990 E-file: Creating the E-file

Follow these steps to create the e-file:

- If no e-file diagnostics exist, create the file to send to the IRS by clicking the button on the Organizer screen. A pop-up box appears on the screen confirming that the files were created successfully.

- Make sure that the file is generated as the last step before sending (after ALL changes have been made to the return). If not, incorrect information will be sent to the IRS.

Generating the E-file

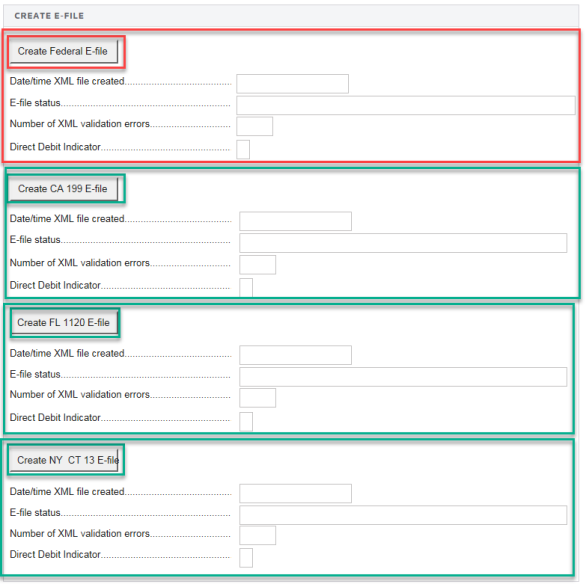

- Navigate to E-file > Return > Create E-File.

- Click the Create Federal E-file button (in area outlined in red).

- A popup screen will show XML File for Federal Exempt Org. The return is being created.

- Click OK. Another popup screen will show Start XML Validation.

- Click OK. If there are no errors, the XML validation is completed. Otherwise, the XML Validation result will indicate the number of errors.

- To review the validation errors, select View > Diagnostics > Efile XML Validation Errors, and select Federal. You will not be able to use GoTo to navigate to these errors.

- Correct the invalid input causing the errors.

- Recreate the test file by clicking the button labeled Generate Federal E-file to clear all validation errors.

- The application creates an e-file (to be filed with the IRS) only when no e-file diagnostics exist.

- If the e-file was created without any problem, the application shows a message stating E-files created successfully.

- Use the various state buttons to create the files for the e-filed state returns (in areas outlined in green).

E-file/990_ef_return_8.htm/TY2020

Last Modified: 08/13/2020

Last System Build: 09/13/2021

©2020-2021 Thomson Reuters/Tax & Accounting.