990 E-file: Enabling E-file

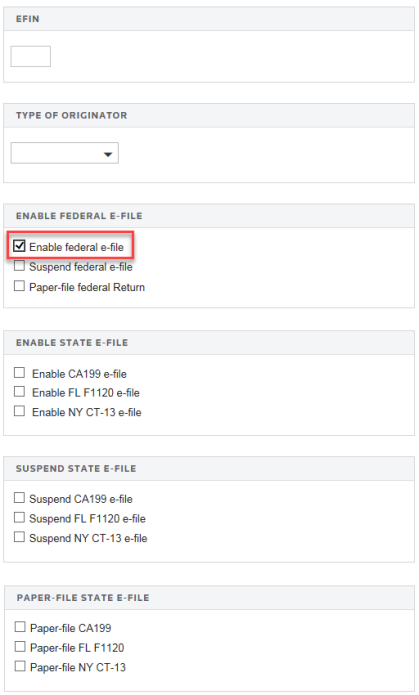

- On the Organizer tab, select E-file > Return > Enable E-file > Enable E-file.

- Be sure that Auto-Compute is turned on.

- Enter the EFIN (a six-digit number assigned by the Andover IRS service center) and the originator (the ERO is normally the paid preparer). Both fields are mandatory entries.

- Select the type of originator: ERO, Online Filer, Reporting Agent, IRS Agent, Financial Agent, or Large Taxpayer. The default is None selected.

- Check the box to enable e-file for the federal return. This is a mandatory entry.

- If desired, select the states for e-file.

- If desired, select the option to suspend the states for e-file.

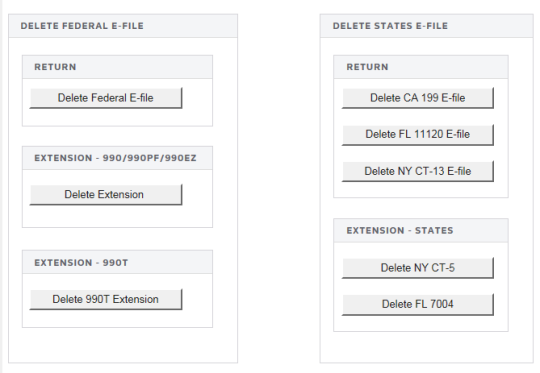

Deleting the E-file

- On the Organizer tab, select E-file > Return > Enable E-file > Delete E-file.

- Select the e-file you wish to delete (federal, extension, and/or state e-file).

- Click the appropriate button.

E-file/990_ef_return_3.htm/TY2020

Last Modified: 08/13/2020

Last System Build: 09/13/2021

©2020-2021 Thomson Reuters/Tax & Accounting.