1040 E-file: Reviewing the E-file

Returns and extensions created are transmitted to the IRS as XML files. The XML file can be downloaded from the RS Browser for your review and recordkeeping and can also be reviewed with the E-file Viewer.

Downloading the XML File

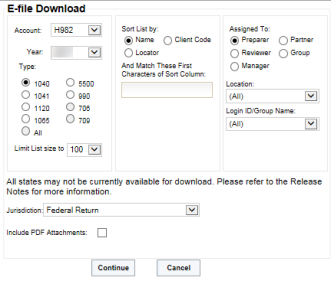

- Select Returns Processing > E-file > Download.

- Specify your search criteria (account number, tax year, and 1040 as the tax type), and select Federal Return or a state return as the return type. Click Continue.

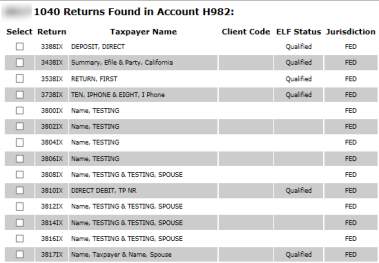

- Select the returns to download, and click Continue.

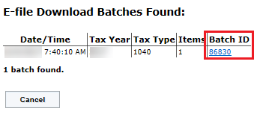

- On the left menu, click Batch Status.

- Enter the search criteria (user, date range, return type of 1040, and download type of Federal Return or a state return), and click Continue.

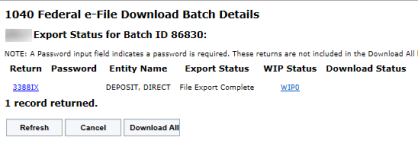

- Click the Batch ID hyperlink. This takes you to the details for that return.

- You may need to enter the return password, if applicable.

- Click the hyperlink under Return to select the target location for the XML file.

- Download the return to the selected location.

When viewing the XML file (through Internet Explorer or a text editor), the return data can be identified by the surrounding schema element names. For example, on Form 1040, Page 1, line 7, Wages of $440,000 would display in the XML file as:

<WagesSalariesAndTipsAmt>440000</WagesSalariesAndTipsAmt> - Reviewing the actual XML file will confirm the accuracy of the return or extension e-file that is sent to the IRS.

Reviewing with the E-file Viewer

Another way to review the e-file is with the E-file Viewer. The E-file Viewer displays the raw XML file and a form view of the e-file information. The form view of the e-file information is not available for state returns.

- After creating the e-file, exit the return.

- From the RS Browser Returns list, select the account number, year, and return type.

- Select a single return by placing a check mark to the left of the return.

- Select E-file Viewer from the ribbon above the selected return.

E-file/1040_ef_send_6.htm/TY2020

Last Modified: 02/17/2020

Last System Build: 09/13/2021

©2020-2021 Thomson Reuters/Tax & Accounting.