Depreciation: Data Entry

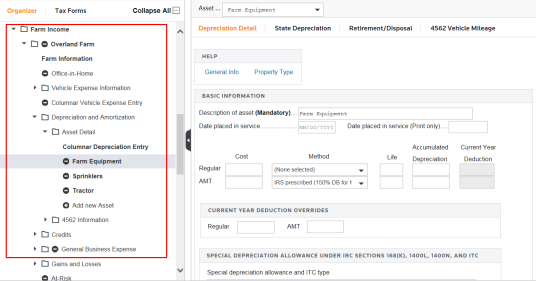

This is the main Depreciation Detail screen. To see more of the form, expand the form window.

Enter all depreciation information for this asset here. You can scroll down this screen for more options and data entry fields.

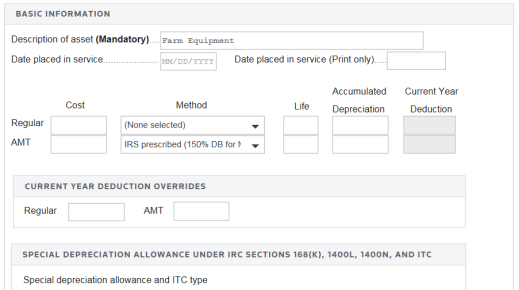

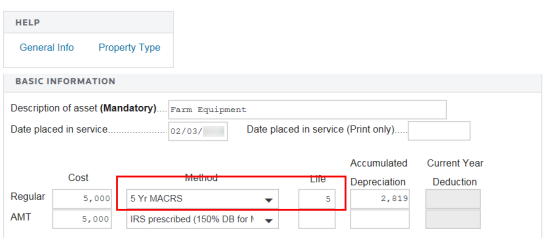

To ensure that depreciation calculates and prints correctly for each asset, you must enter the description, date placed in service, cost, and method or life.

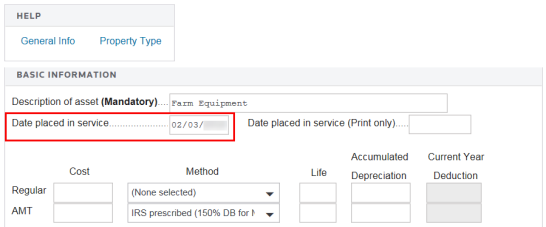

The Date placed in service is a mandatory entry. Enter an 10-character date for calculation purposes. This should be the date that depreciation is to begin. You must enter a real Date Placed in Service for depreciation to compute. You can enter a nonstandard date for print purposes in the Date placed in service (Print only) field. You can enter the month and year or VAR.

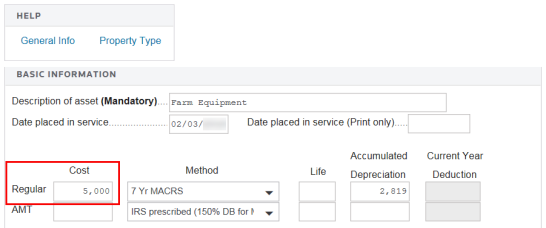

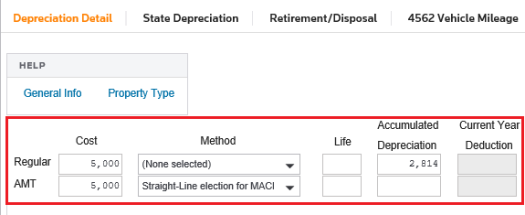

The unadjusted cost is a mandatory entry that must be entered as a positive amount.

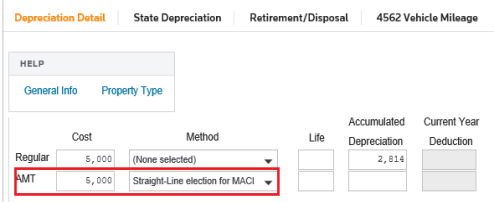

Enter the AMT cost basis only if it differs from the cost basis for regular depreciation purposes. It is not necessary to reduce this cost by §179 expenses or bonus depreciation basis reduction. This entry is not required to compute AMT depreciation. If you make no entry, the regular depreciation basis is used.

