Insurance Returns

The objective of this guide is to assist you in preparing your insurance return, whether it is a consolidation or is filed as a single return.

Topics Covered

This manual includes:

- Overview for Insurance Returns

- Using the Tax Accounting System

- Choosing the NAIC annual statement as your data method

- Preparing Insurance Returns

- Working with Your 1120-L Tax Return

- Working in Your 1120-PC Return

- Working in the Tax Application

- Net Operating Loss

- Consolidating Your Insurance Return

- Working in your Consolidation

- Printing the Return

- Mixed Group State Consolidation

- International

How do I get started?

The first thing you should decide is how you want to enter your information into ONESOURCE Income Tax.

You can either use the Tax Accounting System and import balances and adjustment amounts, which also uses the automatic Schedule M-3 functionality, or you can import data from the NAIC Annual Statement into Organizer.

Charts for Insurance Returns

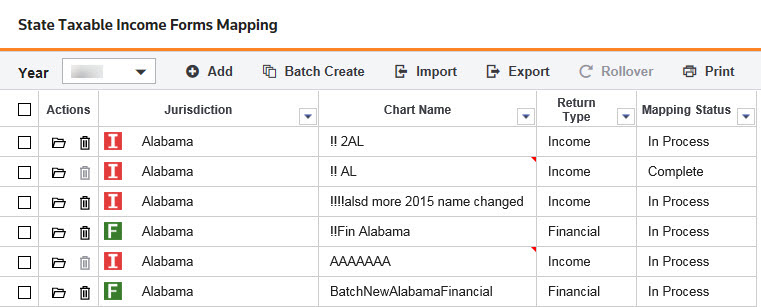

In addition to assigning a federal chart of accounts and adjustment charts, you can also assign State TI Workpapers, Forms Mapping charts to insurance binders.

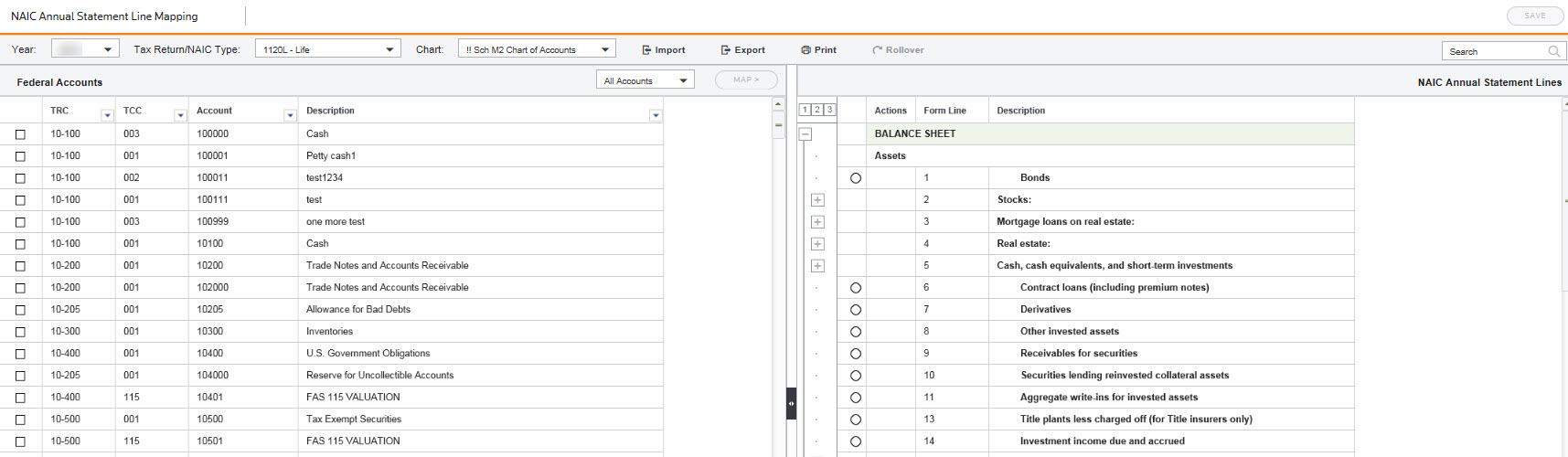

You can map accounts of a federal chart of accounts to the lines of the NAIC Annual Statement on the NAIC Annual Statement Line mapping charts. These mapping charts are year specific for a particular federal chart of accounts, for 1120L -Life and Separate Accounts, for 1120PC - Property/Casualty, Health, and Title NAIC types. The mapping charts are located in the Charts folder, under the Federal folder, and named NAIC Annual Statement, Line Mapping. When you assign the mapped chart of accounts to a binder, the NAIC Annual Statement Reconciliation views for 1120L and 1120PC automatically populate for the Balance Sheet and Statement of Income.

NAIC Annual Statement Line Mapping Chart

State TI Workpaper Forms Mapping Chart

If you use the Tax Accounting System for insurance returns, the process starts with setting up charts, then importing or entering data in the Tax Accounting System, reviewing data, and then computing the binder to transfer the data into the tax application Organizer.

Follow our best insurance practices and choose the correct entity type, data source, and structure to set up your insurance return. Then your return calculates and prints correctly, and allows for a successful e-filing to the IRS or states.

Consolidations

Complex federal regulations governing consolidations for mixed group consolidations are a difficult and complicated process. After correctly identifying your consolidation structure, several concerns that are unique to mixed group consolidations, such as loss reserve discounting, salvage and subrogation, failed-life returns, and statutory-to-tax adjustments require specialized expertise and intricate calculations. Taking these into consideration, this manual guides you through the tax return preparation process.

1120/oit_insurance_intro.htm/TY2021

Last Modified: 08/10/2021

Last System Build: 01/31/2023

©2021-2022 Thomson Reuters/Tax & Accounting.