990 E-file: Creating the E-file for the Extension

Follow these steps to create the e-file:

- If no e-file diagnostics exist, create the file to send to the IRS by clicking the button on the Organizer screen. A pop-up box appears on the screen confirming that the files were created successfully.

- Make sure that the file is generated as the last step before sending (after ALL changes have been made to the extension). If not, incorrect information will be sent to the IRS.

- Exit the locator and extension.

Creating the E-file

- Go to E-file > Extension > Create E-file.

- Click the appropriate Create... button on this form (for first or second extension).

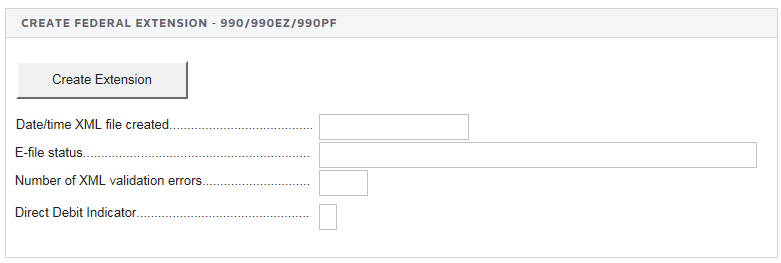

- For 990/990-EZ/990-PF:

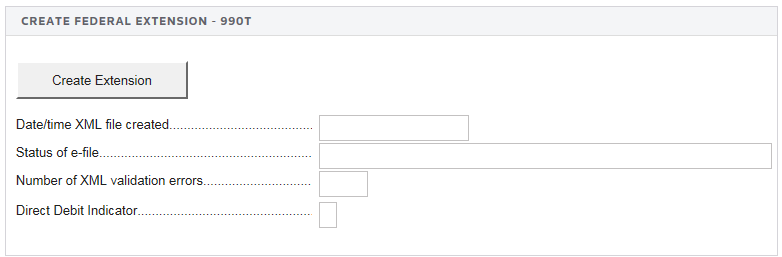

- For 990-T:

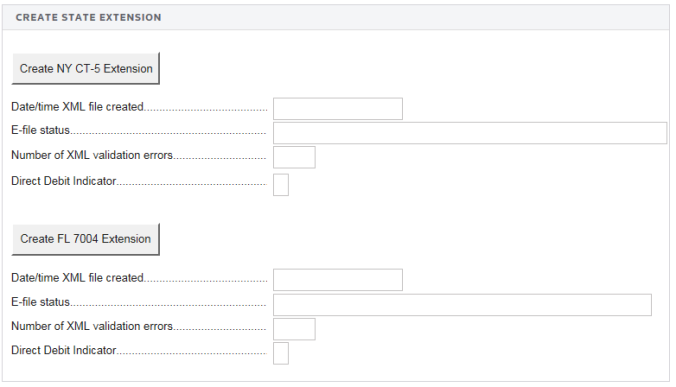

- For State Extensions:

- If the file was created without any problem, the application shows a message stating E-files created successfully.

- Review the XML file information.

This step is also used for reviewing selections for transmission and for disqualifying a previously qualified return. For further instruction on these functions, press the corresponding button.

E-file/990_ef_extensions_8.htm/TY2020

Last Modified: 02/17/2020

Last System Build: 09/13/2021

©2020-2021 Thomson Reuters/Tax & Accounting.