Insurance Returns: 1120-PC: Loss Reserve Discounting (LRD)

LRD has two ways to discount: company experience and treasury experience. The tax software supports the Treasury basis (IRS) and the Company experience basis calculations, computing the discount factors back to accident year (AY) +14 years.

The Loss Reserve Discounting (LRD) calculations require the transfer of information from Schedule P of the Property and Casualty Annual Statement and the company payment pattern calculations also require information from Schedule P. You can download this information from the NAIC files using either the 1120-PC and LRD combined transfer or the separate LRD transfer, or you can enter the information into the LRD Annual Statement screens.

Loss reserves can be discounted using the IRS discount factors or company payment patterns. The system default for Loss Reserve Discounting uses the IRS factors. A combination of the IRS factors and company payment pattern can be used. This option is provided by the company’s line of business.

On a title insurance company, we do not calculate the IRS discount factors for the miscellaneous casualty area.

For company experience basis, the NAIC file can never synchronize with the LRD schedule in Organizer. The reasons are:

- The two-year gap between the NAIC Schedule P data and tax. For example, the 2019 imported Schedule P data is not used for the tax calculation until the 2021 tax year.

- Company experience basis requires a minimum of five (5) years of a company’s historical payment pattern data. The current year NAIC Schedule P does not have this.

For example, for a company to use company experience as the basis to discount its loss reserves in the 2021 tax year, it needs data from NAIC Schedule P for tax years 2020, 2019, 2018, 2017, and 2016. To see how our software calculates LRD using the company experience basis, you need to enter, at a minimum, Schedule P data for years 2020, 2019, 2018, 2017, and 2016 into Organizer. In real life, our software automatically rolls over and transfers Schedule P prior year information for you.

LRD Lines

The lines of business can be calculated all by one method or a combination of two methods: the company payment pattern and/or the IRS payment pattern. The company payment pattern comes from the Annual Statement transfer. The IRS payment pattern is a compilation of the industry averages. The loss reserves can be chosen by lines; one calculated by the payment pattern and the other calculated by the IRS payment pattern

Compute Options

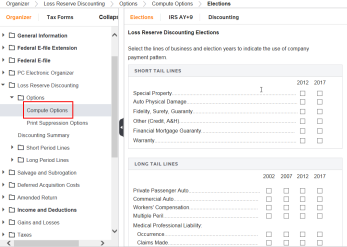

Navigation: Organizer > Loss Reserve Discounting > Options > Compute Options

On the Elections tab, select the lines of business and years to discount using company payment pattern on this tab.

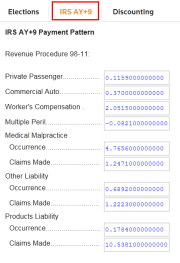

The IRS AY+9 tab shows the payment pattern the IRS uses in computing discount factors.

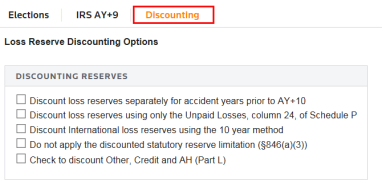

The Discounting tab gives you options such as:

- Discount loss reserves separately for accident year’s prior to AT +10.

- Discount loss reserves using only the unpaid losses, column 24 of Sch P.

- Discount International loss reserves using the 10 year method.

- Do not apply the discounted statutory reserve limited (S846).

- Check to discount Other, Credit and AH (Part L).

Print Suppression Options

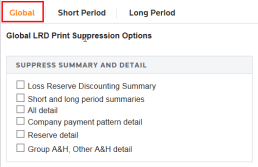

Navigation: Organizer > Loss Reserve Discounting > Options > Print Suppression tab

On the Global tab, the Global LRD Print Suppression Options allow you to suppress the following items by selecting the check box:

- Loss Reserve Discounting Summary

- Short and Long period summaries

- All detail

- Company payment pattern detail

- Reserve detail

- Group A&H, Other A&H detail

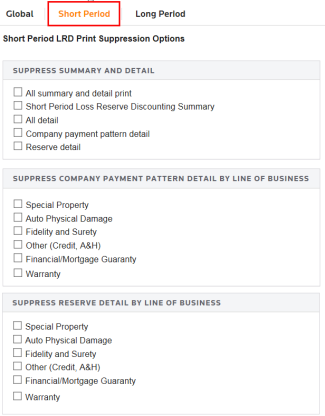

On the Short Period tab, the Short Period Suppression Options allow you to suppress the following:

- Suppress Summary and Detail print items by selecting an item check box.

