1120 E-file: Validations

The IRS has defined a rigid structure that must be used to create e-file tax returns. This structure is necessary and critical to ensure e-file returns can be transmitted to and viewed by IRS systems. E-file returns not meeting these requirements will be rejected by the IRS.

To ensure returns meet its strict formatting requirements, the IRS performs two levels of validations on all received returns: business rule validation and schema validation.

Business Rule Validation

The MeF system verifies the return data against a series of business rules. Most business rules test for such things as missing information, mismatched information, or incorrect data. Two examples are:

- If Form 1120, line 8 has a non-zero value, then Schedule D (Form 1120) must be attached.

- If Form 1120, Schedule L is present, Form 1120, Item D Total Assets must equal Form 1120, Schedule L, line 15d.

A business rule that fails will result in a reject diagnostic and will prevent the return from being e-filed.

Business rule validations consist of two types of reject diagnostics. One type of reject diagnostic compares information within the return to the business rules. These diagnostics can be cleared by correcting the tax return information and computing the return.

The second type of diagnostic is generated by the Business Rules Management System (BRMS). The BRMS compares the e-file XML file to the business rules. These diagnostics are cleared by correcting the tax return information and re-creating the e-file or re-generating the validation file. Diagnostics generated through BRMS are identified by an asterisk appearing in front of the diagnostic

Business rules also include database validation checks to ensure information contained in the e-file agrees with information contained in the IRS databases. For example, if the taxpayer’s EIN and Name Control (first four characters of the taxpayer name) do not match data in the IRS e-file database, the return will be rejected. This type of business rule violation cannot be detected until the return is submitted to the IRS.

Schema Validation

Schemas provide the basic definition for elements – what is required, field length, data type, allowable values, etc. Data integrity depends on each data element complying with the data format specifications. The MeF system verifies this by validating each return against the schemas. If a data format error is encountered, the return is rejected.

When the e-file is created, we automatically validate the XML file against the IRS schemas. If there are XML validation errors, the number of errors is reported on the Create E-file screen, and each error is displayed in the View > Diagnostics menu. An e-file cannot be submitted if validation errors exist.

Correcting Validation Errors with GoTo Functionality

Creating the e-file also identifies and reports any validation errors that exist, but the validation error message can be difficult to understand, and finding where to correct the error might not be clear. To aid in correcting validation errors, a Validation File can be created that includes GoTo functionality.

Follow the steps below to create a Validation File with the GoTo functionality:

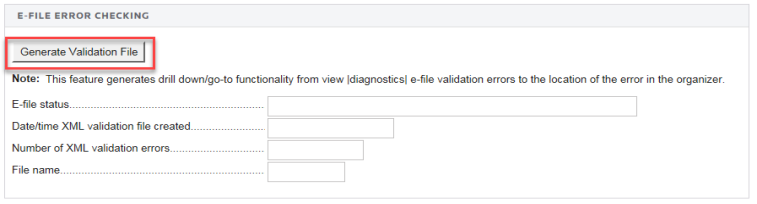

- In the Organizer, select Federal E-file > Error Checking, and then select the Generate Validation File button.

- Creating the XML file with the GoTo functionality for states is performed separately in the State E-file > Validation spreadsheet.

- After the validation file is created, access View > Diagnostics > E-file Validation Errors.

- Selecting a validation error should take you to the source of the error. The source of the error can be an Organizer or a Tax Form field. If the error is contained in a Tax Form field, you should hyperlink to the applicable Organizer field to update.

- Repeat this process until all validation errors are eliminated.

- After all validation errors are eliminated, use Create E-file to create the final XML file that can be transmitted.

- GoTo functionality is not available for XML files created using the Create E-file button. However, if an XML file is created using the Create E-file steps shown above then the GoTo functionality should be reestablished.

The GoTo capability does not function for some XML validation errors.

E-file/1120_ef_validation.htm/TY2020

Last Modified: 03/20/2020

Last System Build: 09/13/2021

©2020-2021 Thomson Reuters/Tax & Accounting.