Part II: Preparing an International E-file in GoSystem Tax

Step 1: Prepare and Review Your Foreign Entity Returns

The forms 5471, 8858, 8621, 8865 and 8886 can be completed in a GoSystem subsidiary locator and incorporated into an ONESOURCE 1120 e-file. Multiple international forms can be prepared in a single GoSystem locator.

Including a return in the international e-file is based on a number of settings as follows:

- Set the print condition of the return.

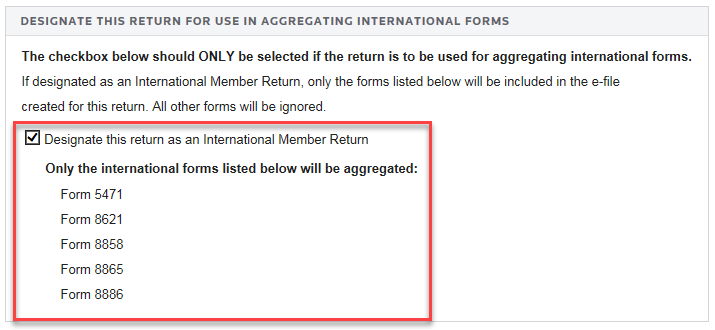

- Select Federal E-file > International Member Return. Then select the check box International Member Return (for aggregating the forms listed below).

Checking the International Member Return e-file check box for a subsidiary or parent return will cause only the information entered on the international forms listed to be picked up for that return.

When entering data for the international forms, related forms must be properly associated. For example, a Form 8858 related to a specific Form 8865 should be entered in the correct Form 8865 Organizer folder.

Diagnostics are updated when the Organizer is computed. There are two types of diagnostics that you should be sure to review: Rejects and Alerts.

Reject diagnostics identify conditions in the return that cause the IRS to reject the return when transmitted. The conditions generating a Reject diagnostic MUST be corrected before transmitting.

The existence of an Alert diagnostic does not prevent the return from being e-filed. However, you should still investigate the conditions that generates these diagnostics as they may reveal input errors.

Reviewing E-file Diagnostics

- Select View > Diagnostics. Two folders exist for e-file diagnostics: one for Alerts and the other for Rejects.

- There are two folders for Electronic Filing diagnostics: one for Alerts and one for Rejects. The number inside the parenthesis indicates the number of errors.

- Expand each folder to view the diagnostics.

- Double-click each diagnostic (or navigate to the field, if applicable) to use the GoTo functionality and view the condition in the Organizer or Tax Forms that is creating the diagnostic.

- Make changes in the Organizer and recompute.

Step 2: Create a Top Consolidation Return and Select the International Locators for E-Filing

The international portion of the e-file (.xit file) is created within a top consolidation locator by performing the following steps:

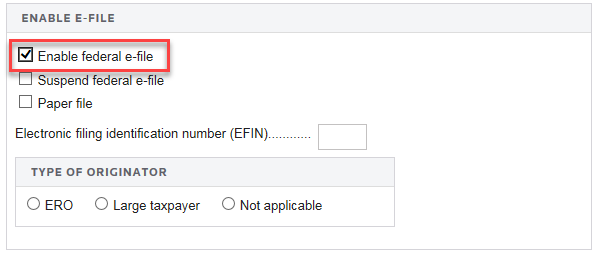

- In the Organizer of the top consolidation locator, select Federal E-file > Enable. Select the Enable federal E-file check box, shown below.

- Click the International > Aggregation within Same Account to open the screen.

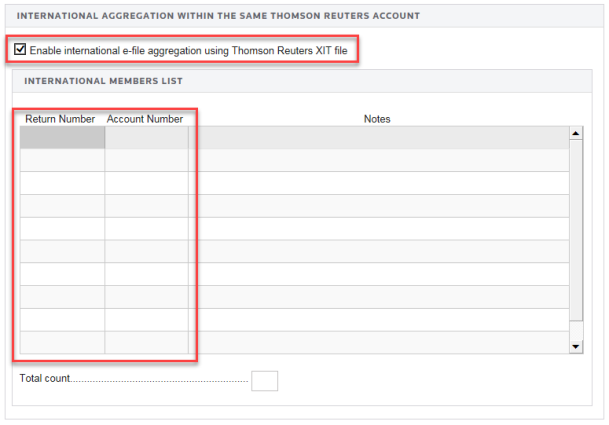

- Click the Enable international E-file aggregation using Thomson Reuters XIT file check box, shown below.

- In the International Members List grid, enter the locator and account number for each GoSystem entity with international returns (Forms 5471, 8621, 8858, 8865 and 8886) are listed. Add any Notes desired in the fields provided.

