1041 E-file: Preparer Explanation for Not E-filing

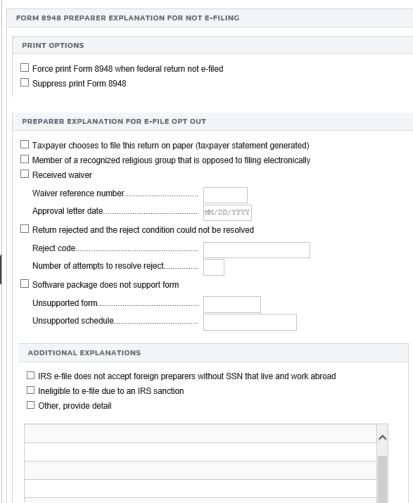

If a preparer is claiming exceptions to the requirement to e-file a tax return or has forms that are not available in our software, complete the Preparer Explanation for Not Filing Electronically to generate Form 8948 to file with the tax return.

- Select E-file > Additional Information > E-file Opt Out > Preparer Explanation.

- Enter information for the Form 8948 Preparer Explanation for Not E-filing.

- If desired, select the option to force print Form 8948.

- If desired, select the option to suppress print of Form 8948.

- Indicate if the taxpayer chose to file this return on paper. The taxpayer, not the preparer, will send the paper return to the IRS. If this option is selected, we will automatically print a Taxpayer Statement for this.

- Indicate if the preparer is a member of a recognized religious group that is conscientiously opposed to e-file.

- Indicate if the preparer received a waiver from the requirement to e-file. If so, enter the waiver reference number and the date of the approval letter.

- Indicate if the return was rejected by the IRS and the reject condition cannot be resolved. If so, enter the reject code and the number of attempts made to resolve the reject.

- Indicate if the preparer’s e-file software does not support Form [fill in the blank] or Schedule [fill in the blank].

- Indicate if the preparer is ineligible to e-file because the IRS does not accept foreign preparers who live and work abroad if they do not have Social Security numbers.

- Indicate if the preparer is currently ineligible to e-file due to an IRS sanction.

- If the reason is not listed above, select the option to indicate Other, and describe the circumstances that prevent the preparer from e-filing this return.

E-file/1041_ef_mandate_2.htm/TY2020

Last Modified: 03/20/2020

Last System Build: 09/13/2021

©2020-2021 Thomson Reuters/Tax & Accounting.