1120 E-file: Attachments

An attachment is additional information that can be included in the e-file as part of the XML file, or included as a separate PDF file. Elections are also included in the XML file. An election containing columnar data can be attached as a separate PDF file.

PDF File Attachments

Follow these steps to attach PDF files:

- Go to Federal E-file > Attachments > PDF Attachments > Summary screen, and select the Attach PDF button.

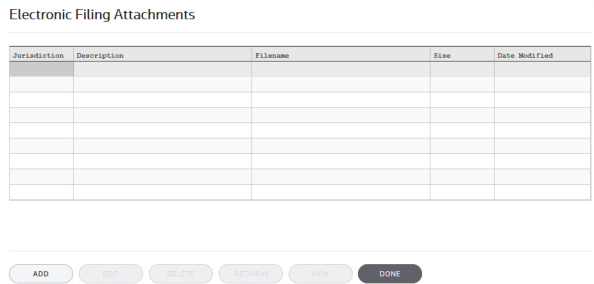

- The following Electronic Filing Attachments screen is displayed:

- On the Electronic Filing Attachments screen, select Add to add a new attachment.

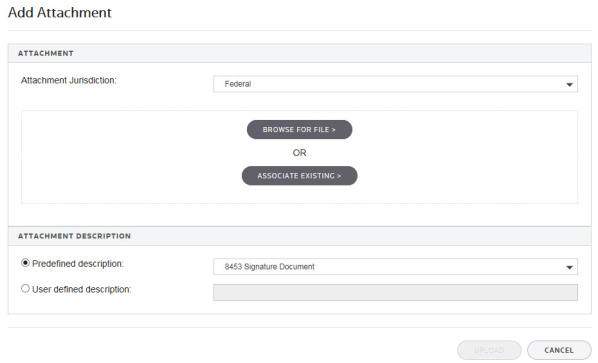

- On the Add Attachment pop-up screen, select the Attachment Jurisdiction from the drop-down list that applies to this attachment. Select Next.

- The next dialog box allows you to browse to the location of the desired PDF file. Highlight the PDF file, and then select Open.

- The Add Attachment to Federal Return pop-up screen displays information about the selected attachment. You must now select a meaningful title for the attachment. Either you can elect one of the listed titles by selecting the IRS predefined description option, or enter your own User defined description. The default user-defined title is the file name, without the extension. After selecting either option, select Finish.

The IRS has created lists of recommended names and descriptions for PDF attachments at http://www.irs.gov/Tax-Professionals/e-File-Providers-&-Partners/Recommended-Names-and-Descriptions-for-PDF-Files-attached-to-Modernized-e-File-MeF-Business-Submissions. - A pop-up dialog box confirms the Attachment successfully added. Select OK.

- The selected PDF file now appears in the Electronic Filing Attachments window showing the selected jurisdiction, attachment title (description), file name, file size, and date modified. Select Done to complete the attachment.

- The details for each PDF attachment are displayed below the Summary screen. The name of the attached file should appear under that file folder. Details for each PDF attachment are presented on a separate detail screen.

Forms Allowed as PDF Files

The IRS allows attachment of certain forms as PDF files instead of requiring the forms to be included in the XML file. Navigate to Organizer > Federal E-file > Attachments > PDF Attachments > Additional Information > Forms Allowed as PDF tab.

These forms listed in the PDF Attachments section can be attached as PDF files without meeting any other requirements. If using this option, by checking the applicable boxes, the form is prevented from inclusion in the XML portion of the e-file. Also, they must use the predefined titles from the PDF attachment dialog.

If information has been entered in Organizer for any of these forms, but you intend to attach the form as a PDF file, select the check box(es) to prevent those forms from being included in the XML file.

