1065 State E-file: K-1 Aggregation

The state K-1 aggregation functionality allows the user to incorporate state-specific K-1 information from other returns, or from third-party software. The user can either utilize this aggregated K-1 information as an addition to the state K-1 information already entered in a specific locater or binder, or it can be used to replace existing state K-1 information.

Aggregating state K-1s for one specific state does not impact the K-1 information used by another state for reporting purposes.

Use the following steps when utilizing the K-1 Aggregation process:

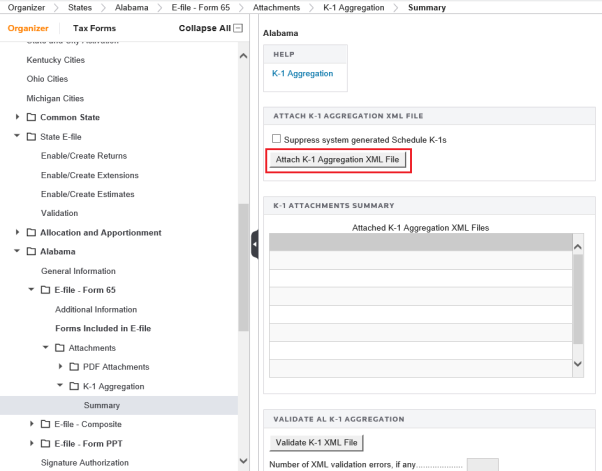

- Expand the state’s E-file folder: Organizer > [State] > E-file > Attachments > K-1 Aggregation > Summary.

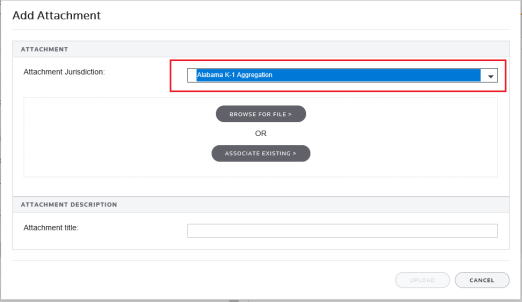

- On the Summary screen, click the Attach K-1 Aggregation XML File button to access the Add Attachments screen. Select the state for which you wish to aggregate K-1 information.

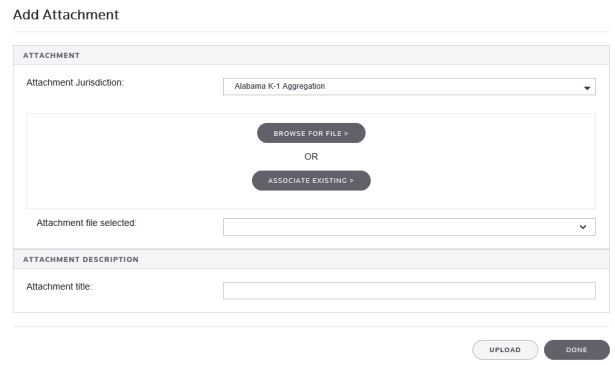

- Browse to and select the desired K-1 XML file. The default attachment title is the file name, without an extension. Click Upload.

The file extension must be.XML. A downloaded state e-file can have an extension specific for that state. For example, a state e-file for Alabama would have an extension of XAL. However, this file extension must be changed to XML before it can be attached for K-1 aggregation.

Do not change the Attachment Title description.

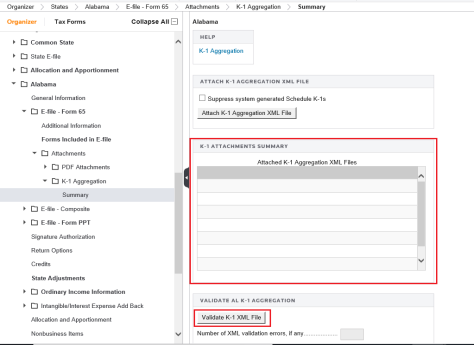

- Once successfully attached, the K-1 XML file is displayed on the K-1 Aggregation > Summary screen.

- On the Summary screen, click the Validate K-1 XML file button. If any validation errors exist in the K-1 XML file, the file must be detached from the locator, corrected, and reattached. This process must be repeated until the K-1 XML file contains no validation errors.

- On the same screen, find the Suppress system generated Schedule K-1s check box.

- Selecting this check box forces the software to override any K-1 information entered in the return for that state, and report only the aggregated K-1 information. This is a state-by-state option.

- When the check box is cleared, the software includes K-1 information originating from the locator, and also uses the aggregated K-1 information.

- The aggregated Schedule K-1 detail is included in the state XML file upon creating the state's e-file.

E-file/1065_ef_state_5.htm/TY2020

Last Modified: 03/20/2020

Last System Build: 09/13/2021

©2020-2021 Thomson Reuters/Tax & Accounting.