Insurance Returns: Electronic Organizer

If the insurance company is not required to file an Annual Statement, data can be entered directly into the 1120-L or 1120-PC Electronic Organizer. The data source method selected should be Electronic Organizer, not Annual Statement.

Data that is directly entered in the Annual Statement Organizer pages is not supported. All data entry should be made in the 1120-L or 1120-PC Electronic Organizer.

Schedule M-3

There are two ways to complete the data entry for Schedule M-3 in the Electronic Organizer. The first method, DIF import files, is preferred because it saves you the most time.

DIF Import Files

- DIF import files are used to import data for all three parts of Schedule M-3.

- Part I of Schedule M-3 is used only for single company or top consolidated returns.

- DIF import files are available for 1120-L, 1120-PC, and 1120 separate returns, including Part I for top consolidations.

- Use the Schedule M-3 DIF/KAT files located at this link (https://www.riahelp.com/html/2021/guides/1120/2021_DIF_1120_Sch_M-3.zip) to import the data.

Data Entry

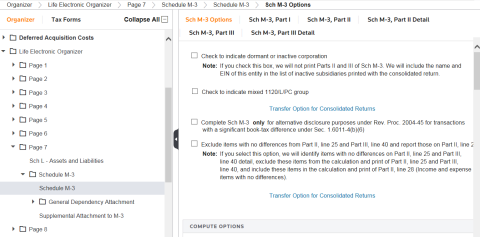

Entering Schedule M-3 data directly into the Electronic Organizer. Data can be directly entered in the M-3 Organizer fields. The navigation is:

- 1120L: Organizer > Life Electronic Organizer Page 7 > Schedule M-3

- 1120PC: Organizer > PC Electronic Organizer Page 8 > Schedule M-3.

Statutory-to-Tax Adjustments

Because tax adjustment balances are entered directly into the Organizer, there are no statutory-to-tax adjustments. Statutory tax adjustments are used for Annual Statement users only.

Adjustments and Reclasses

Adjustments, which are made either automatically or entered directly in the Organizer while preparing the return, are one-sided only. However, Reclasses are two-sided entities with both a debit and credit amount entered. An example of a reclass adjustment occurs when an amount is included in Other Income when it should have been included in Interest Expense.

You can reconcile a balanced return back to the statutory calculations through a summary of reclasses and tax adjustments. This summary is an important part of the supporting documentation of the insurance return.

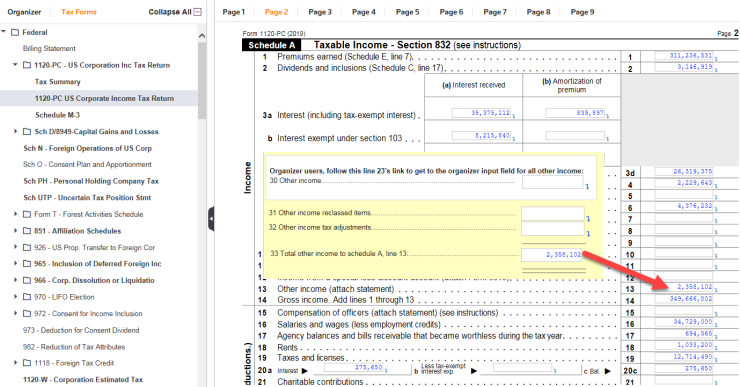

Navigation: Tax Forms > Federal > 1120-PC Corporate Income Tax Return > 1120-PC Pg 1-8 > 1120-PC, Page 2 tab

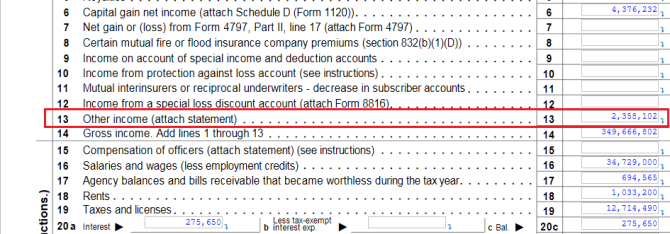

Select the link on line 13 to view the yellow detail.

Select the link (blue turn-down arrow) in the Other Income field on the tax return.

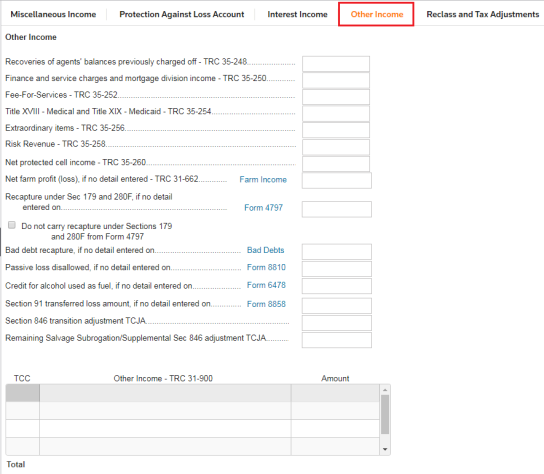

Scroll down to Other Income Reclassed Items or Other Income Tax Adjustments, which are shown on the yellow detail image. Select the Other Income tab to view a screen where you can enter adjustments.

Reclasses In Balance

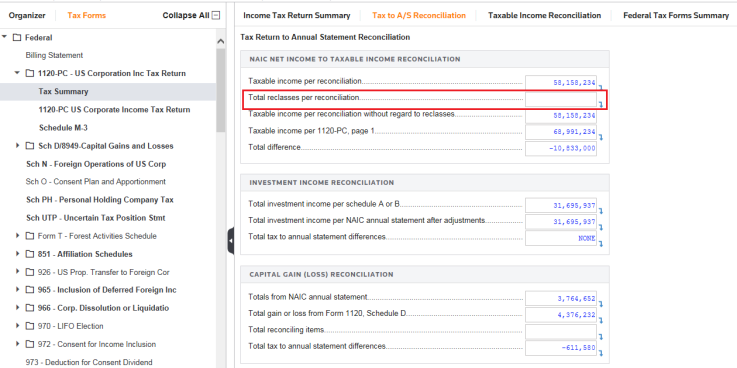

To keep a return in balance, reclass items must be balanced entries. You can verify that the return is balanced by navigating to the Total Reclasses per reconciliation field, which is the second field shown on the screen below and is outlined with a box.

Navigation: Tax Forms > Federal > 1120-PC Corporate Income Tax Return > Tax Summary > Tax to A/S Reconciliation tab

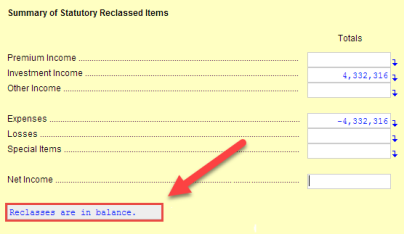

You can select the field and use the down arrow link to open the Summary of Statutory Reclassed Items. If the return is in balance, a message stating this appears at the bottom of the screen.

1120/oit_ins_data_source_3.htm/TY2021

Last Modified: 03/20/2020

Last System Build: 01/31/2023

©2021-2022 Thomson Reuters/Tax & Accounting.