Trial Balance Bridge: Workpapers

You can use Bridge to preview and print the following types of workpapers:

- Adjusting Journal Entries

- Workpaper Notes

- G/L Account Sequence

- Detail

- Taxable Income Detail

- Taxable Income Variance Detail

- Balance Sheet Detail

- Schedule M-1 Detail

- Schedule M-1 Variance Detail

- Rental Real Estate Property Detail

- Other Rental Property Detail

- Royalty Property Detail

- Farm Property Detail

- Schedule M-3 Detail

- Summary

- Taxable Income Summary

- Taxable Income Variance Summary

- Balance Sheet Summary

- Schedule M-1 Summary

- Schedule M-1 Variance Summary

- Schedule M-2 Summary

- Rental Real Estate Property Summary

- Rental Real Estate Summary

- Other Rental Property Summary

- Other Rental Summary

- Royalty Property Summary

- Royalty Summary

- Farm Property Summary

- Farm Summary

- TRC and TCC Summary

- Schedule M-3 Summary

- MRC and MCC Summary

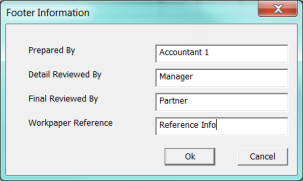

Under File > Report Footer Setup, you can enter the Prepared By, Detail Reviewed By, Final Reviewed By, and Workpaper Reference information for the reports. Information entered here will print at the foot of each report page.

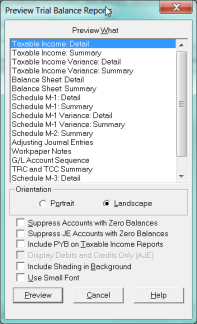

Select File > Print Preview to show the Print Preview dialog box. A list of available workpapers appears under Preview What.

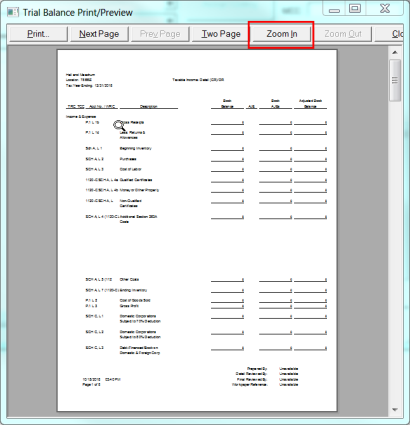

The Taxable Income detail workpaper appears. To enlarge the detail, click Zoom In.

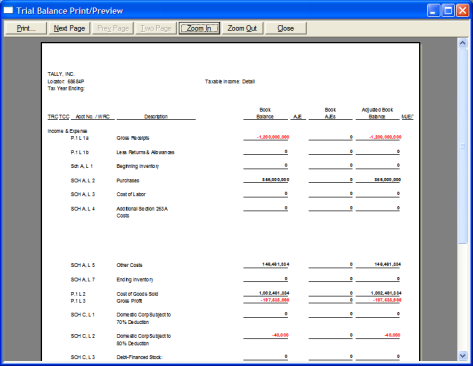

The Income and Expense detail enlarges. Notice that the command buttons on the top of the page control navigation and the size of the form you are viewing. In Bridge, the mouse pointer will change to a magnifying glass when you move it over the workpaper area. You can click the left mouse button to zoom in or out.

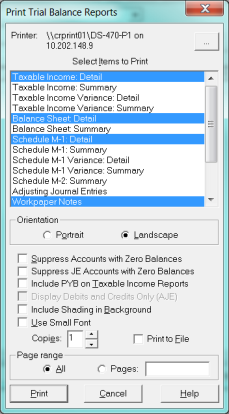

Select File > Print from the Trial Balance Grid to show the Print dialog box. A list of available workpapers appears. Select the appropriate forms to print. You can select multiple copies and determine the print orientation of the workpaper.

Tutorials/bridge_workpapers.htm/TY2019

Last Modified: 02/14/2020

Last System Build: 06/18/2021

©2019-2020 Thomson Reuters/Tax & Accounting.