Insurance Returns: 1120-PC: Salvage and Subrogation

The Revenue Recognition Act of 1990 (RRA) requires that, for the tax years beginning after 1989, salvage and subrogation (S&S) recoverable must be included in determination of losses incurred. This provision is required whether or not an insurer reduced its unpaid losses and loss adjustment expense (LAE) by anticipated S&S recoverable for statutory accounting purposes. Recoverable amounts include those amounts applicable to paid and unpaid losses and LAE and are calculated for tax purposes on a discounted basis. Life insurance companies are not subject to the tax treatment of S&S recoverable.

Salvage is the sale of damaged goods for which the insured has been indemnified by the insurance company. The most typical example of salvage is when the insurance company sells the remains of a car to which it has taken title after the insurance settlement with the insured for the total precrash value of the car.

Subrogation is the collection by the insurance company of the amount of a paid claim from a negligent third party or his insurer. Although subrogation is a liability concept, you might well find that subrogation actually outweighs salvage even in your company’s auto physical damage experience. For example: to speed claim settlement, your company has paid for the physical damage of your not-at-fault insureds and then collected subrogation from the insurance companies of the at-fault drivers.

Salvage Recoverable is the estimated salvage and subrogation (net of expenses) to be recovered on all claims incurred to date, whether reported or unreported.

Methods of Calculation of Salvage and Subrogation

To calculate the Salvage & Subrogation (S&S) option for the Annual Statement, Schedule P column 24 must be selected for the amounts to flow from the LRD screens to the S&S discount screens.

Two methods apply when discounting the S&S area:

- Alternative 1: This method uses the industry pattern.

- Alternative 2: This method uses the same factors used to discount unpaid losses.

S&S Options

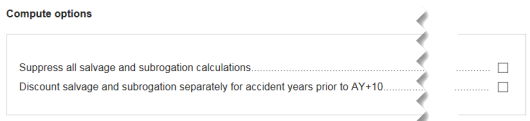

Navigation: Organizer > Salvage and Subrogation > Options > Compute Options

- Global Calculation Suppression: Two options are available to suppress all salvage and subrogation calculations and to discount salvage and subrogation separately for accident years prior to AY+10.

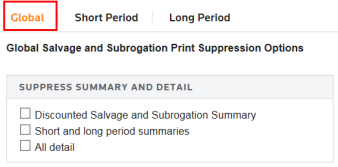

- Print Suppression Options: Select one of the first two check boxes to suppress various detail summaries or select All detail.

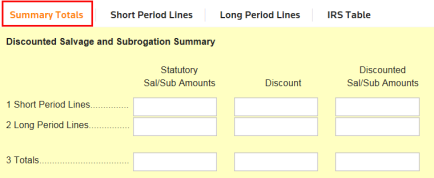

- Discounting Summary: This is where the discounting amounts can be seen for the Short and Long period lines. The IRS Table is also included here for both short and long period lines. It displays the Salvage Discount factors based on published revenue procedures.

1120/oit_1120pc_3.htm/TY2021

Last Modified: 03/20/2020

Last System Build: 01/31/2023

©2021-2022 Thomson Reuters/Tax & Accounting.