1041 E-file: Extension - Entering Signature Information

If you are filing the extension with a payment, enter information on the Signature Authorization Organizer. Signature option details for Form 7004 are applicable only if you have selected the option to allow the IRS to withdraw funds using the entered bank account information on the Bank Information Organizer.

- Select E-file > Signature Authorization.

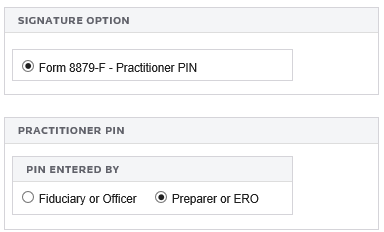

- Select the type of PIN signature: Form 8879F - Practitioner PIN.

- Select the appropriate option to indicate who entered the PIN into the program.

If you select Preparer, Form 8879-F will print for the fiduciary to sign. The preparer must keep the signed Form 8879-F for three years. Do NOT send Form 8879-F to the IRS!

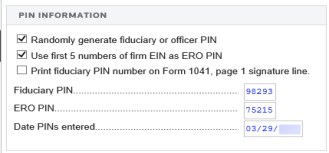

- For the fiduciary/officer PIN, you can select any or all of the following options:

- randomly generate the fiduciary or officer PIN

- use the first five numbers of the Firm Employer ID Number (FEIN) as the ERO PIN

- print the fiduciary PIN on the signature line on Form 1041, Page 1.

- Enter the five-digit PINs (the numbers cannot contain all zeros) for the fiduciary.

- Enter the date the PIN(s) were entered into the program.

E-file/1041_7004_5.htm/TY2020

Last Modified: 03/20/2020

Last System Build: 09/13/2021

©2020-2021 Thomson Reuters/Tax & Accounting.