1040 E-file: Selecting General Dependencies

The General Dependency is created to allow for the submission of information that is not specified in a predefined schema. The IRS has defined two types of General Dependencies applicable to Form 1040:

- General Dependency (Medium) is attached at the return level and allows for an explanation of up to 100,000 characters.

- General Dependency (Small) is attached at the form or schedule level and allows for an explanation of up to 5,000 characters.

Medium General Dependencies

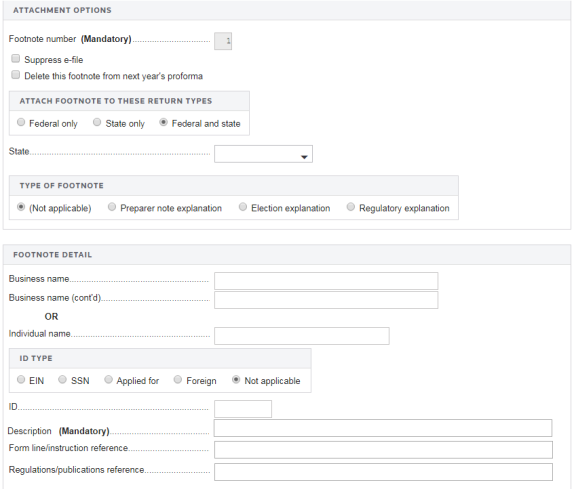

To create a medium general dependency:

- Go to E-file > Attachments > General Dependencies > Overview.

- Click the Medium General Dependency hyperlink.

- Enter a footnote number. This field is mandatory.

- If applicable, select the option to suppress e-file.

- If applicable, select the option to prevent the footnote from being included in next year's proforma.

- Select the appropriate option to attach the footnote to the federal return, the state return, or both returns.

- Select the state, if the footnote is to be attached to a state return. If no state is selected, the footnote will be printed for all state returns generated for the current locator.

- If applicable, select the type of footnote: Preparer Note Explanation, Election Explanation, or Regulatory Explanation.

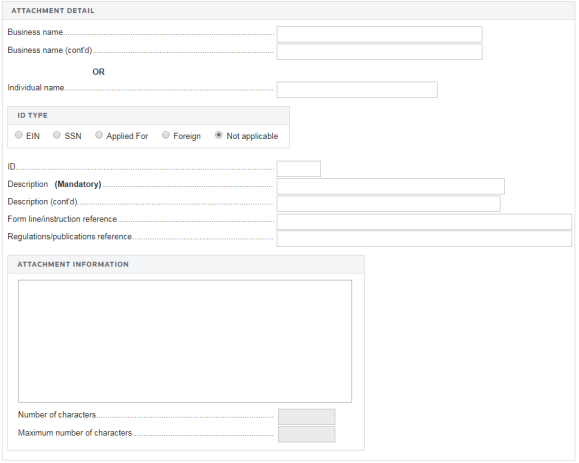

- Enter the business name or individual name associated with the footnote, and select the ID type: EIN, SSN, Applied for, Foreign, or Not Applicable.

- Enter a description for the footnote (mandatory).

- Enter the form line or instruction to which the footnote refers.

- If applicable, enter the regulation/publication to which the footnote refers.

- Enter the text for the footnote. The system prints the footnote on white paper supporting schedules exactly as it is typed in the footnote detail fields. Access additional lines of text by using the scroll bars.

- The number of characters field at the bottom of the screen is for your reference; it does not print.

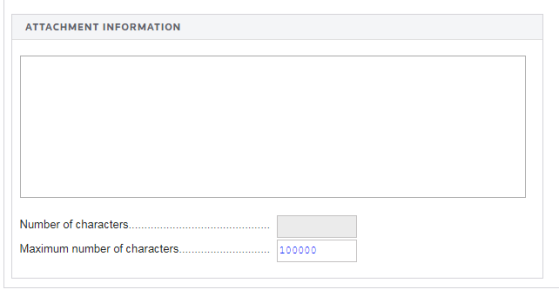

Selecting Form 4562 Dependencies

- Go to E-file > Attachments > General Dependency > Form 4562.

- Add a new description for the dependency.

