International Insurance Returns

Using Foreign Tax Credit data entry screens in an 1120L or 1120PC binder to populate Form 1118

An insurance binder (return type of 1120L or 1120PC) with an international filing type of Foreign Tax Credit can be included in the international calculations (TIBS, FTC and Schedule A&H, and Transfer to US1118).

Currently, all binders with an international filing type of Foreign Entity must have a return type of 1120 to be included in the international calculations (E&P, Look-Thru, Subpart F, and Transfer to US5471). The international filing type (None, Foreign Tax Credit, or Foreign Entity) is assigned at the entity level and inherited by the binders for that entity. Selecting Foreign Tax Credit or Foreign Entity for a binder is permanent.

Viewing the International Filing Type for an Entity

- On the My Binders screen, select the binder.

- Select Properties and then the General tab.

Creating the Top Consolidation Binder

The top consolidation binder should have an international filing type of Foreign Tax Credit and a return type of 1120 rather than 1120L or 1120PC. However, any mix of these binder return types is allowed on the Domestic and International Members tabs of the top consolidation binder for international calculation purposes.

Reviewing the Members

- Select a top consolidation binder.

- Select Properties and then click the Members tab.

Valid Entity Types in International Calculations

The following entity types are allowed for international calculations:

|

Parent |

Division (used in div con members) |

|

Subsidiary |

Elimination |

|

Div Con (used in top consolidation members) |

Corporate single entity |

A subconsolidation entity is not valid for international calculations. If a subconsolidation entity is used on the Domestic Members screen, the subsidiaries of the subconsolidation should be used on the International Members screen for inclusion in the international calculations.

For the valid entity types, when the Foreign Tax Credit binder is added to the Domestic Members screen, the binder is automatically inherited by the International Members screen for inclusion in the international calculations.

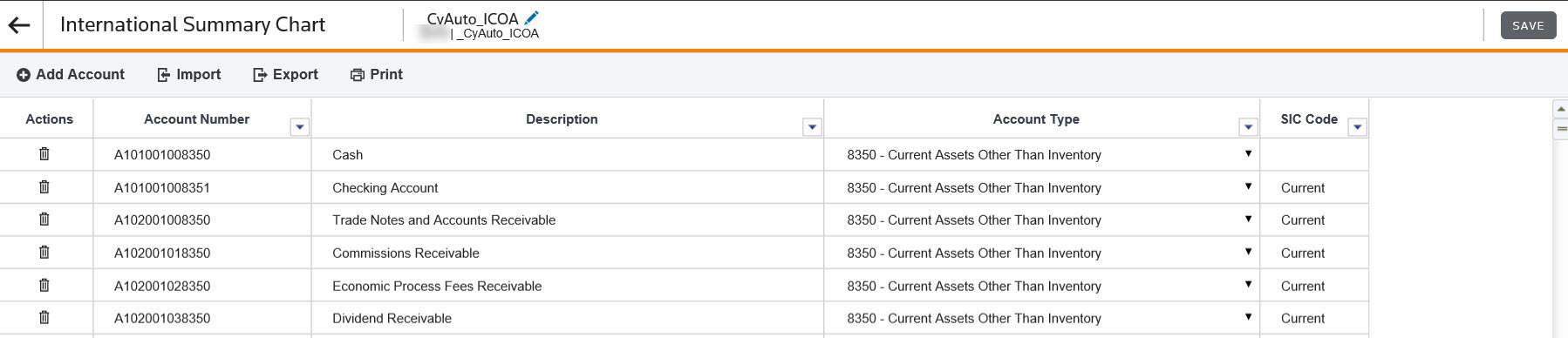

International Summary Chart of Accounts

The International Summary Chart summarizes the earnings and profit to reduce the amount of data that must be sourced in each entity. The accounts and descriptions listed in the chart define the rows on the sourcing workpaper in the binder. Each user-defined account has a system-defined four-digit account type assigned that is used for international calculations only. An example of this chart is shown below.

