1040 E-file: Deleting or Suspending an E-file

Deleting an E-file

If an e-file for a state has already been created and qualified, deleting/deactivating that state from a return does not disqualify the e-file for that state.

To disqualify a state e-file that was previously created and qualified, the e-file must first be deleted before a state is deleted/deactivated from a return.

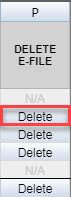

The Delete button deletes the existing XML file for that jurisdiction.

To delete an e-file:

- Go to Organizer > E-file > Enable/Create > Return tab.

- Make sure the Enable check box is checked. You cannot delete an e-file if this check box is blank!

- Click the Delete button for Federal/States that you want to delete in the Delete E-file column.

- The E-file Status changes to indicate that the XML file has been deleted.

If you have clicked the Delete button and the Enable check box was blank, do the following:

- Check the Enable check box.

- Click the Create Return E-files button.

- Click the Delete button.

Suspending an E-file

Suspend can be used when an e-file is not yet ready to be submitted.

- Check the Suspend box in the Suspend column.

- For Suspend, you do not need to create the return e-files again.

- Close the locator.

- The e-file for this locator cannot be submitted from the RS Browser. It will have a status of Qualified-Suspended on the RS Browser E-file Submission screen.

When the e-file is ready to be submitted, you must remove the check from the Suspend box.

- Clear the check from the Suspend box in the Suspend column.

- You do not need to create the return e-files again.

- Close the locator.

- Submit the e-file from RS Browser.

E-file/1040_ef_return_11.htm/TY2020

Last Modified: 08/13/2020

Last System Build: 09/13/2021

©2020-2021 Thomson Reuters/Tax & Accounting.