Trial Balance Bridge: Merge

Merging is the process of combining data from Bridge files with the tax return files and is the final process you perform in Bridge.

After a merge, you can add data in the tax application to complete the return. You can then perform final tax calculations and review and print the final return.

Merge Options

- No suppression Merge will remove existing data such as TCC, description, and financial information from the Organizer prior to the merge operation. This operation affects manual entry, locked data, and overrides as well. The merge operation transfers all accounts to the Organizer.

This option is intended for other than first-year users. - Suppress accounts without balances only Merge will remove existing data such as TCC, description, and financial information from the Organizer prior to the merge operation. This operation affects manual entry, locked data, and overrides as well. The merge operation transfers only accounts with balances to the Organizer.

This option is intended for other than first-year users. - Suppress prior year balances only Existing Organizer data (including manual entry, locked data, and overrides) remains the same. If a description has changed for a detailed item that has previously been merged, a new line item will be added in the Organizer and the original line item (old description) will remain as a separate entry. The merge operation transfers all accounts to the Organizer.

This option is intended only for first-year return to preserve Balance Sheet beginning balances.

The presence of a blank line or more in the Organizer group field between rows of data prior to the merge may cause detailed line items to be out of alignment for beginning and ending balances after the merge operation. - Suppress prior year balances and Suppress accounts without balances Existing Organizer data (including manual entry, locked data, and overrides) remains the same. If a description has changed for a detailed item that has previously been merged, a new line item will be added in the Organizer and the original line item (old description) will remain as a separate entry. The merge operation transfers only accounts with balances to the Organizer.

This option is intended only for first-year return to preserve Balance Sheet beginning balances.

The presence of a blank line or more in the Organizer group field between rows of data prior to the merge may cause detailed line items to be out of alignment for beginning and ending balances after the merge operation. (See screenshot below.)

Existing line items without any balance in the Organizer are not deleted prior to the merge operation.

Always review your defaults before merging your data. These defaults determine what gets merged. Check your Return Defaults for special treatment. If you are importing a closed trial balance, you must enter the word CLOSED in the account box. Otherwise, your return will be out-of-balance.

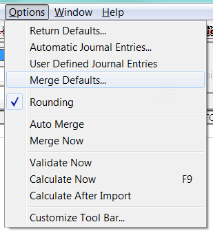

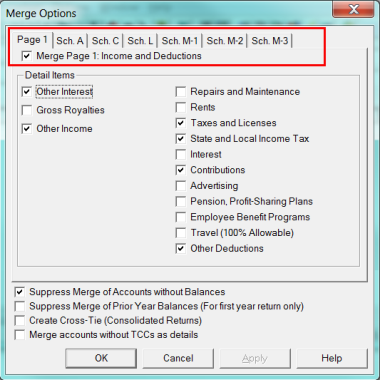

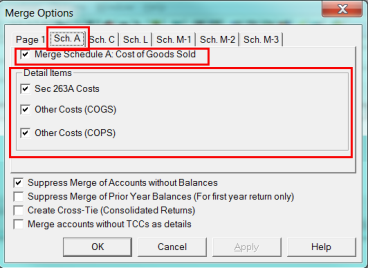

The Merge Option dialog box appears. Check all tabs to determine which forms and detail items will actually be merged. If the check box at the top of a tabbed page is checked, the entire form will be merged.

A checkmark in the check box indicates that the detail will be merged. To suppress detail, clock the appropriate check box to remove the check mark. If you suppress the detail for a TRC, Bridge sums the prior year balances and balance after adjustments and merges only the total.

These are the options for Page 1:

Here are the options for Schedule A:

Here are the options for Schedule L:

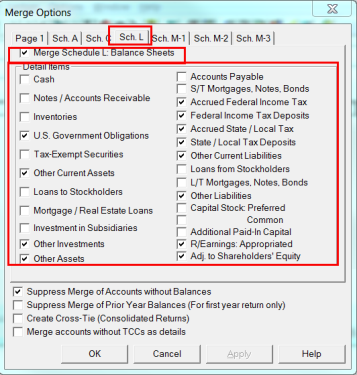

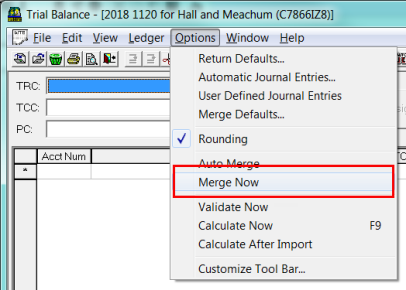

After you set merge defaults, you are ready to merge the bridged data. From the Trial Balance Grid menu bar, select Options > Merge Now. Bridge will merge the data in the bridge file into the tax application. If selected forms have not been specified, no tax forms will be updated. If selected forms have been specified, only the selected forms will be updated.

When the merge is complete, access the tax application to finish preparing the tax return. Select File > Exit to exit Bridge. This will not exit the tax return.

When you exit Bridge and return to the tax application, you can review the amounts bridged into the Organizer screens and make any further changes required to complete the tax return.

Tutorials/bridge_merge.htm/TY2019

Last Modified: 02/14/2020

Last System Build: 06/18/2021

©2019-2020 Thomson Reuters/Tax & Accounting.