You cannot combine locators from different accounts.

- Compute the Organizer.

Step 3: Run the Organizer Computes

Prior to generating the international portion of the e-file, compute each locator with international returns (5471, 8621, 8858, 8865 and 8886). Review and clear any e-file reject diagnostics prior to generating the international segment (*.xit) of the e-file.

Failure to do a recompute may cause the IRS to reject the aggregated ONESOURCE return.

Step 4: Create the International Segment of the E-File

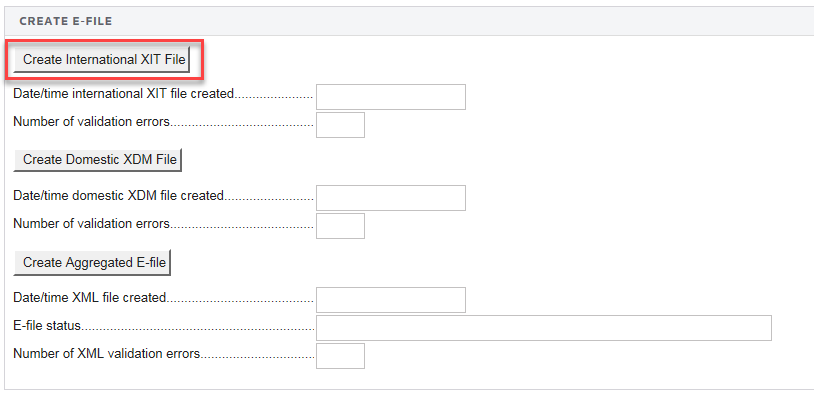

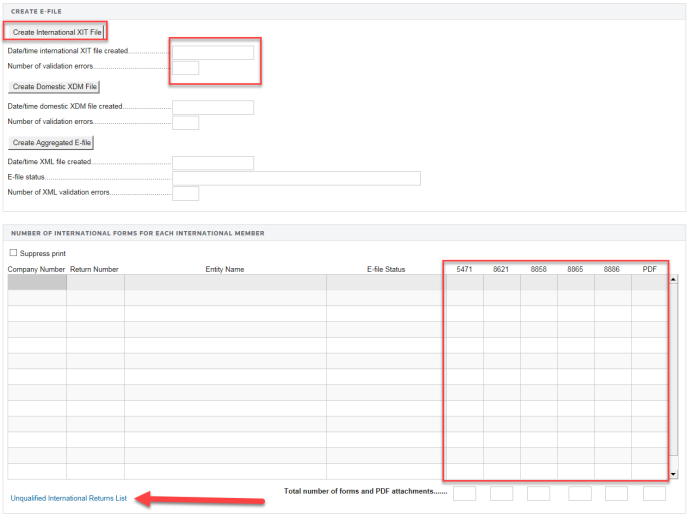

A Federal E-file folder exists in the Organizer for each GoSystem top consolidation locator. The international portion of the e-file is located on the Create E-file screen (Federal E-file > Additional Information > Create E-file), Create International XIT File option.

Follow the steps below to build the international *.xit file. GoSystem reviews the list of locators. If you have indicated that the locators have International Member Returns, GoSystem collects information about Forms 5471, 8621, 8858, 8865, and 8886 within these locators.

Generating the International E-file

- In the Organizer for the top consolidation return, select Federal E-file > Additional Information > Create E-file folder and view the Create E-file screen.

- To generate the *.xit file, (1) click the Create International XIT File button. The reports outcome appears in the (2) Create E-file section, including validation errors, if any, with a date and time stamp.

- After the *.xit file is generated, GoSystem reports (3) the number and type of international forms included in the e-file for each locator/binder in the Number of International For Each International Member Return section.