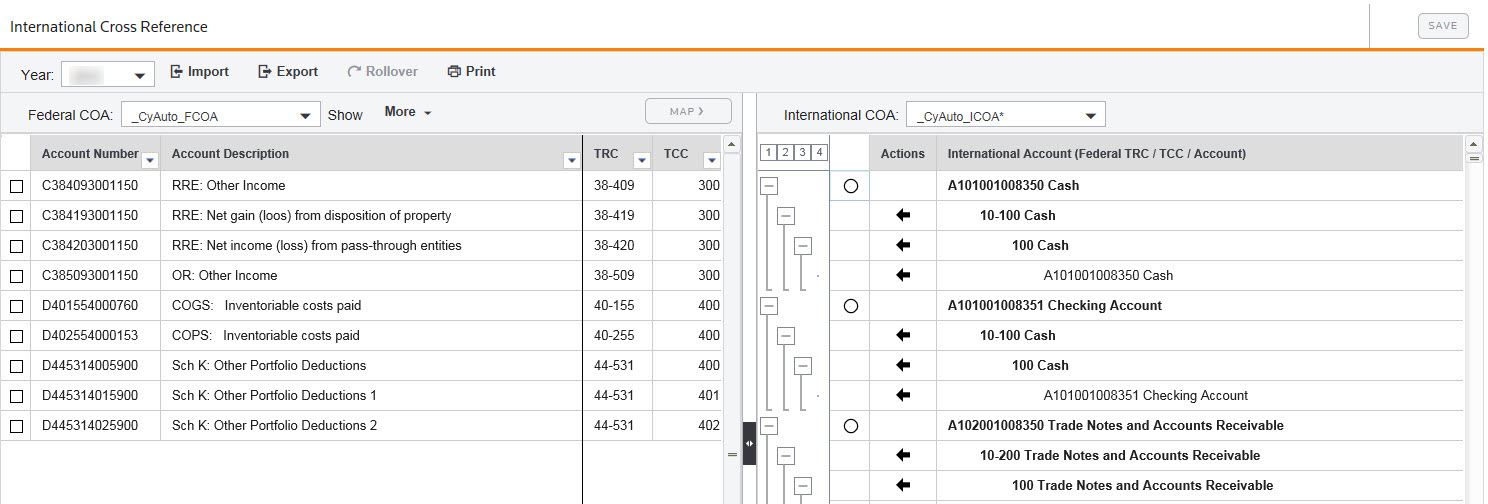

The Federal Chart of Accounts must be cross-referenced to the International Summary Chart in order for amounts to flow to the sourcing workpaper. The International Cross Reference screen establishes the relationship between the federal chart and the summary chart.

An example of the Federal to International cross-reference chart is shown below:

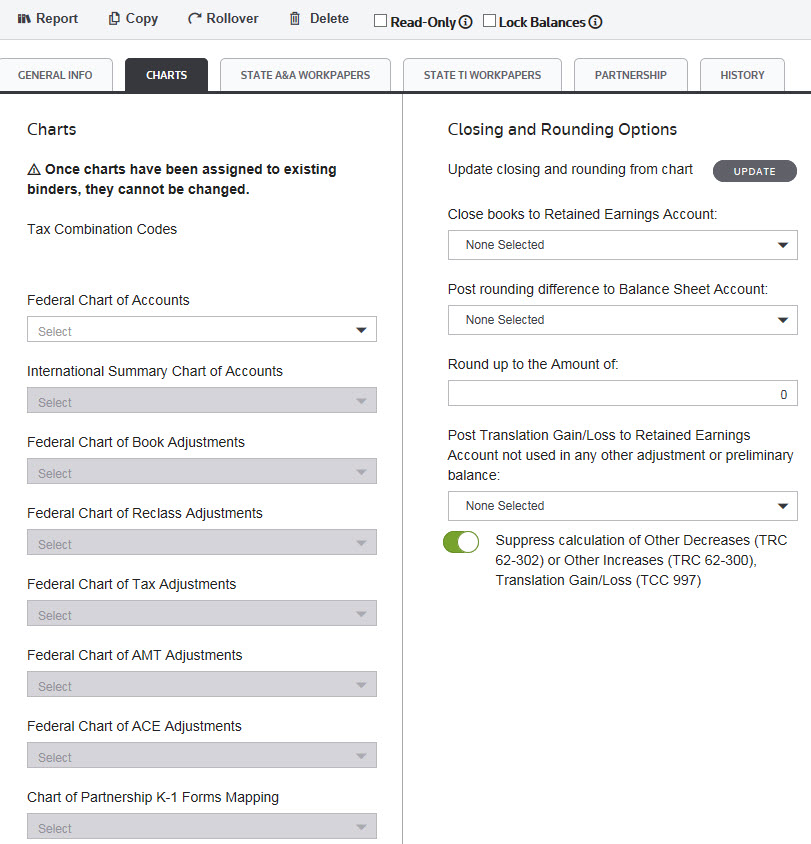

Assigning Federal and International Chart of Accounts

Federal and international charts of accounts can be assigned to binders with return types of 1120L and 1120PC and an international filing type of Foreign Tax Credit. These charts are necessary for data entry or import to the FTC sourcing workpaper. Charts are assigned at an individual binder level or to a group of entities through Enterprise Control Panel.

