1120 State E-file: Spreadsheets

State spreadsheets are provided to enter state information. The following section details the headings available for each spreadsheet.

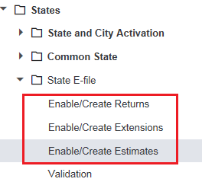

When a state is activated, the option to enable e-file for that jurisdiction is automatically selected. This triggers the e-file diagnostics, that allows the user to clear errors earlier in the return preparation process. This option can be turned off under Organizer > States > State E-file > Enable/Create > Return tab > Enable column.

Enabling e-file does not cause the file to be created or qualified. It only notifies the system of the intention to do so, and triggers the e-file diagnostics.

Enable/Create

Each state and city offering e-file extensions is listed when activated in Organizer > States > State and City Activation. The state extension should be enabled within Organizer > States > State E-File > Enable/Create Returns, or Enable/Create Extensions, or Enable/Create Estimates, as required.

Return Spreadsheet

Create Clicking this button creates the e-file and identifies if there are any reject diagnostics or validation errors. The e-file status and XML information is then displayed.

Enable Selecting this check box is mandatory to create an e-file, to generate reject diagnostics, and to identify validation issues. By default this check box is selected for each state.

EFIN The electronic filing identification number carries from the federal Organizer.

Originator Type The Originator type (ERO or Large Taxpayer) carries from the federal Organizer

Signature Option If the state or city requires a signature, the available options can be selected from the drop down list

Business Name Control Generally, the name is derived from the first four characters of the business name, and it is automatically included in the XML file. An override name control can be entered to be included in the XML file.

Signature Authorization Certification (1120 Only) For states requiring additional information regarding signature, the applicable choice should be selected

E-file Status The e-file status displays after an e-file is created, and is updated when the e-file is submitted, rejected, or submitted.

Date/Time E-file Created The time stamp of the last e-file created is displayed.

Number of Validation Errors The number of validation errors existing when the latest e-file created is displayed.

XML File Name The name of the XML file is displayed. The file name includes the locator number, preceded by an alpha character, and is followed by the tax year indicator. The file extension is unique for each state/city and file type.

XML File Size The size of the latest XML file is created.

Direct Debit Indicator With direct debit information entered and authorized in Common State > General Information > Bank Information, the Direct Debit Indicator shows Yes after the e-file is created.

Delete The Delete button deletes the existing XML file for that jurisdiction. The E-file Status is changed to indicate that the XML file has been deleted.

Federal Copy Spreadsheet

Federal Copy selections are:

- Attach the federal XML file created for this return.

- Attach a federal XML created just for the state attachment (state only copy).

- Attach a federal XML file created in a different return.

Federal EIN By default, this field displays the federal EIN of the current return. If attaching the federal XML from a different return, enter the EIN of that return.

Locator Number By default, this field displays the locator number of the current return. If attaching the federal XML from a different return, enter the locator number of that return.

Account Number By default this field displays the account number of the current return. If attaching the federal XML from a different return, enter the account number of that return.

Top Consolidation EIN (Corporate Non-Taxable Entities) If the federal return is not a single or top consolidation return (that is, parent, subsidiary, etc.), but the state return is a file-able return, then a proforma of the federal 1120 or 1120S return, pages 1-5, is required in XML format. Enter EIN of the top consolidation return.

Top Consolidation Locator Number (Corporate Non-Taxable Entities) If the federal return is not a single or top consolidation return (that is, parent, subsidiary, etc.), but the state return is a file-able return, then a proforma of the federal 1120 or 1120S return, pages 1-5, is required in XML format. Enter the locator number of the top consolidation return.

Top Consolidation Account Number (Corporate Non-Taxable Entities) If the federal return is not a single or top consolidation return (that is, parent, subsidiary, etc.), but the state return is a file-able return, then a proforma of the federal 1120 or 1120S return, pages 1-5, is required in XML format. Enter account number of the top consolidation return.

Federal E-file Status The e-file status of the state only copy of the federal attachment is displayed after the state e-file is created.

Federal E-file Date/Time Created The time stamp of the of the state-only copy of the federal attachment is displayed after the state e-file is created.

Federal Number of Validation Errors The number of validation errors of the state-only copy of the federal attachment is displayed after the state e-file is created.

Federal XML File Name The XML file name of the state only copy of the federal attachment is displayed after the state e-file is created.

Extension Spreadsheet

Each state and city offering e-file extensions is listed when activated in Organizer > States > State and City Activation. The state extension should be enabled within Organizer > States > State E-File > Enable/Create Extensions.

Create Clicking this button creates the e-file, and identifies if there are any reject diagnostics are validation errors. The e-file status and XML information is then displayed.

Enable Checking this field is mandatory to create an e-file, to generate reject diagnostics, and to identify validation issues.

EFIN The electronic filing identification number carries from the federal Organizer.

Originator Type The Originator type (ERO or Large Taxpayer) carries from the federal Organizer

E-file Status The e-file status displays after an e-file is created, and is updated when the e-file is submitted, rejected or submitted.

Date/Time E-file Created The time stamp of the last created e-file is displayed.

Number of Validation Errors The number of validation errors existing when the latest created e-file is displayed.

XML File Name The name of the XML file is displayed. The file name includes the locator number, preceded by an alpha character, and followed by the tax year indicator. The file extension is unique for each state/city and file type.

Direct Debit Indicator With direct debit information entered and authorized in Common State > General Information > Bank Information, the Direct Debit Indicator shows Yes after the e-file is created.

Estimates Spreadsheet

Each state and city offering e-file estimates is listed when activated in Organizer > States > State and City Activation. The state extension should be enabled within Organizer > States > State E-File > Enable/Create Estimates.

Create Clicking this button creates the e-file for that quarter, and identifies if there are any reject diagnostics are validation errors. The e-file status and XML information is then displayed.

Enable Checking this field is mandatory to create an e-file, to generate reject diagnostics, and to identify validation issues.

EFIN The electronic filing identification number carries from the federal Organizer.

Originator Type The Originator type (ERO or Large Taxpayer) carries from the federal Organizer.

E-file Status The e-file status displays after an e-file is created, and is updated when the e-file is submitted, rejected, or submitted.

Date/Time E-file Created The time stamp of the last e-file created is displayed.

Number of Validation Errors The number of validation errors existing when the latest e-file created is displayed.

XML File Name The name of the XML file is displayed. The file name includes the locator number, preceded by an alpha character, and followed by the tax year indicator. The file extension is unique for each state/city and file type.

XML File Size The size of the latest XML file is created.

Direct Debit Indicator With direct debit information entered and authorized in Common State > General Information > Bank Information, the Direct Debit Indicator shows Yes after the e-file is created.

Validation Spreadsheet

To aid in correcting errors, a Validation File for the return can be created that includes GoTo functionality.

E-file Status The e-file status displays after an e-file is created. If not qualified, diagnostics and/or validation errors exist

Date/Time E-file Created The time stamp of the last validation file created is displayed.

Number of Validation Errors The number of validation errors existing with the last validation file created. This number is not updated until the next validation file is created.

XML File Name The name of the validation file is displayed. The file name includes the locator number, preceded by an alpha character, and followed by the tax year indicator. The file extension is unique for each state/city and file type.

E-file/1120_ef_state_6.htm/TY2020

Last Modified: 03/20/2020

Last System Build: 09/13/2021

©2020-2021 Thomson Reuters/Tax & Accounting.