1120 E-file: Transmissions and Acknowledgments

Transmissions

An electronic postmark is created bearing the date and time (Central time zone) that the e-file is received at the host computers. If timeliness of filing is in question, the IRS uses the electronic postmark that is adjusted to the time of the taxpayer. For example, if the taxpayer is located in the Eastern time zone, one hour would be added to the electronic postmark to determine the filing time. Conversely, if the taxpayer is located in the Pacific time zone, two hours would be subtracted from the electronic postmark.

If the electronic postmark is on or before the prescribed deadline for filing, but the return or extension is received by the IRS after the prescribed deadline for filing, it is treated as filed on the electronic postmark’s date if received within two days of the electronic postmark. If the electronic postmark is after the prescribed deadline for filing, the IRS receipt date is the actual filing date.

Acknowledgments

The IRS electronically acknowledges the receipt of all returns and extensions as either Accepted or Rejected for specific reasons. Returns and extensions which pass all IRS validations are considered filed as soon as they are accepted. Returns and extension that do not pass validation are rejected, and are considered not accepted.

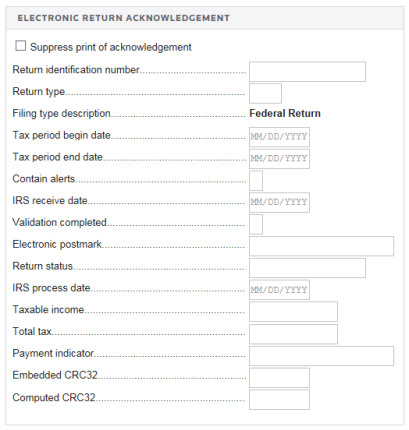

Example of Acknowledgment Information

To generate an Electronic Return Acknowledgment:

- Go to Federal E-file > Status.

- Scroll down the screen to view the Electronic Return Acknowledgment section.

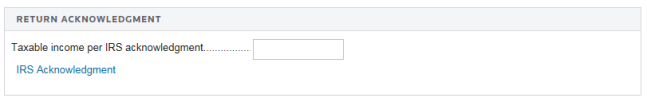

- Select the IRS Acknowledgment link to view the taxable income acknowledgment shown below.

Transmission Perfection Period For Rejected Returns

When a transmitted e-file return is rejected, there is a 10-day Transmission Perfection Period to prepare that return for e-file retransmission. For Form 7004 extensions, the perfection period is only five (5) days. Perfection of the return for e-file retransmission generally means that the originally signed return might have errors in the format of the XML or errors that cause the return to fail the IRS e-file business rules. When a previously rejected electronic return is Accepted by the IRS within the 10-day Transmission Perfection Period, it is deemed to have been received on the date of the first reject that occurred within that 10-day period.

In other words, the 10 days is actually a look back period, and is determined once the return is accepted. The IRS looks back 10 days from the date the return is Accepted to determine if there have been any rejects for the same EIN and Year. If there have been one or more rejects within that 10 day look back period, the IRS uses the received date on the earliest reject as the received date for the Accepted return. Refer to IRS Publication 4163 - Modernized e-File (MeF) Information for Authorized IRS e-File Providers for Business Returns for more information regarding rejected returns and extensions.

The Transmission Perfection Period is NOT an extension of time to file; it is a period of time that is granted to correct errors in the E-file. The Transmission Perfection Period applies to business returns filed on MeF, without regard to the date filed, due date, or extended due date. The yearly cut-over period does not extend the 10-day Transmission Perfection Period. Moreover, the perfection period is never extended for weekends, holidays, or the end of the year cutoff.

Rejected E-filed Returns

Taxpayers who cannot get their return accepted or who decide to file a paper return instead, must also ensure that their paper return is filed timely. To be considered timely filed, this paper return must be postmarked by the later of the due date of the return (including extensions), or ten (10) calendar days after the date the IRS last gives notification that the return was rejected.

Follow the steps below to ensure that the paper return is identified as a rejected electronic return, and the taxpayer is given credit for the date of the first reject within the 10 day transmission perfection period:

- The taxpayer must call the IRS (at 1-866-255-0654) to advise that they have not been able to have their return accepted. The e-Help Desk then provides an e-case number to the taxpayer.

- The taxpayer should prepare the paper return and include the following:

- An explanation of why the paper return is being filed after the due date.

- A copy of the reject notification.

- A brief history of actions taken to correct the electronic return.

- Write in red at the top of the first page of the paper return REJECTED ELECTRONIC RETURN – (DATE). The date indicated should be the date of the first reject within the 10-day transmission perfection time frame.

- The taxpayer must sign the paper return. The PIN that was used on the rejected e-file return cannot be used as the signature on the paper return.

Corporations, partnerships, and tax-exempt organizations required to e-file must contact the e-Help Desk (1-866-255-0654) for assistance in correcting rejects before filing a paper return. They must receive authorization from the e-Help Desk before filing a paper return.

Rejected E-filed Extensions

If the IRS rejects the application for filing extension request, and the reason for the rejection cannot be corrected and retransmitted, the provider must take reasonable steps to inform the taxpayer of the rejection within 24-hours of receiving the acknowledgment. The provider must also provide the taxpayer with a Business Rule explanation.

- If the electronic application for filing extension can be retransmitted, it must be filed by the later of the due date of the return or five calendar days after the date the Service gives notification the application for extension is rejected.

- If the electronic application for filing extension cannot be accepted for processing electronically, the taxpayer must file a paper application for filing extension. In order for the paper application for filing extension to be considered timely, it must be filed by the later of the due date of the filing extension or five calendar days after the date the IRS gives notification that the filing extension is rejected. The paper application for filing extension should include an explanation of why it is being filed after the due date and include a copy of the electronic rejection notification.

E-file/1120_ef_trans_ack_1.htm/TY2020

Last Modified: 03/20/2020

Last System Build: 09/13/2021

©2020-2021 Thomson Reuters/Tax & Accounting.