Depreciation: Options

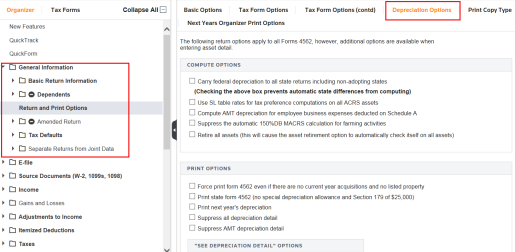

The tax application provides a central location to enter common depreciation options that apply to ALL Forms 4562. Open the General Information > Return and Print Options folder, and click the Depreciation Options tab.

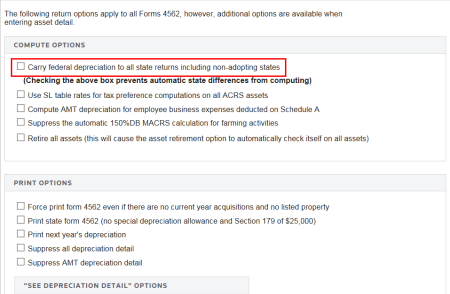

If you select compute and print options on the Depreciation Options tab, they will apply to ALL Forms 4562. Additional options are available when you enter individual asset detail.

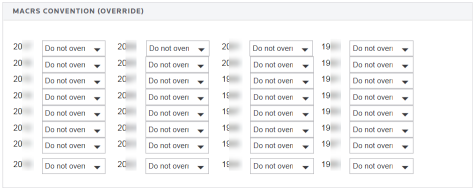

In 1040, scroll down the Depreciation Options tab to the MACRS Convention (override) section. You can choose to override the MACRS convention for any of the years listed. The MACRS convention per asset is selected within Asset Detail data entry, and the depreciation expense is automatically calculated by the tax application, so no entry is necessary unless you want to override the MACRS Convention.

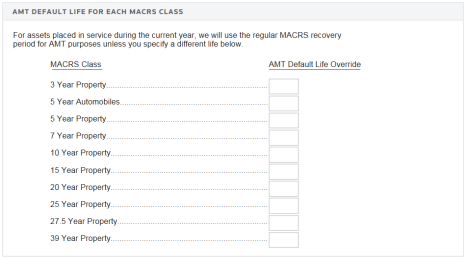

Scroll down the same screen to override the AMT Default Life. This option is available for all MACRS classes.

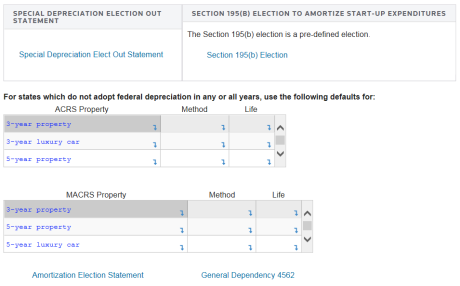

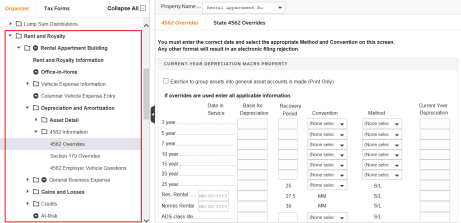

Use the States > Common State > State Depreciation/Gains screen to enter depreciation adjustments for states that do not adopt federal depreciation in any or all years. For 1040, these options are located under the Depreciation Options tab of the General Information > Return and Print Options Organizer.

Use the Form 4562 Information folder to answer vehicle questions and enter overrides for Form 4562 and Section 179, if necessary.

Tutorials/depr_options.htm/TY2019

Last Modified: 02/14/2020

Last System Build: 06/18/2021

©2019-2020 Thomson Reuters/Tax & Accounting.