5500 E-file: Selecting Signature Options

As part of its E-file Mandate, the Department of Labor requires that each return be digitally signed with a UserID and PIN. Plan Administrators, Sponsors, Direct Filing Entities and plan service providers with written authorization to sign on behalf of the plan administrator must obtain these credentials directly from the DOL at https://www.efast.dol.gov/.

- On the Organizer tab, select E-file > Signature Options.

- Registration with the DOL is required for the Plan Administrator, Sponsor, Plan Service Provider, and/or Direct Filing Entity (DFE) that will sign and take responsibility for the e-filed return/report. Select the appropriate signer from the Forms List Window.

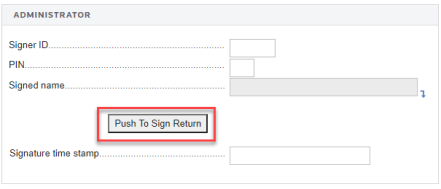

- If you select Administrator, for example.

- Enter the UserID, PIN obtained from the DOL, and the signature name.

- When clicked, the Push To Sign Return button will populate the Signature Time Stamp field. The Signer ID and PIN will also be encrypted in compliance with DOL regulations.

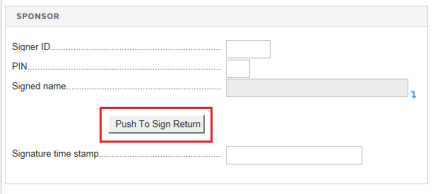

- If you select Sponsor:

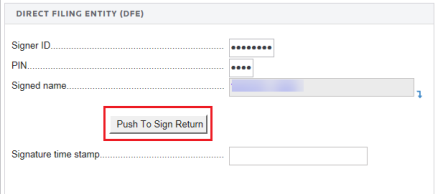

- If you select Direct Filing Entity:

If any changes are made after signing the return, you must resign the return to update the correct time stamp.

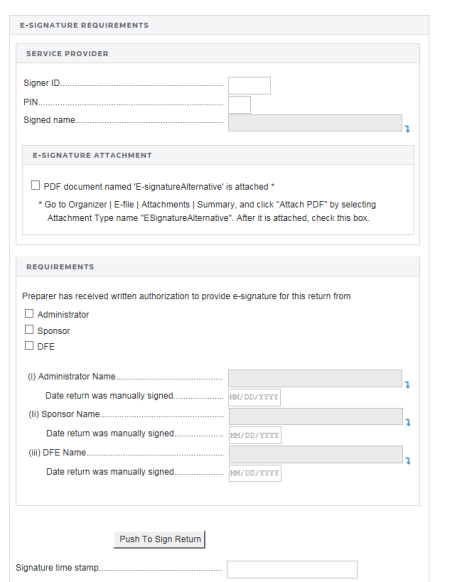

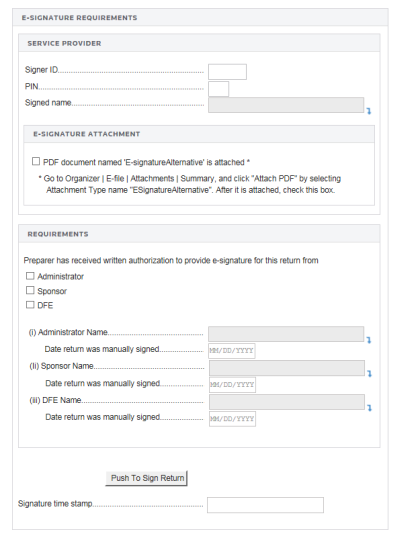

- On the right side of the screen (be aware that you may have to scroll right), enter e-signature requirements:

- For the service provider, enter the SignerID, PIN, and signature name.

- For the E-signature Attachment, indicate if a PDF document named E-signatureAlternative is attached to the return. Please go to Organizer > E-file > Attachments > Summary, and click Attach PDF by selecting the Attachment Type name ESignatureAlternative. Once it is attached, check this box.

- Indicate that the preparer has received written authorization to provide the e-signature for the return from the administrator, sponsor, and/or the DFE. For each selection, enter the name and the date on which the return was manually signed.

- When clicked, the Push To Sign Return button will populate the Signature Time Stamp field. The Signer ID and PIN will also be encrypted in compliance with DOL regulations.

- To select general signature options, select the E-signature hyperlink at the top of the screen. The following screen appears.

- Indicate if a PDF document named E-signatureAlternative is attached to the return. Please go to Organizer > E-file > Attachments > Summary, and click Attach PDF by selecting the Attachment Type name ESignatureAlternative. Once it is attached, check this box.

- Indicate if the preparer has received written authorization to provide the e-signature for the return.

- Enter the plan administrator’s name and the date the return was manually signed by the administrator.

- For an e-signature, enter the Signer ID, PIN, and signature name.

- When clicked, the Push To Sign Return button will populate the Signature Time Stamp field. The Signer ID and PIN will also be encrypted in compliance with DOL regulations.

E-file/5500_ef_3.htm/TY2020

Last Modified: 02/17/2020

Last System Build: 09/13/2021

©2020-2021 Thomson Reuters/Tax & Accounting.