You can view chart assignments by right-clicking the binder and selecting Properties:

Data Entry and Import into Foreign Tax Credit Screens

For 1120L and 1120PC binders, the following Foreign Tax Credit data entry screens are available for data entry or import:

- Sourcing Workpaper

- Interest Apportionment Information

- R&D Apportionment Information

- Foreign Income Taxes

Since TAS functionality exists for 1120L and 1120PC binders, tax adjusted amounts flow directly to the FTC Sourcing workpaper trial balance column. For international calculation purposes, the amounts in this column can be overridden manually or by import. Batch and single entity imports have been created for import into the Sourcing Workpaper Trial Balance Override screen. Sourcing workpaper trial balance amounts (from either TAS transfer or override), along with any allocation or apportionment, are required for successful international calculations.

The Sourcing Workpaper Trial Balance Override template is defined as follows:

Divisional Consolidations

Similar to a binder with a return type of 1120, international information for an insurance divisional consolidation can be entered at the division or divisional consolidation level. Each division of the divisional consolidation should have the same return type and international filing type as the divisional consolidation. Each division may use a different federal chart of accounts but must use the same international chart of accounts. In this scenario, at the enterprise level, multiple federal charts would be cross-referenced to the same international chart.

TAS preliminary balance and journal entry adjustment amounts are always entered at the divisional level. The amounts then consolidate in the divisional consolidation process.

When sourcing is performed at the division level, sourcing workpaper and other international data is imported or entered in the division binders on data entry screens located beneath the Foreign Tax Credit folder. This international data then consolidates in the divisional consolidation process.

When sourcing is done at the divisional consolidation level, all data entry or imports on data entry screens located beneath the Foreign Tax Credit folder (including the Sourcing Workpaper Trial Balance Override import) is completed in the consolidated binder.

To set the data entry level, right-click the Divisional Consolidation Binder Properties, click the International tab, and then check (or uncheck) the box.

Preparing Form 1118

The Form 1118s populated by the international calculations are under the Intl Foreign Tax Credit and Intl Foreign Tax Credit - AMT Organizer folders. Data manually entered or transferred to these international versions of the 1118 will not consolidate at a higher level. These organizers should be used throughout the organization structure if international calculations are used.

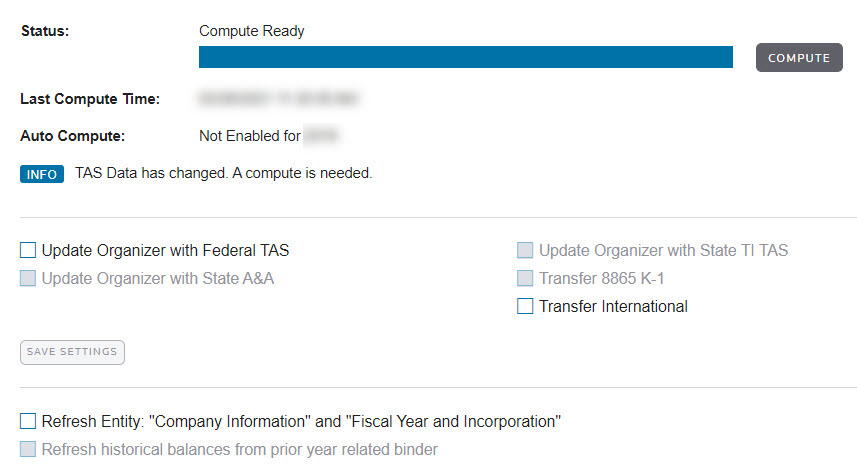

Tax Credit

When you execute the transfer to the 1118 from the International Compute screen, data is transferred to international 1118s in the top consolidation and legal entity binders (that is, Parent, Subsidiary, and Div Con binders with an international filing type of Foreign Tax Credit). The calculated amounts for the Form 1118 can be transferred to the current Top Con binder, or a different Top Con binder. As part of the transfer process, any information currently in the Form 1118 of the transfer destination binder is deleted. Therefore, we recommend that you wait until the last transfer from the international computes is done before you manually enter or override any information in the 1118 Organizer.

The International Compute dialog box is depicted below, with the Transfer To US1118 option selected for a specific Top Con binder.

1120/oit_international.htm/TY2021

Last Modified: 08/10/2021

Last System Build: 01/31/2023

©2021-2022 Thomson Reuters/Tax & Accounting.