5500 E-file: Form 5500 Pension Benefit Plans Numbered Greater than 500 - DOL Criteria for Final Year XML Elements

Please check the XML after creating the e-file to match all of the element values below.

Form5500/n1:SubtlActRtdSepCnt = 0 and

Plan number (n1:FilingData/n1:Form5500/n1:SponsDfePlanNum) greater than 500)

Plan number (n1:FilingData/n1:Form5500/n1:SponsDfePlanNum) greater than 500)

Below are the changes to be made in the Organizer or Tax Form 5500:

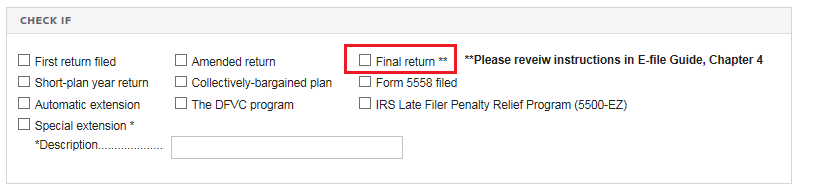

- Navigate to Organizer > 5500 Series > Plan Name > Basic Plan Information > Basic Plan Information.

- Select the option for Final Return.

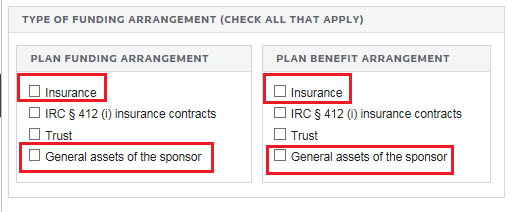

- Navigate to Organizer > 5500 Series > Plan Name > 5500 > Form 5500 >5500 Information.

- In the Type of Funding Arrangement section, only Insurance OR General assets of the sponsor are checked.

- Ensure that the following XML element is as shown:

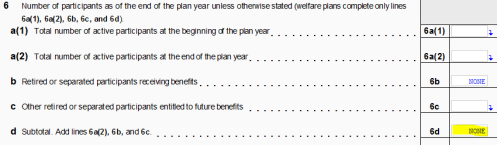

n1:FilingData/n1:Form5500/n1:SubtlActRtdSepCnt = 0 - Navigate to Tax Forms > Form 5500 > Page 2. Line 6d should be NONE.

E-file/5500_ef_final_year_5.htm/TY2020

Last Modified: 02/17/2020

Last System Build: 09/13/2021

©2020-2021 Thomson Reuters/Tax & Accounting.