1120 E-file: Error Checking

Before a qualified e-file can be created, all e-file errors must be cleared.

Types of E-file Errors

Reject Diagnostics Reject diagnostics identify conditions in the return, which result in an IRS rejection for failure to meet IRS Business Rules. Reject diagnostics also identify many of the common conditions that can result in an XML validation error. The conditions generating the reject diagnostic must be corrected before a qualified e-file can be generated.

Alert Diagnostics Alert diagnostics might also be present. While Alert diagnostics do not prevent the creation of a qualified E-file, the conditions causing these diagnostics should still be investigated since they can reveal input errors.

XML Validation Errors Data that does not meet the strict schema formatting requirements of the IRS schemas result in XML validation errors. Reject diagnostics and XML validation errors are displayed within a return in the View > Diagnostics menu.

How to Find the E-file Diagnostics

Click here to see a short video about how to use the e-file diagnostics information in Organizer.

https://onesourcesupport.onesourcelogin.com/Product/self_Service/SearchingforDiagnostics/index.html

Clearing Reject Diagnostics

With e-file enabled, reject diagnostics are generated whenever conditions within the return fail to meet IRS business rules, or when conditions exist that lead to the most common validation errors. Since reject diagnostics can be generated at any time when the return data is changed, frequent review of the diagnostics during the return preparation process should make creating a qualified e-file less time-consuming.

Review reject diagnostics in the View > Diagnostics menu. For most diagnostics, selecting on the diagnostic description should take you to the source fields that need attention. Where this GoTo functionality is not available, the steps for navigating to the source fields should be listed in the diagnostic description.

Correcting XML Validation Errors

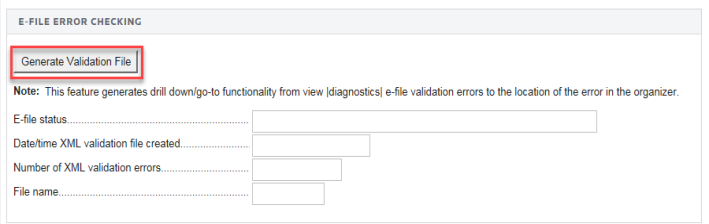

XML errors are identified when an e-file is created. But prior to creating this e-file, perform error checking by generating a validation file. This allows you to select each error and be taken to the source of the error.

On the Error Checking screen, select the Generate Validation File button. Once the validation file is completed, the Number of validation errors field indicates if any XML errors exist. If errors exist, use the View > Diagnostics menu to access the validation errors with GoTo functionality enabled.

- The XML file created during error checking is not transmitted to the IRS. selecting the validation error takes you to the source of the error, using GoTo functionality. This can be either a Tax Form or an Organizer field. However, if it is a Tax Form field, you should hyperlink to the applicable Organizer field and correct the input.

- The XML validation errors listed in the View > Diagnostics menu are not updated until the XML file is re-created.

- A single input problem can often generate multiple XML errors. Correcting the cause of one error can automatically correct other errors.

- There might be some XML validation errors where the GoTo capability does not function.

E-file/1120_ef_steps_6.htm/TY2020

Last Modified: 09/13/2021

Last System Build: 09/13/2021

©2020-2021 Thomson Reuters/Tax & Accounting.