1041 E-file: E-file Opt Out: Taxpayer Statement

- Select E-file > Additional Information > E-file Opt Out > Taxpayer Statement.

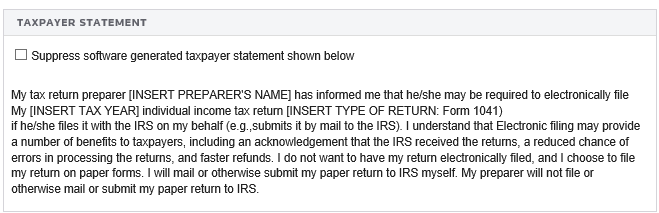

- Indicate if you wish to suppress the following statement:

My [INSERT TAX YEAR] individual income tax return [INSERT TYPE OF RETURN: Form 1041)

My tax return preparer [INSERT PREPARER'S NAME] has informed me that he/she may be required to electronically file if he/she files it with the IRS on my behalf (e.g., submits it by mail to the IRS). I understand that Electronic filing may provide a number of benefits to taxpayers, including an acknowledgment that the IRS received the returns, a reduced chance of errors in processing the returns, and faster refunds. I do not want to have my return electronically filed, and I choose to file my return on paper forms. I will mail or otherwise submit my paper return to IRS myself. My preparer will not file or otherwise mail or submit my paper return to IRS.

E-file/1041_ef_mandate_3.htm/TY2020

Last Modified: 03/20/2020

Last System Build: 09/13/2021

©2020-2021 Thomson Reuters/Tax & Accounting.