-2022 Thomson Reuters/Tax & Accounting.