The tax application provides all of the common depreciation methods for regular and AMT purposes.

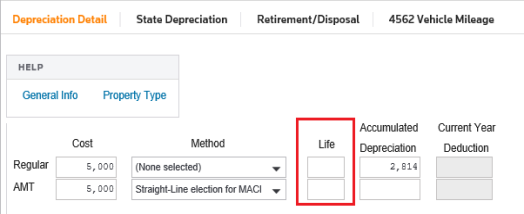

For MACRS and ACRS assets, leave the Life field blank; use this field only for pre-ACRS or straight-line methods. With no entry, the calculation defaults to class life.

If you enter M5 (MACRS 5 year) as the Method and also enter 5 in the Life field, the tax return uses the straight-line election over five (5) years. Do not enter a life when using a MACRS or ACRS method to compute the asset using the prescribed declining balance percentage for the method selected.

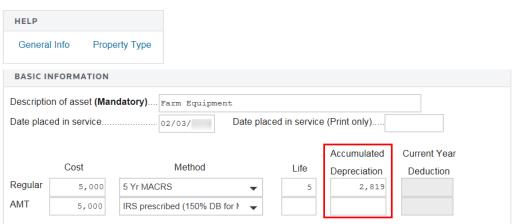

Accumulated depreciation should reflect the actual business depreciation expensed in all prior years. Enter the total accumulated depreciation for all prior years here for each asset. Do not include prior year §179 deductions or prior year special depreciation deductions in the accumulated depreciation amount.

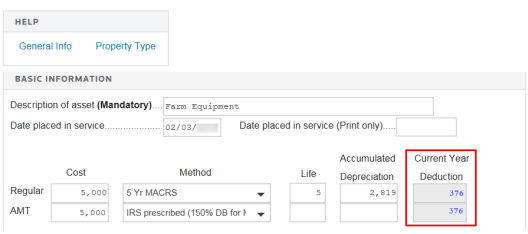

Even though this is an Organizer screen, the Current Year Deduction, a system-generated amount, is shown here for your convenience.

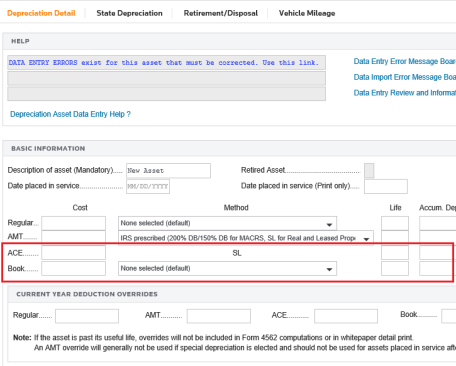

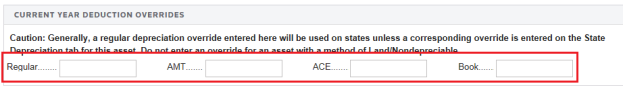

(1065/1120 only) Notice the ACE and Book fields. These are found on business returns only. You can override the automatic calculation for current year depreciation deduction for Regular, AMT, ACE, or Book purposes by making entries here. The fields circled in red are ACE and Book depreciation. ACE is automatically calculated when applicable, unless you suppress it.

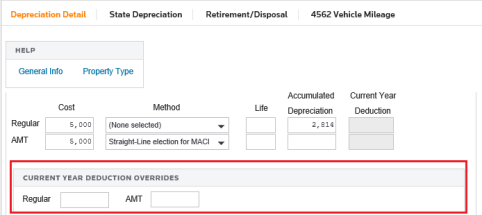

To override any of the computed current year deductions for Regular or AMT, ACE or Book depreciation, enter the deduction amount or NONE in these fields. The business use percentage is applied to the regular current year override field only.

A similar regular current year override field exist in 1065/1120 as well.

