Part III: Aggregating GoSystem International Returns with ONESOURCE 1120 E-file

ONESOURCE International Users

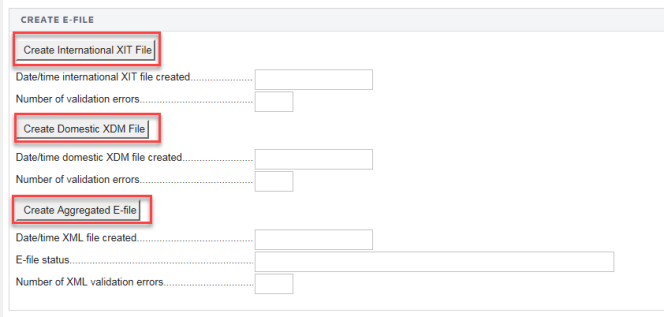

Creating the XML file for ONESOURCE International top consolidation binders with an international filing type, Foreign Tax Credit, is divided into three parts:

- Create International XIT File

- Create Domestic XDM File

- Create Aggregated E-file.

The returns prepared in GoSystem are aggregated with any foreign forms completed in ONESOURCE.

Including an Externally Created XIT File

To include an externally created XIT file in your ONESOURCE 1120 consolidated return, use the same procedures as you would for attaching PDF files.

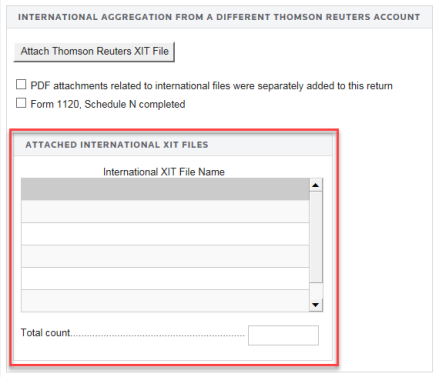

- Go to Federal E-file > International > Thomson Reuters International and select Attach Thomson Reuters XIT File

- On the Electronic Filing Attachments screen, click the Add button.

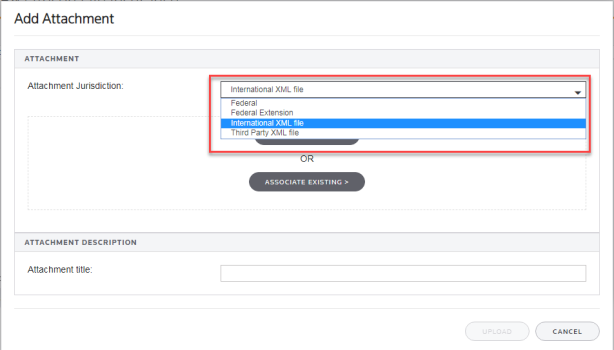

- In the Add Attachment dialog box, select International XML file from the drop-down list as the attachment type.

- Browse to and select the applicable XIT file, and click Upload.

- On the Electronic Filing Attachments screen, the uploaded file will appear in the attachments list. Select Done.

Reviewing and Creating the Aggregated International E-file in Organizer

- In Organizer, expand the Federal E-file > International folder.

- Select the Thomson Reuters International File folder to display a screen with a list of the international XIT files that have been attached.

- After generating the international portion of the e-file (Federal E-file > Additional Information > Create E-file > Create International XIT File button) and the domestic segment of the e-file (Federal E-file > Additional Information > Create E-file > Create Domestic XDM File button), click the Federal E-file > Additional Information > Create E-file > Create Aggregated E-file button to combine the ONESOURCE and GoSystem returns into one aggregated XML file ready for submission to the IRS.

ONESOURCE Domestic-only Users

If you are an ONESOURCE domestic-only user, you must first enable e-File aggregation in the ONESOURCE top consolidation binder.

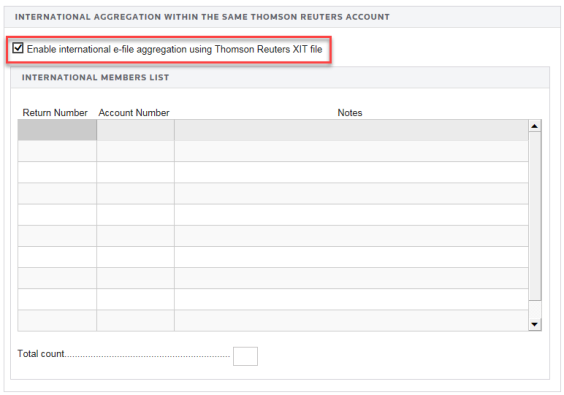

Enabling E-file Aggregation

- In Organizer, expand the Federal E-file > International folder.

- Click the Aggregation Within the Same Account folder to open the screen. Select the Enable international e-file using Thomson Reuters XIT file check box.

- Compute the binder.

Including an Externally Created XIT File

To include an externally created XIT file in your ONESOURCE 1120 consolidated return, use Attach Thomson Reuters XIT File and follow the same steps below. Navigation: Federal E-file > International > Thomson Reuters International File.

If the Enable international E-file using Thomson Reuters XIT file check box is selected in the top consolidation binder, the Attachment dialog box includes an additional selection type for an International XML file in the Attachment Jurisdiction drop-down list.

Reviewing and Creating the Aggregated International E-file in the Organizer

- Select Federal E-file > International > Thomson Reuters International File folder to display the list of the attached international XIT files.

- Click Federal E-file > Create E-file. On the resulting screen, click the Create International XIT button to generate the international e-file portion.

- On the same Create E-file screen, press the Create Domestic XDM File button to general the domestic e-file portion.

- After generating the international portion of the e-file and the domestic segment of the e-file, click the Create Aggregate E-file button on the same Create E-file screen to combine the ONESOURCE and GoSystem international returns into one aggregated XML file that is ready for submission to the IRS.

E-file/1120_aggregation_5.htm/TY2020

Last Modified: 02/17/2020

Last System Build: 09/13/2021

©2020-2021 Thomson Reuters/Tax & Accounting.