Trial Balance Bridge: Journal Entries

Bridge allows you to make different types of journal entries.

If an unadjusted trial balance is imported, you can make all book journal entries in Bridge.

You can make book and tax journal entries to adjust accounts to their proper tax balance.

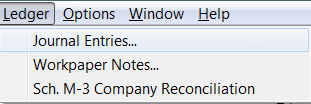

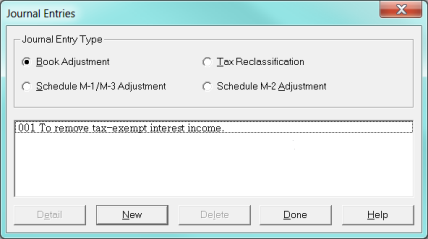

From the Trial Balance Grid, select Ledger > Journal Entries to show the Journal Entries dialog box. Select the type of journal entry by clicking the appropriate radio button under Journal Entry Type:

- Book Adjustments: Entries posted to finalize account balances prior to tax considerations. Book adjustments can only be posted to general ledger accounts.

- Schedule M-1/M-3 Adjustments: Entries to reconcile book and taxable income. Entries must affect income or expense on one side and Schedule M-1 on the other.

- Tax Reclassification: Entries to reclassify balances between accounts for tax return presentation.

- Schedule M-2 Adjustment: Entries to reconcile beginning and equity Schedule M-2 journal entries are balanced automatically. That means that you are making one-sided journal entries to adjust the M-2 accounts only.

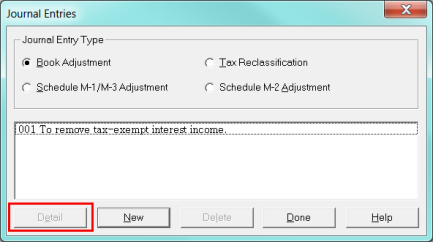

Any existing journal entries for the selected Journal Entry Type appear in a scrollable list. To show detailed information for a journal entry, click the journal entry to select it. Then click the Detail button.

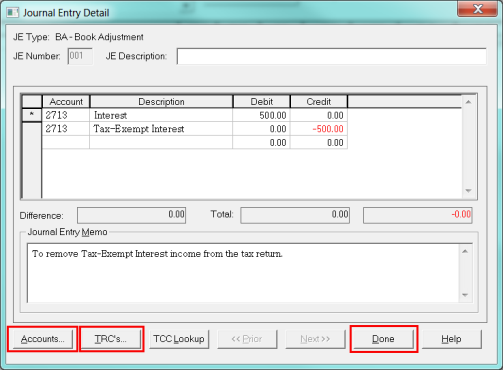

The buttons on the bottom of your Detail screen provide additional information and navigation.

- The Accounts button lists all accounts and their description.

- The TRCs button lists all TRCs and their descriptions to create a journal entry using a TAXnnn account.

- The Done button exits the dialog box and saves the entry.

Tutorials/bridge_je.htm/TY2019

Last Modified: 02/14/2020

Last System Build: 06/18/2021

©2019-2020 Thomson Reuters/Tax & Accounting.