Depreciation: Navigation

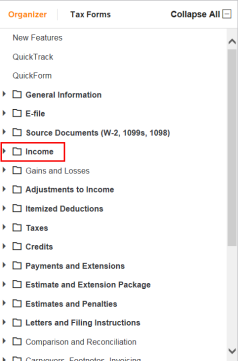

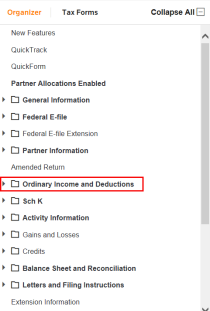

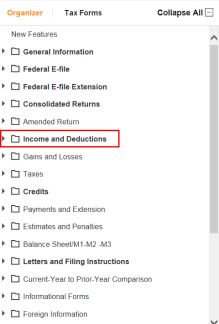

To locate the main depreciation screen in the Organizer, from the Forms List Window, select the Income folder (1040). This folder may be called Ordinary Income and Deductions (1065) or Income and Deductions (1120).

1040

1065

1120

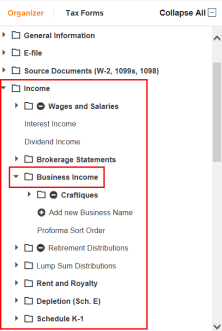

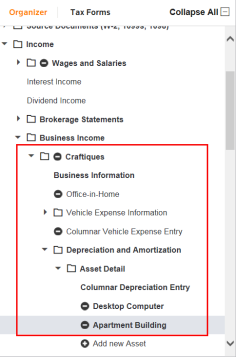

Select the applicable Organizer for the activity whose asset you are depreciating. For example, select the Business Income folder to depreciate a business asset, or select Rent and Royalty or Vacation Home/Other Rental to depreciate a rental property asset.

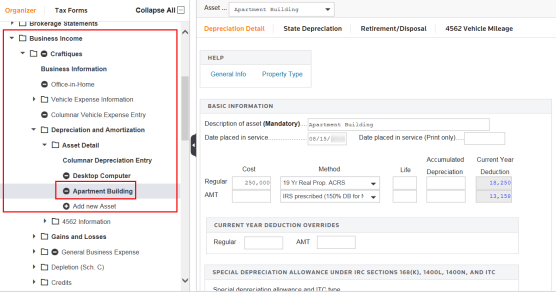

Under the entity that is depreciating the asset, select Depreciation and Amortization. You can select depreciation for the trade or business entity as shown here, or select any activity such as a farm, depletion, or passive activity.

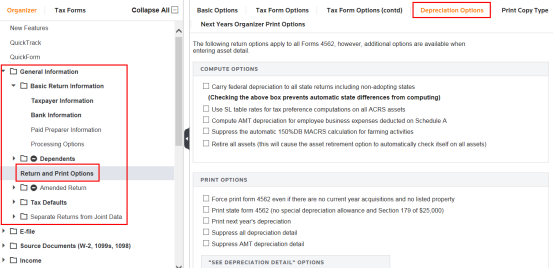

You can enter Depreciation Options for this return under the General Information > Return and Print Options > Depreciation Options tab.

To see a list of existing assets or to add new assets, select the Asset Detail folder. All existing assets are shown. Select the asset, or choose Add New Asset.

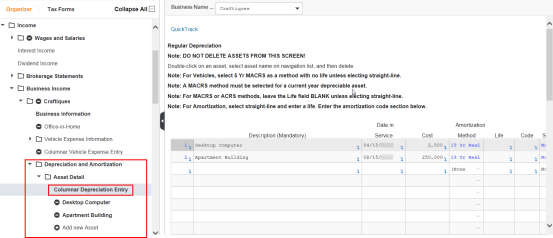

You can also enter multiple assets for the activity on the Columnar Depreciation Entry screen.

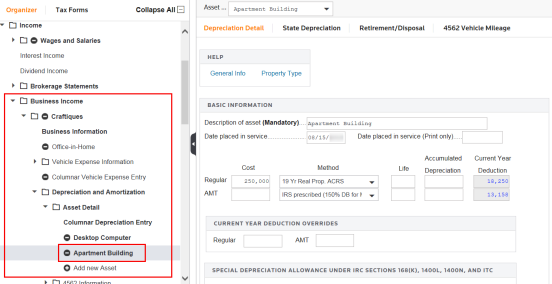

To enter detail information for each asset, select the Depreciation and Amortization > Asset Detail folder under the activity, and select the listed asset. Although the folders are slightly different for each type of return, they all have a form called Asset Detail where you enter the detail depreciation information for each asset. An asset’s depreciation automatically ties to the activity based on what organizer you entered the information under. If you enter depreciation under the Farm Organizer, the depreciation ties to the farm.

You can use the hyperlinks to take you from the Tax Forms to the related Depreciation Organizer screen.

Tutorials/depr_navigation.htm/TY2019

Last Modified: 02/14/2020

Last System Build: 06/18/2021

©2019-2020 Thomson Reuters/Tax & Accounting.