1040 E-file: Setting 1040 E-file Defaults

- In Tax Defaults, navigate to the E-file > 1040 tab.

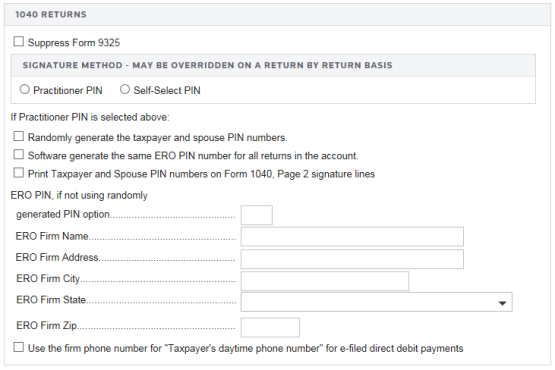

- If applicable, select the option to suppress Form 9325.

- Select the default signature method: Practitioner PIN or Self-Select PIN. You may override this default on a return-by-return basis.

- If you select the Practitioner PIN, you can select any or all of the following options:

- randomly generate the taxpayer and spouse PINs

- use the software to generate the same ERO PIN for all returns in the account

- print taxpayer and spouse PINs on the signature lines on Form 1040, Page 2.

- Enter the ERO PIN for all returns in the account if you are not generating the ERO PIN randomly.

- For the ERO, enter the ERO firm name, address, city, state, and ZIP.

- Select the option, if desired, to use the firm phone number for the taxpayer’s daytime phone number for e-filed direct debit payments.

E-file/1040_ef_defaults_2.htm/TY2020

Last Modified: 02/17/2020

Last System Build: 09/13/2021

©2020-2021 Thomson Reuters/Tax & Accounting.