1120 E-file: Attachments to the Return

Attachments to the tax return include:

- Tax forms

- Statements

- Elections

- Notices

- Schedules

- Other types of miscellaneous information that might be required by IRS form instructions or regulations

- Schedules or additional information that the preparer wants to attach to the return

These attachments can be submitted electronically as XML documents or as PDF attachments.

XML Documents

If the IRS has defined a schema for information to be included in the return, then that information must be provided in XML format. The types of schemas cover:

Tax Forms We automatically format, in XML, any tax form information that is included in the return.

Information Requested on Tax Form Instructions For example, a tax form line for Other Income might include instructions to attach detail. In some cases, the schema provides specific data elements, and in other cases the schema allows for entry of free-form text. We automatically format, in XML, this additional information that is included in the return.

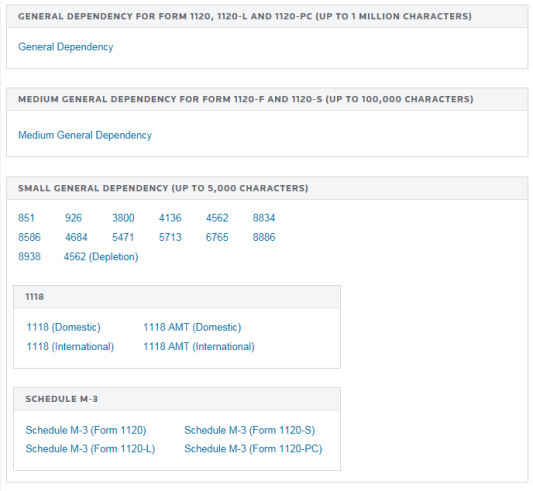

General Dependency

The General Dependency feature allows for the submission of information that is not specified in a predefined schema. This includes information that is requested in regulations or publications, which is not specified in form instructions but must be included in XML format. The IRS created the general dependency schemas to provide a method for submitting in XML other information not specifically defined by other schemas. The IRS general dependency schemas can also be used to include information for IRS workarounds until schemas are updated. The IRS provides

General Dependency Available for Form 1120, this is attached at the return level and allows for an explanation of up to one million characters.

General Dependency (Medium) Available for Forms 1120S and 1120-F, this is attached at the return level and allows for an explanation of up to 100,000 characters.

General Dependency (Small) Attached at the form or schedule level, this allows for an explanation of up to 5,000 characters. The General Dependency (Small) can be attached to the following forms:

- Form 851

- Form 926

- Form 1065

- Form 1118

- Form 1118 AMT

- Form 3800

- Form 4136

- Form 4562

- Form 4684

- Form 5471

- Form 5713

- Form 6765

- Form 8586

- Form 8834

- Form 8865

- Form 8886

- Schedule M-3 (Form 1120)

- Schedule M-3 (Form 1120-L)

- Schedule M-3 (Form 1120-PC)

- Schedule M-3 (Form 1120-S)

Data elements for each general dependency include:

- Business Name

- Taxpayer identification number

- Form line or instruction reference

- Regulation reference

- Description: A meaningful title or explanation for the attachment. The IRS uses the description as the General Dependency title when viewing the return.

- Additional information: This is the explanation with the number of characters limited by the general dependency type.

If the requested information or election requires presentation in a columnar format, the IRS will allow this information to be submitted as a PDF attachment.

Special Condition Description

The Form 1120, 1120S, and 1120-F schemas include a Special Condition Description that can be used to provide information without the IRS having to update its schemas. Special conditions calling for additional information might arise from natural disasters, late legislation, recent Revenue Procedures, and so forth. The IRS includes when the Special Condition Description should be used in the Known Issues and Solutions file on its Website, http://www.irs.gov/.

PDF Attachments

The tax return can also include non-XML documents, known as binary attachments, submitted in PDF format. PDF attachments allow taxpayers to provide requested documentation that includes required signatures and third party documents as required by forms and instructions.

Each file attached to a return must contain an unique, meaningful title and description for the attachment. If the description of the file is not representative of its contents, it can result in a delay in the return processing.

The following are examples of descriptions that can also delay processing:

- Other

- PDF Attachment

- Miscellaneous Information

The description is used to identify the attachment when the IRS displays the PDF.

- Do not password protect or encrypt PDF attachments.

- Keep PDF attachments as small as possible.

- If using Adobe Acrobat, avoid requiring compatibility with Adobe Acrobat versions earlier than version 8. Making the PDF file compatible with earlier versions will increase the size of the file.

- Move the compression/quality slider on Create PDF From Scanner to higher compression in order to lower the size of the file when the source document is of decent quality and from scanner input.

- Each individual uncompressed PDF cannot exceed 60 MB. The total of all uncompressed PDF files in the return cannot exceed 1 GB.

- The file name of each PDF cannot exceed 57 characters, including the file extension.

- The file name cannot include the following special characters:

- Apostrophe (')

- Double quotation mark (")

- Left and right angle brackets (<) and (>)

- Vertical bar (|)

- Square brackets ([ ])

- Caret (^)

- Ampersand (&(the and symbol above the number 7 on the keyboard))

- Slashes (/) and (\)

- Colon and semicolon (:) and (;)

- Question and exclamation marks (?) and (!)

- Asterisk (*)

- Double periods (..)

Using the System

All information entered to complete tax forms and supporting detail is automatically included in XML.

General Dependency information applicable to the return level is entered through Organizer > Federal E-file > Attachments > General Dependencies. The Overview screens contains links to each of the form specific general dependencies (Small General Dependencies).

E-file/1120_ef_attachments.htm/TY2020

Last Modified: 03/20/2020

Last System Build: 09/13/2021

©2020-2021 Thomson Reuters/Tax & Accounting.