Business Returns E-file: Viewing and Sending Qualified Returns and Extensions

After all Reject Diagnostics and XML Validation Errors have been corrected, the e-file is now Qualified for transmission to the IRS or state. Before transmitting a qualified return or extension, use the e-File Viewer to confirm the accuracy of the return.

Once you have selected Create E-file in Organizer, go to E-file on the Income Tax menu bar.

-

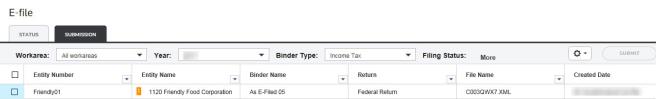

To submit a return, select the Submission tab.

-

Select the Workarea,Year, and Binder Type from the drop-down lists to get a list of all the available returns.

- Select the return(s) you want to submit for e-filing.

-

Select Submit.

E-file/oit_ef_steps_8.htm/TY2020

Last Modified: 08/10/2021

Last System Build: 09/13/2021

©2020-2021 Thomson Reuters/Tax & Accounting.