Business Returns E-file: Aggregating Forms from International Member Returns

ONESOURCE and GoSystem returns can be created that include only international forms. The international forms in these returns can still be aggregated into the final primary return. Under this scenario, international XML files (referred to as XIT files during this process) are created from corporate subsidiary returns and then aggregated with corporate top consolidation returns or partnership returns.

Create International Forms And Designate International Member Return

- Using a corporate subsidiary return, complete all information necessary to generate your international forms. When entering data for the international forms, related forms must be properly associated. For example, a Form 8858 related to a specific Form 8865 should be entered in the correct Form 8865 Organizer folder. Any number of subsidiary returns can be used.

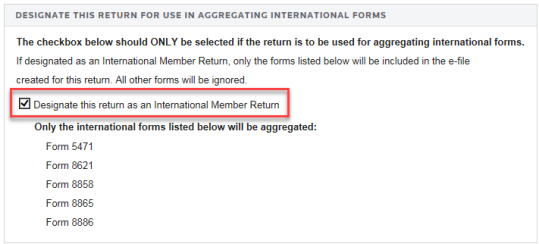

- In the Organizer of a subsidiary return, select Federal E-file > International Member Return. Select the check box to designate this return as an International Member Return. As a result, the XIT file created for this return will only include information for the international forms.

- Even though the international forms are prepared in these International Member Returns, the XIT files are not created here. Instead, these XIT files will be created within a top consolidation return.

Create XIT File in a Corporate Top Consolidation Return

- To create the International E-file (XIT file), the top consolidation return must first be enabled for aggregation. To enable aggregation, in the Organizer of the top consolidated return:

- Enable e-file within the Federal E-file folder.

- Select International > Aggregation Within Same Account.

- Select the Enable international E-file aggregation using Thomson Reuters XIT file check box.

- In the International Members List section, list each of the International Member Returns by Locator Number. Each return must be from the same account as the top consolidation return.

Remember, the International Member Returns are the subsidiary returns containing the international forms.

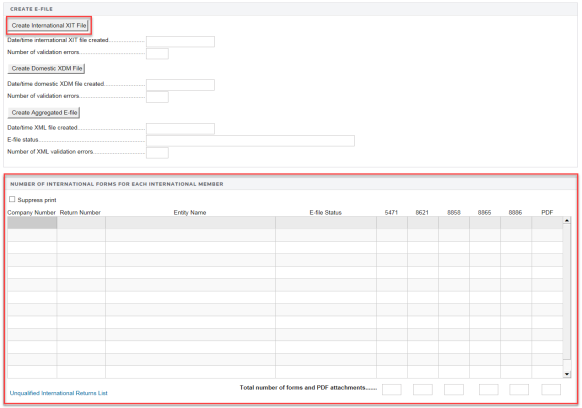

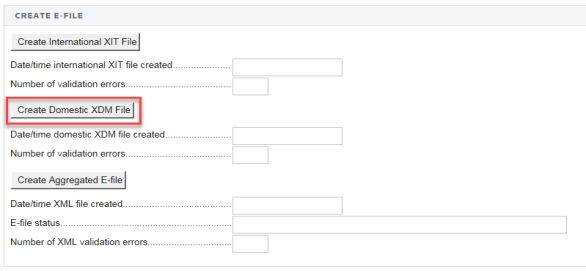

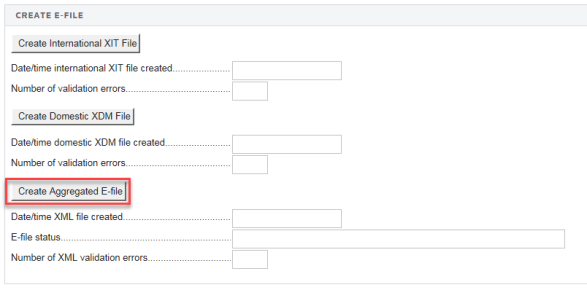

- With this top consolidation return enabled for e-file aggregation, the Create E-file screen now includes three separate Create buttons. On the Create E-file screen shown below:

- Select the Create International XIT File button to create the XIT file.

- After the XIT file is created, review the Number of International Forms for Each International Member section.

- The International XIT file is now available to download for aggregation with corporate top consolidation returns or partnership returns.

Download International XIT File

-

Successfully generate an e-file XML file in Organizer. The system automatically creates a PDF file of the XML when you click the Create Electronic File button to create a federal or state e-file.

Be patient! The E-File Viewer may take time to load.