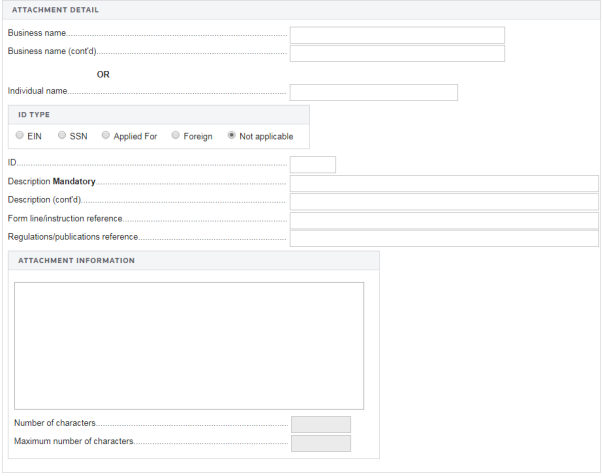

- Enter the business name or individual name for Form 4562.

- Select the ID type: SSN, EIN, Applied For, or Foreign.

- Enter the SSN or EIN or Missing EIN (numbers only).

- Enter the description of the general dependency (mandatory).

- Enter the form line or instruction reference.

- Enter the regulations reference.

- Enter attachment information.

- Enter the total number of characters entered for the general dependency.

- Enter the maximum number of characters allowed by IRS e-file programming.

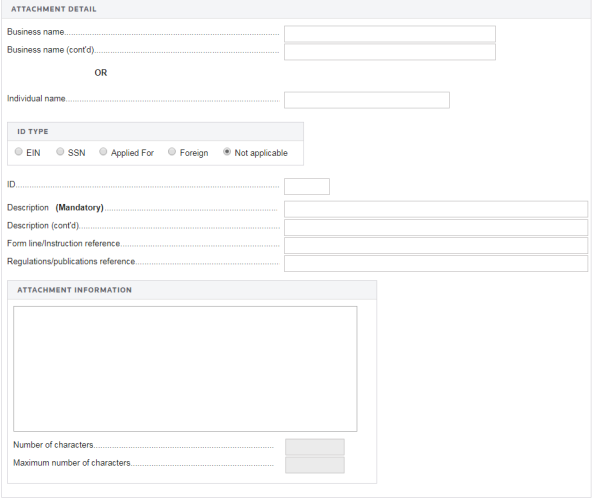

Selecting Form 4684 Dependencies

- Go to E-file > Attachments > General Dependency > Form 4684.

- Add a new description for the dependency.

- Enter the business name or individual name for Form 4684.

- Select the ID type: SSN, EIN, Applied For, or Foreign.

- Enter the SSN or EIN or Missing EIN (numbers only).

- Enter the description of the general dependency (mandatory).

- Enter the form line or instruction reference.

- Enter the regulations reference.

- Enter attachment information.

- Enter the total number of characters entered for the general dependency.

- Enter the maximum number of characters allowed by IRS e-file programming.

Selecting Form 8959 Dependencies

- Go to E-file > Attachments > General Dependency > Form 8959.

- Add a new description for the dependency.

- Enter the business name or individual name for Form 8959.

- Select the ID type: SSN, EIN, Applied For, or Foreign.

- Enter the SSN or EIN or Missing EIN (numbers only).

- Enter the description of the general dependency (mandatory).

- Enter the form line or instruction reference.

- Enter the regulations reference.

- Enter attachment information.

- Enter the total number of characters entered for the general dependency.

- Enter the maximum number of characters allowed by IRS e-file programming.

Selecting Form 8960 Dependencies

- Go to E-file > Attachments > General Dependency > Form 8960.

- Add a new description for the dependency.

- Enter the business name or individual name for Form 8960.

- Select the ID type: SSN, EIN, Applied For, or Foreign.

- Enter the SSN or EIN or Missing EIN (numbers only).

- Enter the description of the general dependency (mandatory).

- Enter the form line or instruction reference.

- Enter the regulations reference.

- Enter attachment information.

- Enter the total number of characters entered for the general dependency.

- Enter the maximum number of characters allowed by IRS e-file programming.

E-file/1040_ef_return_5.htm/TY2020

Last Modified: 08/13/2020

Last System Build: 09/13/2021

©2020-2021 Thomson Reuters/Tax & Accounting.