5500 E-file: Form 5500 for Pension Benefit Plans Numbered Less than 501 - DOL Criteria for Final Year XML Elements

Please check the XML after creating the e-file to match all of the element values below.

SchH/n1:AllPlanAstDistribInd ='1' or

SchI/n1:AllPlanAstDistribInd = '1' ) and

SchH/n1:TotAssetsEoyAmt = 0 or

SchI/n1:TotAssetsEoyAmt = 0 ) and

Form5500/n1:TotActRtdSepBenefCnt =0 and

Plan Number Form5500/n1:SponsDfePlanNum) less than; 501)

SchI/n1:AllPlanAstDistribInd = '1' ) and

SchH/n1:TotAssetsEoyAmt = 0 or

SchI/n1:TotAssetsEoyAmt = 0 ) and

Form5500/n1:TotActRtdSepBenefCnt =0 and

Plan Number Form5500/n1:SponsDfePlanNum) less than; 501)

Below are the changes to be made in the Organizer or Tax Form 5500 and other Schedule H or I:

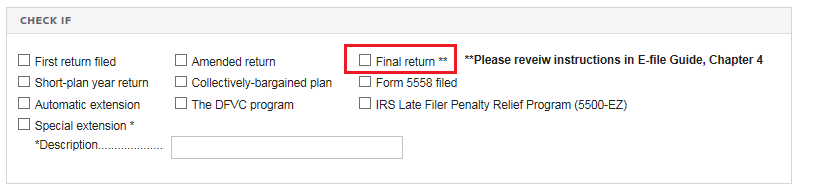

- Navigate to Organizer > 5500 Series > Plan Name > Basic Plan Information > Basic Plan Information.

- Select the option for Final Return.

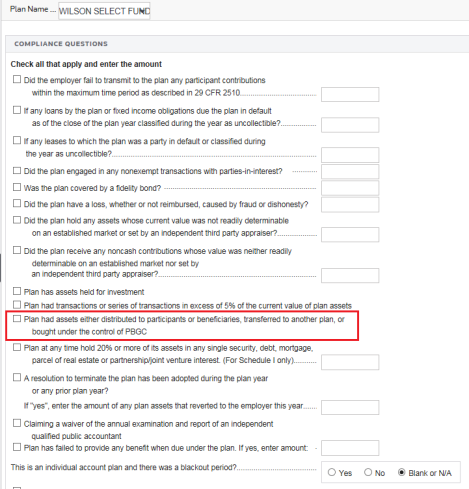

- Navigate to Organizer > 5500 Series > Plan Name > 5500 > Financial Information (Sch. H/I) > Transactions during plan year.

- Select the following option:

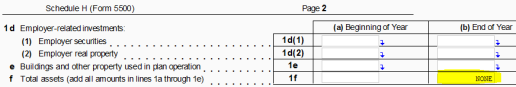

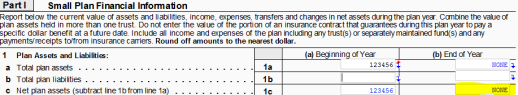

- Navigate to Tax Forms > Schedule H, Page 2, OR navigate to Schedule I.

For Schedule H, Page 2, line 1(f)(b) should be NONE.

For Schedule I, line 1(c)(b) should be NONE.

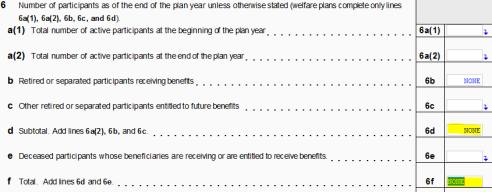

- Navigate to Tax Forms > Form 5500 > Page 2. Lines 6d and 6f should be NONE.

E-file/5500_ef_final_year_4.htm/TY2020

Last Modified: 02/17/2020

Last System Build: 09/13/2021

©2020-2021 Thomson Reuters/Tax & Accounting.