1120 E-file: Using the Application

The application provides several methods for entering federal tax elections. Each method for entering elections can be completed in Organizer > Federal Tax Elections.

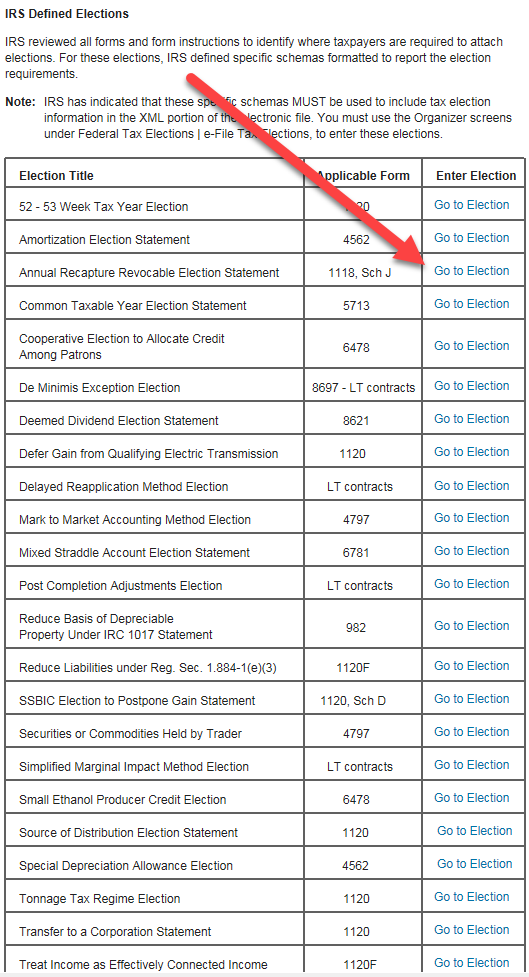

E-file Tax Elections

The E-file Tax Elections (Organizer > Federal Tax Elections > e-File Tax Elections > e-File Tax Elections) screens are used for entering IRS Defined Elections. These elections are included in the XML file using the specific IRS-defined schemas.

Select the hyperlink (blue) in the Enter Election column to go to the specific election selected.

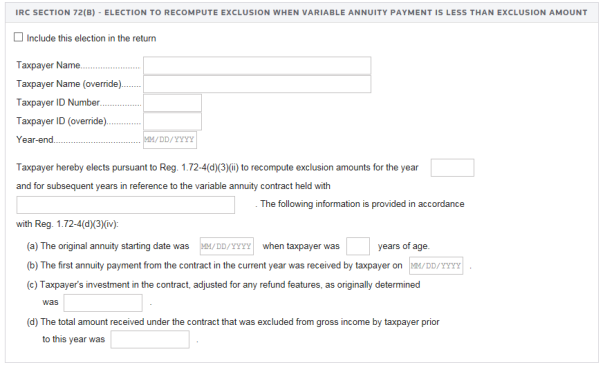

Predefined Elections

Many elections are included in the Organizer where you can choose those that are applicable to the return. These elections are included in the XML file using the General Dependency schema. For example, the IRC §72(b) election is found in Organizer > Federal Tax Elections > Predefined Elections > Code Selection 43-174(b) > Sec 72(b).

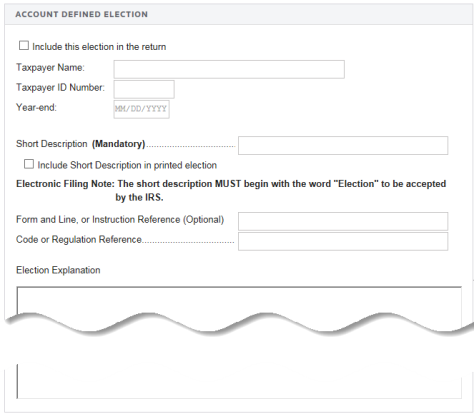

Account-defined Elections

You have the ability to set up your own elections in Tax Defaults, These elections are displayed within Organizer > Federal Tax Elections > Account Defined Elections when you open your return. Then you can select those elections that might apply to this return.

Modifications can be made to these elections, but Account Defined elections cannot be added within the return.

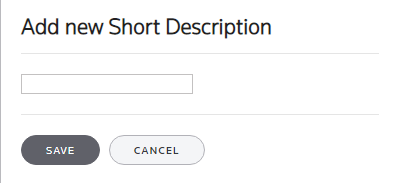

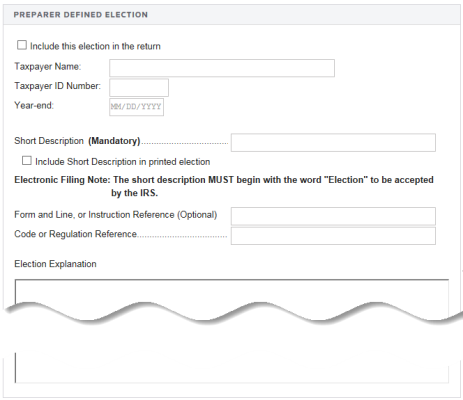

Preparer-defined Elections

You can add your own return-specific elections using the Preparer-Defined Elections screen by entering a new Short Description.

These elections are included in the XML file using the General Dependency schema.

E-file/1120_ef_elections_3.htm/TY2020

Last Modified: 03/20/2020

Last System Build: 09/13/2021

©2020-2021 Thomson Reuters/Tax & Accounting.