1040 E-file: Appendix F - E-filing Amended Returns

Amended Returns Supported for E-file

We support the federal return and the following states for amended e-file. Those e-filed on a separate amended form are marked with *. Those e-filed with a check box for Amended on the main form are marked with ‡.

|

|

Processing an Amended Return for E-file

Locating the Original Return

- In RS Browser, select Returns on the top menu.

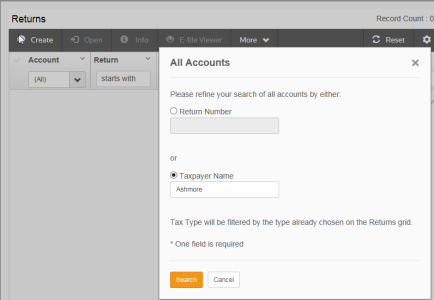

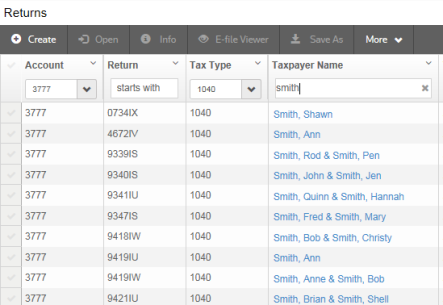

- Select the account and return type (1040) from the drop-down lists. If you select All for the account, a dialog box will appear for you to enter either the return number or the taxpayer name. You must enter one of these. Then click Search.

- A list of the returns meeting the specified criteria appears. Click the check mark column (first column) to select the return you wish to amend.

Copying the Original Locator into a New Locator

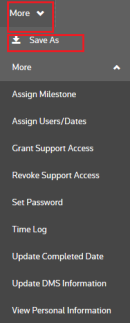

- On the Returns toolbar, select More, then select Save As.

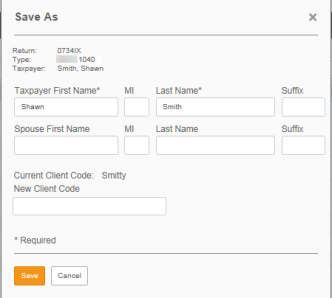

- Enter the information for the new locator, and click Save.

- Make a note of the new locator number.

- From the Returns menu, locate and open the new return.

Completing the Amended Return

- Complete the data entry to update the return.

- Re-compute the return.

- Generate and transmit the e-file.

E-file/1040_ef_app_f_amended.htm/TY2020

Last Modified: 12/23/2020

Last System Build: 09/13/2021

©2020-2021 Thomson Reuters/Tax & Accounting.