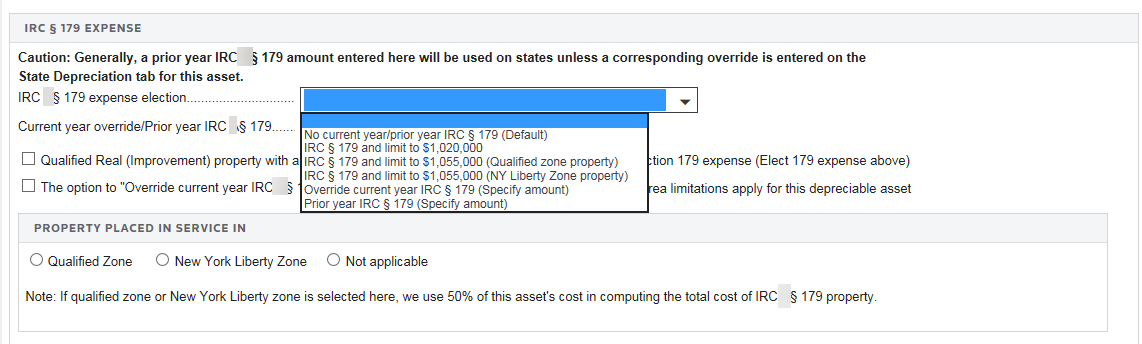

Once you scroll down the Depreciation Detail screen, you can access other depreciation options. To compute a valid §179 amount, you must enter a MACRS method and a current year date for the asset.

To compute AMT depreciation when using an ACRS method, you must select a choice from the list box. AMT is automatically calculated for MACRS assets. If you want to suppress the automatic calculation, select a choice here.

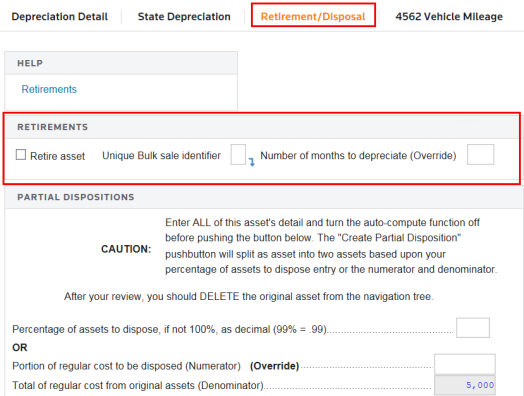

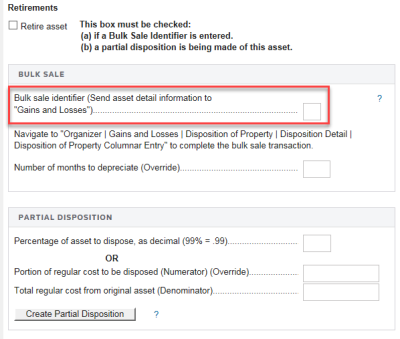

To indicate that an asset is retired, go to the Retirement/Disposal tab, and check the box outlined in red below.

If you do not retire this asset on Form 4797, you must either enter the number of months to depreciate the asset within the current year, or override the current year depreciation deduction. If the asset is part of a bulk sale transaction, type a unique identifier (01-99) in the field outlined in red for each bulk sale transaction. Use the same identifier for each asset that is part of the same bulk sale. You must also type a date retired or sold on Form 4797 to retire an asset to Form 4797.

