1065 E-file: Enabling E-file

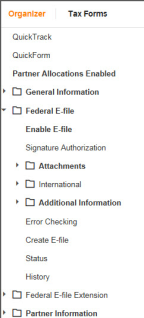

- In the Organizer, select the Federal E-file (or Federal E-file Extension) folder.

- Select Enable (or Enable Extension).

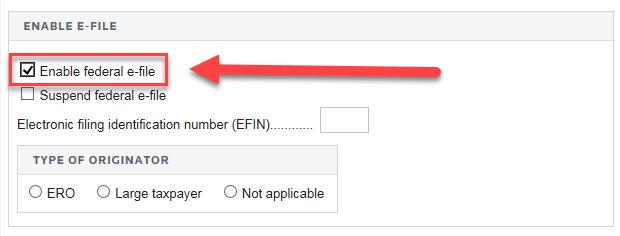

- On the Enable E-file screen, all three substeps (a, b, and c( are required:

- Select the Enable Federal E-file check box. Selecting the Suspend federal E-file check box allows qualified e-files to be created, but prevents the return from being displayed as a return that can be submitted.

- Enter the Electronic Filing Identification Number (EFIN).

- Select the option for the Type of Originator: ERO or Large Taxpayer.

E-file/1065_ef_steps_2.htm/TY2020

Last Modified: 03/20/2020

Last System Build: 09/13/2021

©2020-2021 Thomson Reuters/Tax & Accounting.