1040 E-file: Preparer Explanation for Not E-filing

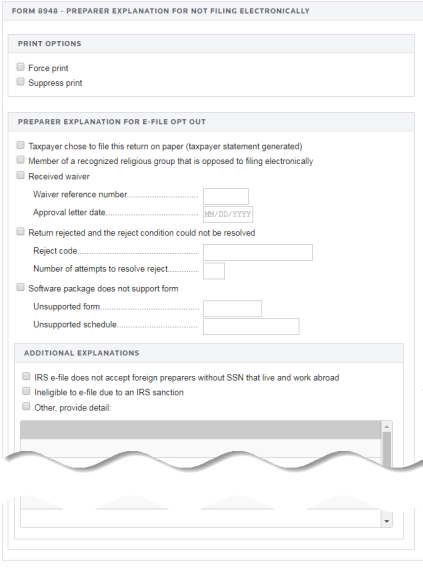

If a preparer is claiming exceptions to the requirement to e-file a tax return, complete the Preparer Explanation to generate Form 8948 to file with the tax return.

If a return is not e-filed, the program defaults to printing Form 8948. To suppress print of Form 8948, select the option to suppress Form 8948.

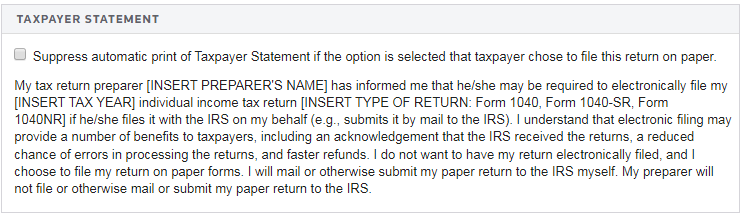

If the option is selected that the taxpayer chose to file the return on paper, the program will also print a taxpayer statement as stated in IRS Notice 2010-85 to be signed and dated by the taxpayer on or before the date the tax return is filed with the IRS.

This written statement should not be attached to the tax return, but retained by the tax return preparer.

If you have your own prepared statement for this purpose, you may suppress the taxpayer statement generated by the program.

E-file/1040_ef_mandate_2.htm/TY2020

Last Modified: 11/26/2019

Last System Build: 09/13/2021

©2020-2021 Thomson Reuters/Tax & Accounting.