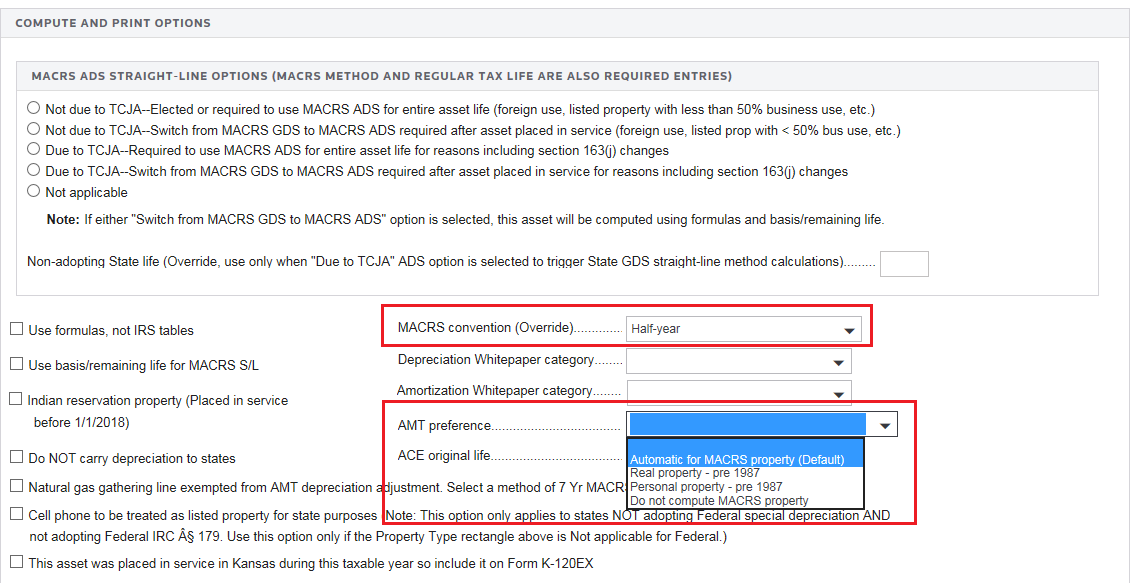

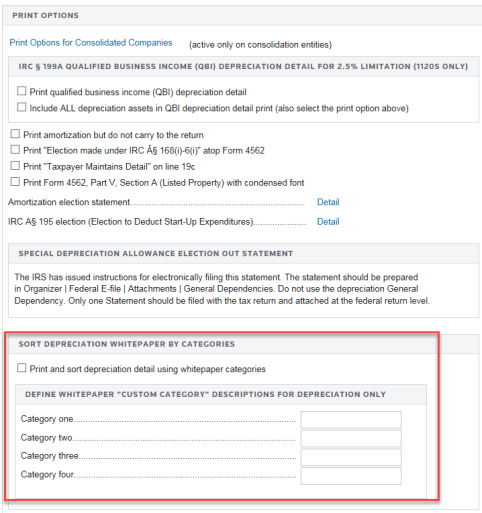

Here are some additional compute/print options. The Whitepaper Category list box allows you to sort your assets by category when printed, shown here for 1065.

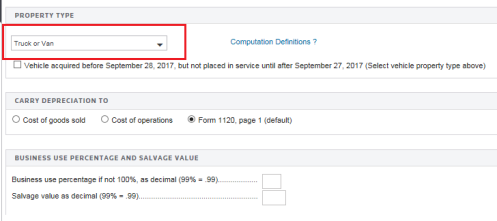

The 1120 screen contains some additional available options. You should always use the Property Type section when entering vehicles or listed property. 1040 does not have this section.

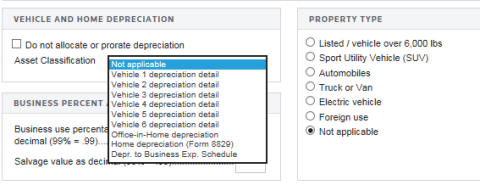

Vehicle, Home Depreciation, and Business Expense depreciation options relate to using the general business expense schedule instead of Form 2106. 1065 does not have this section.

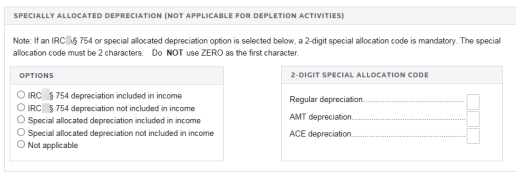

(1065 only) You can specially allocate §754 or other depreciation that needs to be specially allocated. 1040 and 1120 do not have this section.

Tutorials/depr_data_entry.htm/TY2019

Last Modified: 08/13/2020

Last System Build: 06/18/2021

©2019-2020 Thomson Reuters/Tax & Accounting.