1041 E-file: Creating the E-file for the Extension

After verifying that e-file diagnostics do not exist, create the electronic data file.

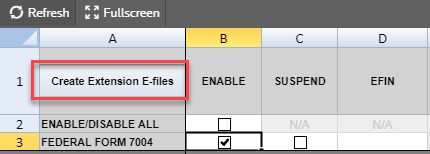

- Go to E-file > Enable/Create, and select the Extension tab.

- Click the Create Extension E-files button on this form.

- Check the E-file Status column. If the file was created without any problem, the application shows a message in the column stating XML file is created - Return is ‘Qualified.’

- If issues exist with the e-file, note the message in the E-file Status column. If you receive the message that XML is created but NOT qualified - Diag needs to be cleared, resolve the diagnostics as detailed in 1041 E-file: Extension - Reviewing E-file Diagnostics.

- You may also receive this message if validation issues exist: XML is created but NOT qualified - Please clear vali.errors. Resolve the validation errors.

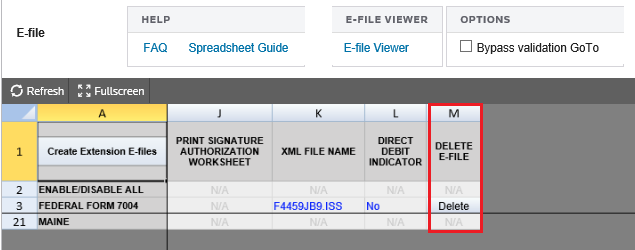

- Note the date/time of e-file creation, number of validation errors, XML file name, and direct debit indicator.

- If, for some reason, you need to delete the e-file, click the Delete button in the Delete E-files column. This button deletes only the e-file, but does not delete any information on the return.

Deleting an E-file

The Delete button deletes the existing XML file for that jurisdiction. To delete an e-file:

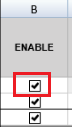

- Make sure the Enable check box is checked. You cannot delete an e-file if this check box is blank!

- Click the Delete button in the Delete E-file column.

- The E-file Status changes to indicate that the XML file has been deleted.

If you have clicked the Delete button and the Enable check box was blank, do the following:

- Check the Enable check box.

- Click the Create Extension E-files button.

- Click the Delete button.

E-file/1041_7004_9.htm/TY2020

Last Modified: 03/20/2020

Last System Build: 09/13/2021

©2020-2021 Thomson Reuters/Tax & Accounting.