Reviewing Returns: Diagnostics and Overrides

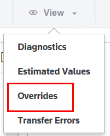

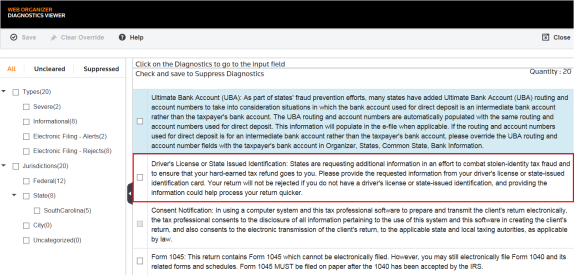

Several search and review tools are available under the View menu. The tax application generates a list of all diagnostics and warning messages indicating possible problems or errors in your return. You should always review and clear all diagnostics prior to completing a return.

There are five types of diagnostics: Severe, Informational, Electronic Filing Alerts, Electronic Filing Rejects, and Efile XML Validation Errors (if applicable). The “informational” folder lists all informational diagnostics or nonsevere diagnostics.

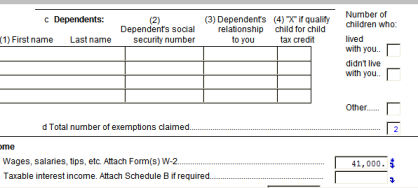

For instance, the system reminds you that the taxpayer’s driver’s license number or State Identification Number needs to be entered. Click the Diagnostics field for a direct link to the input field. You can then enter the correct data. This automatically clears the diagnostic. Use the Previous History icon to return to the Diagnostics screen.

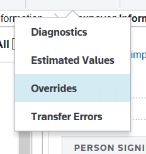

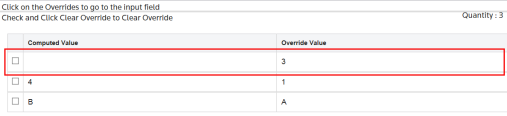

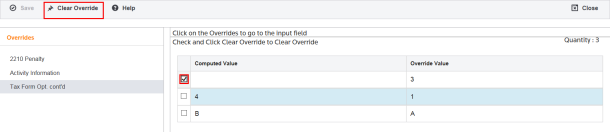

Another good review procedure is to clear all overrides. The tax application automatically scans the return and documents all overrides found.

Click the override to access the screen where the override originated.

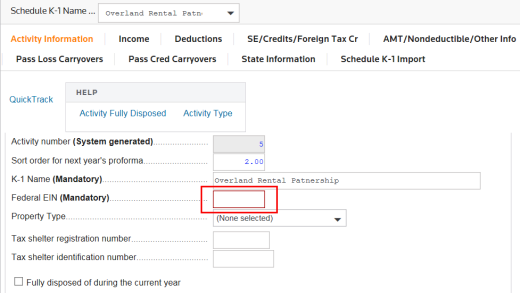

You are taken to the field where the override (*) was entered.

To remove an override, select the check box next to the overridden field, and click Clear Override.

A good practice is to always fully recompute the return after you clear overrides and diagnostics, or after you make any major changes to the return. Once the override is removed, the number from Organizer flows in correctly.

If you override system-calculated or carried amounts, the supporting whitepaper schedule totals (generated from detail) may not foot to the return.

If you override fields, you may get unintended results on comprehensive system-generated forms and schedules, such as AMT and passive limitations.

Tutorials/review_diagnostics.htm/TY2019

Last Modified: 03/19/2020

Last System Build: 06/18/2021

©2019-2020 Thomson Reuters/Tax & Accounting.