990 E-file: Setting E-file Tax Defaults

Setting General Tax Defaults for E-file

To set up e-file tax defaults for the entire firm, follow these steps:

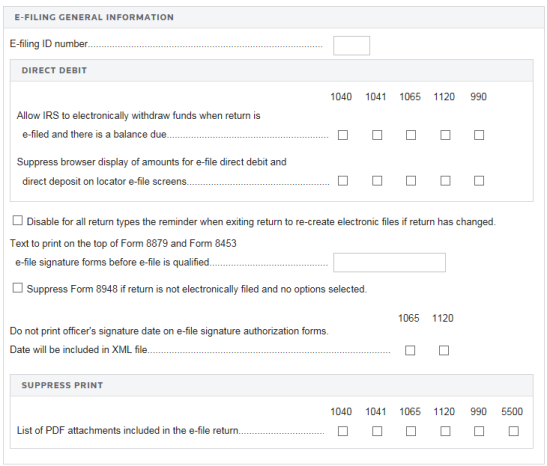

- In Tax Defaults, select E-file > General Information tab.

- Enter the E-file ID Number (EFIN) for the firm.

- Select the option, if desired, to allow the IRS to electronically withdraw funds when the return is e-filed with a balance due.

- For all return types, indicate if you wish to disable the reminder to recreate e-files (for those returns that have changed) when you exit the return.

- Enter text to print on the top of Form 8879 and Form 8453 e-file signature forms before the e-file is qualified.

- Select the option, if desired, to suppress Form 8948 if the returned is not e-filed and there are no options selected.

- (Does not apply to 990) Select the option, if desired not to print the officer’s signature date on the e-file signature authorization forms for 1065 and 1120. The date will be included in the XML file.

- Select the option, if desired, to suppress print of the list of PDF attachments included in the e-file return. You may select this for one, more than one, or all of the listed tax return types.

Setting 990 Tax Defaults

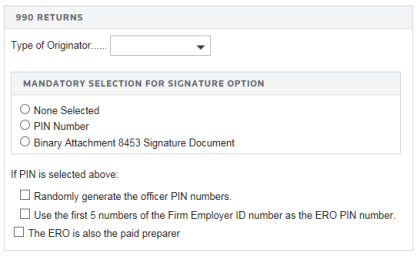

- Navigate to E-file > 990.

- Select the type of originator: ERO, Online Filer, Reporting Agent, IRS Agent, Financial Agent, or Large Taxpayer. The default is None Selected.

- Select the default signature method: None Selected, PIN, or Binary Attachment 8453 Signature Document. You may override this default on a return-by-return basis.

- If you select the Practitioner PIN, you can select any or all of the following options:

- randomly generate the officer PINs

- use the first five numbers of the Firm Employer ID Number (FEIN) as the ERO PIN.

- If applicable, select the option to indicate that the ERO is also the paid preparer.

E-file/990_ef_defaults.htm/TY2020

Last Modified: 02/17/2020

Last System Build: 09/13/2021

©2020-2021 Thomson Reuters/Tax & Accounting.