Part I: The International E-file

The International E-file in GoSystem Tax

You can complete the following forms in GoSystem Tax subsidiary returns and mark them for inclusion in the e-file: 5471, 8621, 8858, 8865, and 8886. Any elections prepared in these returns will be included in the e-file downloaded for ONESOURCE. All GoSystem Tax international returns and related elections are presented in the consolidated entity's section of the ONESOURCE 1120 e-file.

PDFs attached in the GoSystem locators will not be included in the international e-file downloaded for ONESOURCE. PDF files should be attached in the ONESOURCE top consolidation binder.

Creating the International Portion of the E-file

Creating the international portion of the e-file in GoSystem for aggregation with an ONESOURCE 1120 return requires the following steps:

- Prepare and review your foreign entity returns.

- Verify that the returns are marked for inclusion in the international e-file.

- Clear any e-file Reject diagnostics, and review any Alert diagnostics.

- Create a top consolidation and select the international locators for e-filing.

- Run Organizer computes.

- Create the international segment of the e-file.

- Clear any diagnostics.

- Download the international (.xit) e-file.

Important! Since the tax application is updated periodically with new e-filing diagnostics, you must compute the Organizer for each locator after each release and prior to generating the e-file. It is critical that all e-file reject diagnostics are cleared prior to downloading the international e-file for ONESOURCE. Failure to do this will cause the return to be rejected by the IRS.

Aggregating GoSystem Tax International Returns in ONESOURCE

If you are an ONESOURCE - Domestic-only user, you must first enable e-file aggregation in the ONESOURCE top consolidation binder.

Enabling E-file Aggregation

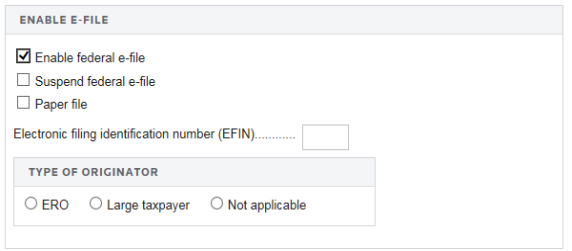

- From within a top consolidation return in the Organizer, select Federal E-file > Enable. Verify that the Enable federal e-file check box is selected.

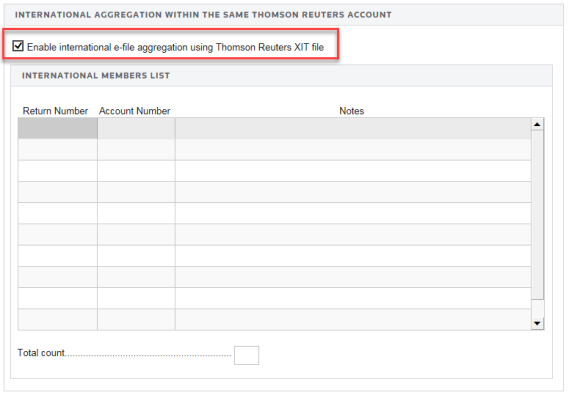

- Click the International folder, and then select Aggregation Within Same Account. On the screen, select the check box (see the box below) labeled Enable International E-file aggregation using Thomson Reuters XIT file.

- Selecting this check box and computing the binder generates Thomson Reuters International File screen, shown below.

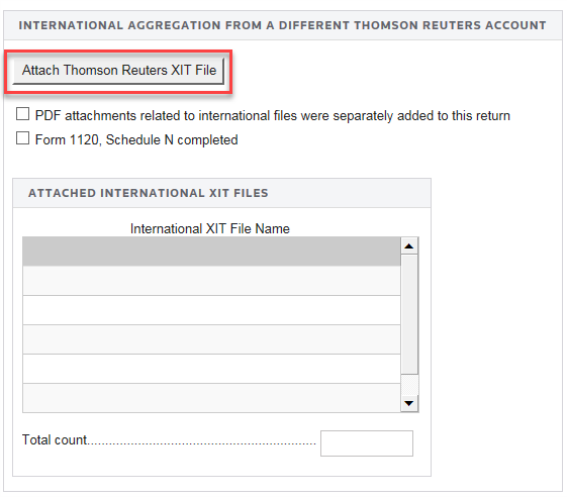

- Click the Attach Thomson Reuters XIT Filebutton to add XIT file(s).

Use the Create E-file screen, Create Domestic XDM File option to build the domestic segment of the e-file consisting of the federal returns prepared in your ONESOURCE entities. Use the Create E-file screen, Create Aggregated E-file option to build the final e-file.

Refer to the ONESOURCE 1120 Federal E-file Guide for information related to submitting an electronic return to the IRS and viewing the status of a return.

Important! Since the GoSystem Tax returns are generated outside the system, ONESOURCE does not prevent you from aggregating and filing GoSystem Tax returns with e-file reject diagnostics. You should clear the e-file reject diagnostics before the international returns are downloaded from GoSystem Tax. Failure to do this will cause your return to be rejected by the IRS.

ONESOURCE International users only Use the Create E-file screen, Create International XIT File option to build the international portion of the e-file. If you have a license for the ONESOURCE International product, the list of foreign returns is populated by the International e-Filing Members List in the top consolidation binder’s Properties.

ONESOURCE Domestic-only user only If you' have prepared some of your foreign returns (5471, 8621, 8858, 8865 and 8886) in ONESOURCE, then manually enter the returns that are not part of the top consolidation’s Domestic Members List in the International folder on the Aggregation Within Same Account screen, International Members List grid. Returns prepared in GoSystem Tax are aggregated with any foreign forms completed in ONESOURCE.

E-file/1120_aggregation_3.htm/TY2020

Last Modified: 08/13/2020

Last System Build: 09/13/2021

©2020-2021 Thomson Reuters/Tax & Accounting.