- Suppress Company Payment Pattern Detail by Line of Business by selecting an item check box.

- Suppress Reserve Detail by Line of Business by selecting an item check box.

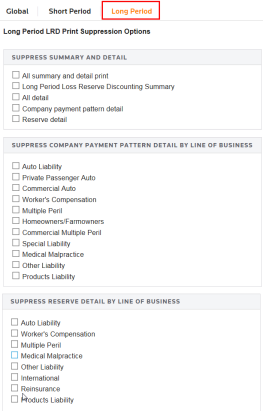

On the Long Period tab, the Long Period Suppression Options allow you to suppress the following:

- Suppress Summary and Detail

- Suppress Company Payment Pattern Detail by Line of Business

- Suppress Reserve Detail by Line of Business

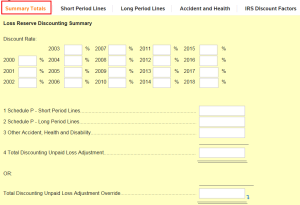

Discounting Summary

Navigation: Organizer > Loss Reserve Discounting > Discounting Summary > Summary Totals tab

This folder is where most of the LRD data is located.

- Summary Totals tab

- Short Period Lines tab

- Long Period Lines tab

- Accident and Health tab

- IRS Discount Factors tab.

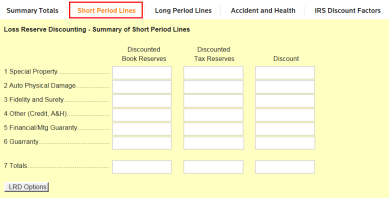

Short Period Lines

For the following short period lines, you can see the amounts from the Company Payment pattern: the Annual Statement and the Loss Reserve Calculations. The Company Payment Pattern shows the last five years of data. The Annual Statement section displays information from columns 23, 24, 35, and 36 of Schedule P. The Loss Reserve Calculation section displays statutory reserves, discounted anticipated Salvage and Subrogation, and Discounted Loss Reserves for the last two years.

Navigation: Organizer > Loss Reserve Discounting > Discounting Summary > Short Period Lines tab

- Special Property

- Auto Physical Damage

- Fidelity and Surety

- Other (Credit & A&H)

- Financial/ Mortgage Guaranty

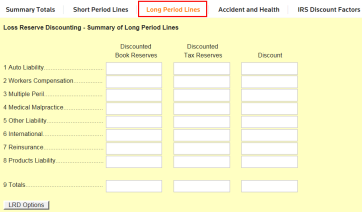

Long Period Lines

For the following Long period lines, you can see the amounts from the Company Payment pattern, the Annual Statement, and the Loss Reserve Calculations. The Company Payment Pattern shows the last fifteen years of data. The Annual Statement section displays information from columns 23, 24, 35, and 36 of Schedule P. The Loss Reserve Calculation section displays statutory reserves, discounted anticipated Salvage and Subrogation, and Discounted Loss Reserves for the last 15 years.

Navigation: Organizer > Loss Reserve Discounting > Discount Summary > Long Period Lines tab

- Auto Liability

- Worker’s Compensation

- Multiple Peril

- Medical Professional Liability

- Other Liability

- International

- Reinsurance

- Products Liability

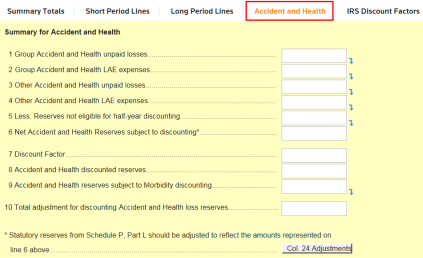

Accident and Health

Summary of Group Accident and Health policies unpaid losses.

Navigation: Organizer > Loss Reserve Discounting > Discounting Summary > Accident and Health tab

- Group Accident and Health unpaid losses

- Group Accident and Health LAE expenses

- Other Accident and Health unpaid losses

- Other Accident and Health LAE expenses

- Less: Reserves not eligible for half-year discounting

- * Net Accident and Health Reserves subject to discounting*

- Discount Factor

- Accident and Health discounted reserves

- Accident and Health reserves subject to Morbidity discounting

- Total adjustment for discounting Accident and Health loss reserves

* Statutory reserves from Schedule P, Part L should be adjusted to reflect the amounts represented on line 6 above.

1120/oit_1120pc_2.htm/TY2021

Last Modified: 03/20/2020

Last System Build: 01/31/2023

©2021-2022 Thomson Reuters/Tax & Accounting.