-

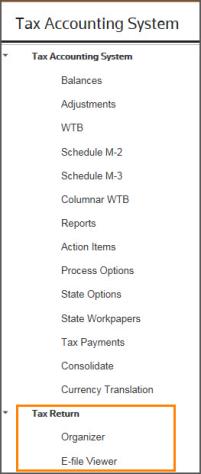

In the binder, on the TAS navigation tree, open the Tax Return folder and click E-File Viewer.

-

The E-File Viewer opens with two panes. The right pane contains additional information about using the E-File Viewer.

-

The left pane contains the navigation tree for viewing the PDF file and the full XML file.

-

On the E-File Viewer navigation tree, click the Full XML node. You can either Open or Save the XML file. If you have an XML editor program, the file will open in the program. If you do not have an XML editor program, your computer will open the XML in Internet Explorer.

-

Click Save to download the XML file to your computer.

Complete E-file: Top Consolidation Return

Step 1: Attach International XIT File. This top consolidation return does not have to be the same return used to create the XIT file.

- Select Federal E-file > International > Aggregation Within Same Account. Be sure the Enable international E-file aggregation using Thomson Reuters XIT file check box is selected.

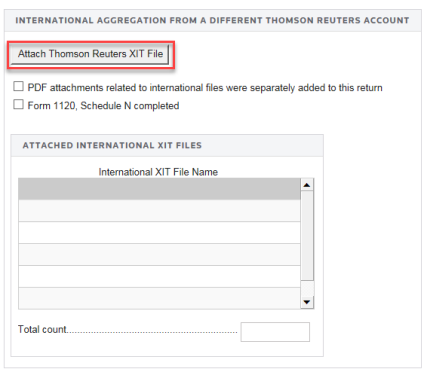

- Select Organizer > Federal E-file > International > Thomson Reuters International File. Then select the Attach Thomson Reuters XIT File button.

- On the resulting Electronic Filing Attachments screen:

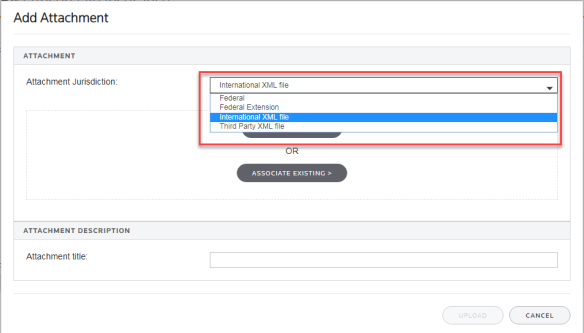

- Select the Add button.

- On the Add Attachments pop-up dialog box, select International XML File from the drop-down list.

- Browse to and select the applicable XIT file, and click Upload.

- On the Electronic Filing Attachments screen, the uploaded file will appear in the attachments list. Select Done.

- After attaching the XIT files, confirm that the XIT attachment details are correct in the Attached XIT File Name section.

The attached XIT file names will include the locator number of the primary return.

Step 2: Create Domestic XDM File. A domestic XML file (referred to as an XDM file during this process) must now be created that includes all other information from the consolidated group. The domestic XDM file includes all forms from the parent and each subsidiary. After consolidation, complete all other e-file steps, including the review of reject diagnostics.

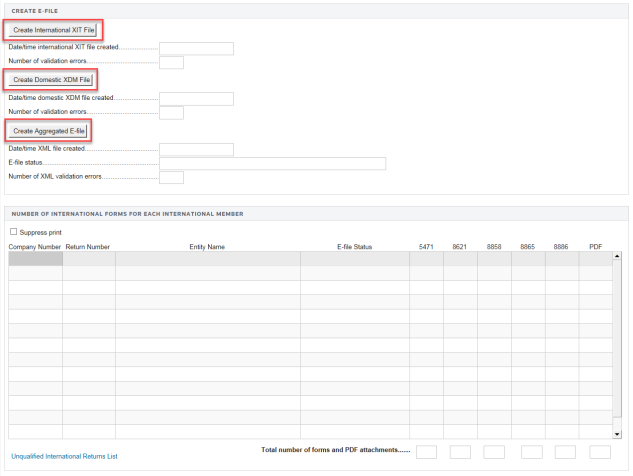

On the Create E-file screen, this time, select the Create Domestic XDM File button.

Step 3: Create Aggregated E-File. The final step combines the International XIT files and the Domestic XDM file into one.aggregated XML file ready for submission to the IRS.

On the Create E-file screen, select the Create Aggregated E-file button.

E-file/oit_ef_aggregation_3.htm/TY2020

Last Modified: 03/20/2020

Last System Build: 09/13/2021

©2020-2021 Thomson Reuters/Tax & Accounting.