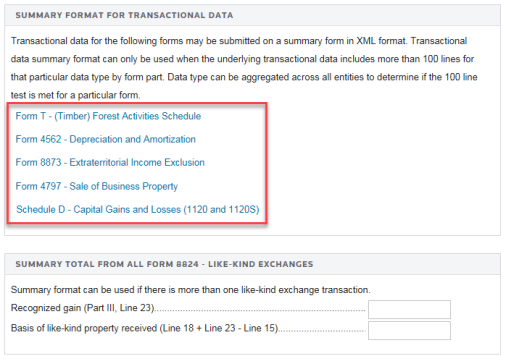

Transactional Data

The IRS allows summary data to be reported for the following forms:

- Form T: (Timber) Forest Activities Schedule

- Form 4562: Depreciation and Amortization

- Form 8873: Extraterritorial Income Exclusion

- Form 4797: Sale of Business Property

- Schedule D: Capital Gains and Losses (1120 and 1120S).

- Go to Organizer > Federal E-file > Attachments > PDF Attachments > Additional Information > Transactional Data tab.

- Follow the hyperlink (boxed in red) for each of the five forms to access the screen where you can enter the transactional data.

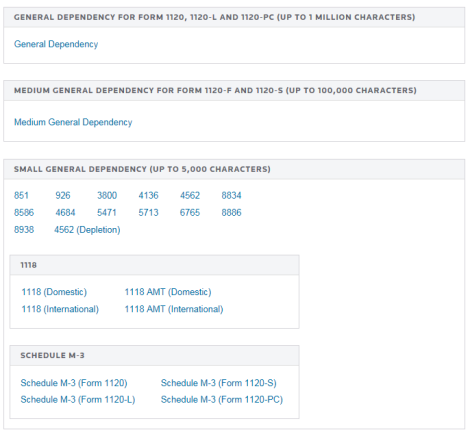

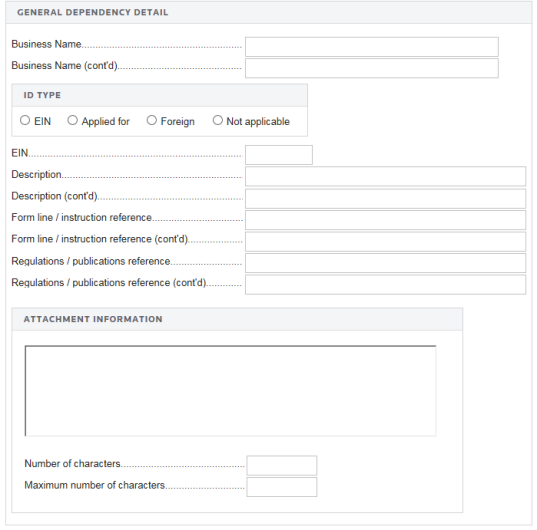

General Dependency

A General Dependency is used for the submission of information that is not specified in a predefined schema. For each form that allows attachment of a general dependency, the Overview screen displays links to access general dependency information. Select a link to access a specific item.

Attachments Included in the XML File

The General Dependency schema is used to include information at the return level for Form 1120. The General Dependency – Medium is used to include information at the return level for Forms 1120-F and 1120S. The General Dependency – Small is used at the form level of all return types for the following forms:

- Form 851

- Form 926

- Form 1118

- Form 1118 AMT

- Form 3800

- Form 4136

- Form 4562

- Form 4684

- Form 5471

- Form 5713

- Form 6765

- Form 8586

- Form 8834

- Form 8865

- Form 8886

- Form 8938

- Schedule M-3 (Form 1120)

- Schedule M-3 (Form 1120L)

- Schedule M-3 (Form 1120PC)

- Schedule M-3 (Form 1120S)

General Dependency at the Return Level

To add a General Dependency:

- Select Attachments > Add General Dependency.

- Select Add new Description.

- In the Add new Description dialog box, add a description in the field provided. An unlimited number of general dependencies can be added. Select OK to close.

- Based on the return type, this information is automatically included in the XML file using the correct general dependency schema.

International Form Attachments

See 1120 E-file: Aggregating International Forms from Returns Created with Third Party Software for more information on international forms.

E-file/1120_ef_steps_4.htm/TY2020

Last Modified: 03/20/2020

Last System Build: 09/13/2021

©2020-2021 Thomson Reuters/Tax & Accounting.