990 E-file: Selecting Signature Options

If you are filing the extension with a payment, enter information on the Signature Authorization Organizer. Signature option details for Form 8868 are applicable only if you have selected the option to allow the IRS to withdraw funds using the entered bank account information on the Bank Information Organizer.

- Navigate to E-file > Extension > Signature Authorization.

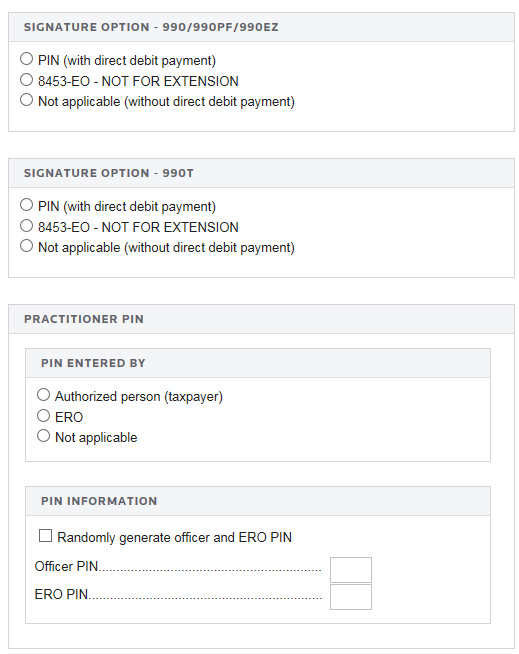

- Select the signature option for 990/990-PF/990-EZ:

- PIN with payment

- 8453-EO-NOT FOR EXTENSION

- Not applicable (without payment).

- Select the signature option for 990-T:

- PIN with payment

- 8453-EO-NOT FOR EXTENSION

- Not applicable (without payment).

- Indicate who entered the PIN: Authorized Person (Taxpayer), ERO, or Not applicable.

- Select the option, if desired, to randomly generate PINs for the officer and ERO.

- Enter the Officer PIN and ERO PIN. This information is mandatory if it is not entered in Tax Defaults.

E-file/990_ef_extensions_5.htm/TY2020

Last Modified: 02/17/2020

Last System Build: 09/13/2021

©2020-2021 Thomson Reuters/Tax & Accounting.