1041 E-file: Return - 990-T Spreadsheet Tab

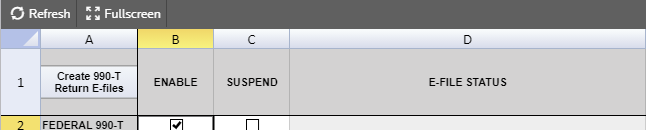

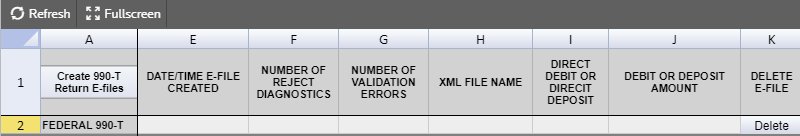

Create 990-T Return E-files Clicking this button creates the e-file and identifies if there are any reject diagnostics or validation errors. The e-file status and XML information is then displayed.

Enable Selecting this check box is mandatory to create an e-file, to generate reject diagnostics, and to identify validation issues. By default, this check box is selected for each jurisdiction.

Suspend Check the Suspend box to prevent qualified e-files from being displayed as returns that can be submitted.

E-file Status The e-file status displays after an e-file is created. The status displays whether the e-file was created successfully, qualified to be submitted for e-file, and/or not qualified because of reject diagnostics or validation errors.

Date/Time E-file Created The time stamp of the last e-file created is displayed.

Number of Reject Diagnostics The number of reject diagnostics existing when the latest e-file created is displayed.

Number of Validation Errors The number of validation errors existing when the latest e-file created is displayed.

XML File Name The name of the XML file includes the locator number, preceded by an alpha character, and is followed by the tax year indicator. The file extension is unique for each state/city and file type.

Direct Debit or Direct Deposit With direct debit information entered and authorized in General Information > Bank Information, the Direct Debit Indicator shows Yes after the e-file is created. For states, the direct debit information entered and authorized in States > Common State > Bank Information shows Yes after the e-file is created.

Debit or Deposit Amount Amount to be debited (if owing) or deposited (if refunded).

Delete E-file The Delete button deletes the existing XML file for that jurisdiction. The Enable check box must remain checked before you click the Delete button. The E-file Status changes to indicate that the XML file has been deleted.

E-file/1041_ef_spreadsheet_6.htm/TY2020

Last Modified: 12/22/2020

Last System Build: 09/13/2021

©2020-2021 Thomson Reuters/Tax & Accounting.