5500 E-file: Form 8955-SSA - Creating the Annual Statement E-file

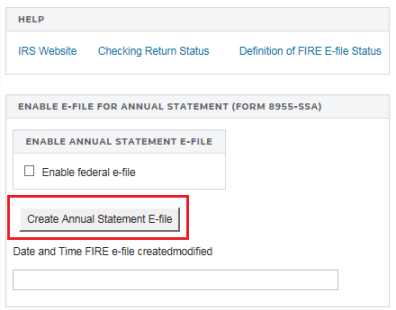

- To create the e-file, click the Create Annual Statement E-file button.

- To review the messages generated by the e-file creation, go to E-file > Annual Statement E-file > Detail. Review the E-file Messages box to view the status of the e-file.

- Select View > Diagnostics to open the Diagnostics dialog box. Select the Electronic Annual Stmt option.

- If you have enabled Annual Statement E-file, two folders will exist for e-file diagnostics: Alerts and Rejects.

- Alert diagnostics: These do not prevent the creation of a qualified e-file. You should still investigate the conditions causing the Alert diagnostics, as these may reveal input errors.

- Reject diagnostics: These diagnostics identify conditions in the return that will result in a IRS rejection for failure to meet IRS requirements.

- Click the Definition of E-file Status hyperlink for information on the status of your return. Returns may be any of the following:

- Awaiting Acknowledgment

- Accepted

- Rejected

- Conditionally Accepted

E-file/5500_ef_8955SSA_4.htm/TY2020

Last Modified: 02/17/2020

Last System Build: 09/13/2021

©2020-2021 Thomson Reuters/Tax & Accounting.