990 E-file: Sending Qualified Extensions to the IRS

Each extension that has been determined to be Qualified for e-file during the extension compute process is a candidate for e-file. The e-file process requires you to select those Qualified extensions that you wish to e-file and create e-file batches. This batching process initiates a process that sends each locator’s e-file data to the IRS. Once filed, the IRS will send back an electronic status indicating whether the e-filed extension has been Accepted or Rejected.

In order to batch returns, you must have ELF ADMIN rights. If you do not have them, your firm administrator may assign these rights to you.

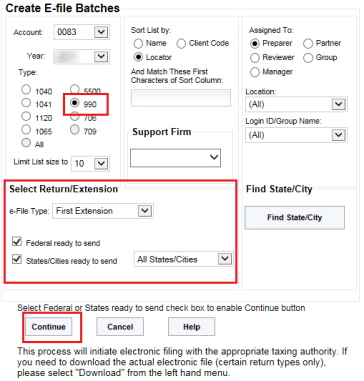

To create an e-file batch, follow the steps below:

- Select Returns Processing > E-file > Select Returns.

- Select an Account, Tax Year, and Extension Type 990 from the drop-down lists.

- Select the number of extensions to display from the Limit list size to drop-down dialog box.

- Select the preparer, reviewer, manager, and/or other user group to filter the list, plus any advanced sort criteria using the Advanced button.

- Select First Extension as the return type.

- Select whether the returns are Federal Ready to Send.

- Click Continue. A list of all extensions matching the criteria you selected is created.

- If you selected Federal Ready to Send:

- You will see a list of locators with the federal return ready to be sent.

- You may select which extensions you wish to send by checking the box in the Select column.

- When you select an extension, we assume that you want to send all extensions that are ready.

- After you made all your selections, click the Submit for e-file button.

- After completing this procedure, your returns will be processed and sent to the IRS.

- The processing status of these locators on the E-file Status Report will show as Awaiting Acknowledgment until the extension has either been Accepted or Rejected by the appropriate taxing authority.

E-file/990_ef_extensions_9.htm/TY2020

Last Modified: 02/17/2020

Last System Build: 09/13/2021

©2020-2021 Thomson Reuters/Tax & Accounting.