Step 5: Clear International Diagnostics

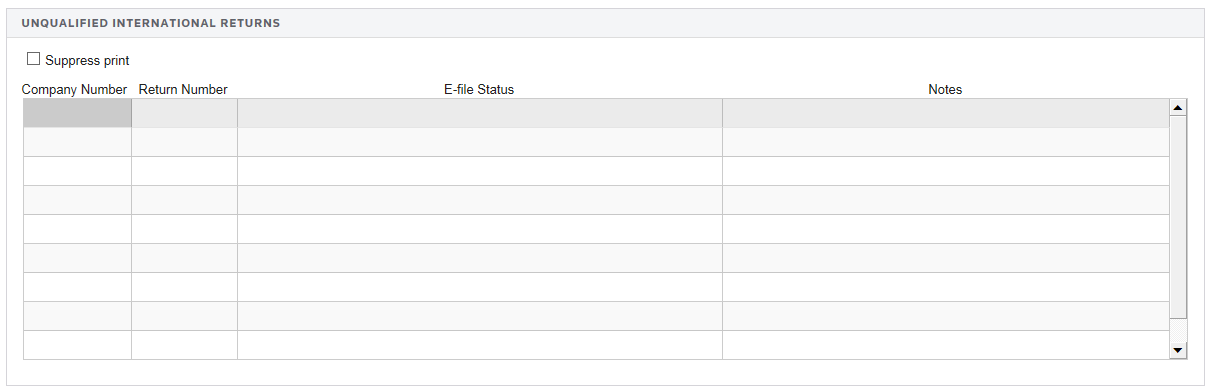

The Unqualified International Returns grid is accessed from the Unqualified International Returns List link located under the Number of International Forms for Each International Member grid shown on the Create E-file screen (see the arrow in the screen above).

Viewing and Clearing the Diagnostics for each Locator

- Open the Organizer in each locator.

- Select View > Diagnostics. Two folders exist for e-file diagnostics: one for Alerts and the other for Rejects.

- Expand each folder to view the diagnostics.

- Select each diagnostic to use the GoTo functionality and to locate the condition creating the diagnostic.

- Make changes in the Organizer and recompute.

To print the international e-filing information, generate a 1120 return using the Selected Federal C Corp > 1120 Income Tax Return > 1120 Pages 1-5 in Print Preview.

The status for all returns, as well as just those locators with e-filing reject diagnostics are found on pages labeled Electronic Filing Information at the front of the return.

Step 6: Download the International Portion of the E-File

The International e-File (*.xit file) can be downloaded from GoSystem to your hard drive or a network location and then integrated into your ONESOURCE 1120 return.

Downloading the File

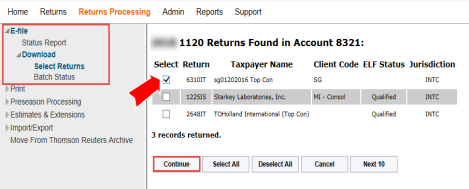

- In the GoSystem Tax Browser menu, select Returns Processing > E-file > Download > Select Returns to open the E-file Download dialog box.

- Choose the appropriate options for the Account and tax Year. Select the correct option in the Type fields.

- Select Int - Fed International as the Jurisdiction from the drop-down list.

- Click the Continue button.

- Select the check box next to the correct locator, and click Continue to begin the download.

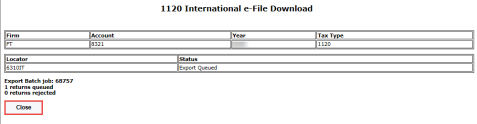

- The 1120 International E-file Download page is displayed with the Export Batch Job number and the number of returns queued. Click the Close button.

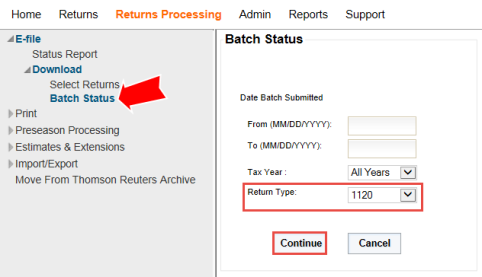

- Click the Return Processing > E-file > Download > Batch Status item on the menu.

- View the progress of your download on the Batch Status screen. Select 1120 Return as the Download Type in the drop-down list, and then click Continue.

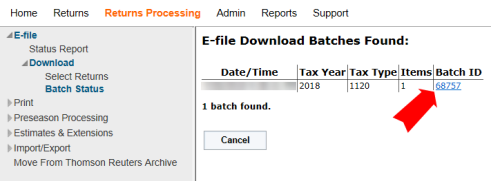

- Click the Batch ID link (blue underline) that relates to the 1120 international e-file download you initiated.

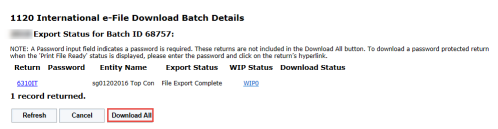

- Click the Download All button in the 1120 International E-file Download Batch Details and Browse to the folder where you would like to store the international *.xit file. You will need this *.xit file for your 1120 return in ONESOURCE.

- Save the file to your local storage.

E-file/1120_aggregation_4.htm/TY2020

Last Modified: 02/17/2020

Last System Build: 09/13/2021

©2020-2021 Thomson Reuters/Tax & Accounting.